What is a quantity limitation in Medicare Part D?

The Initial Coverage Limit (ICL) is a fixed dollar amount ($4,430 in 2022) that acts as the "boundary" between the second part of your Medicare Part D plan or the Initial Coverage Phase (where you and your drug plan share the cost of your drug purchases) and the third part of your plan, the Coverage Gap (where you receive a 75% Donut Hole discount on all formulary drugs).

What is creditable coverage for Medicare Part D?

Sep 18, 2021 · Initial Coverage Limit by David Bynon, September 18, 2021 What is the Medicare Part D Initial Coverage Limit? Once you have met your yearly deductible , you will pay a copayment or coinsurance for each covered drug until you reach the initial coverage limit (ICL). You will then enter your plan’s coverage gap (sometimes called the “donut hole”).

Are You required to have Medicare Part D?

Oct 01, 2021 · You pay the other portion, which is either a copayment (a set dollar amount) or coinsurance (a percentage of the drug's cost). The amount you pay will depend on the tier level assigned to your drug. 1 This stage ends when the amount spent by you and your plan on your covered drugs adds up to equal the initial coverage limit set by Medicare for that year. In 2022 …

Should I drop Medicare Part?

For instance, the Initial Coverage Limit is $4,430 in 2022 as compared to the Initial Coverage Limit of $2,250 in 2006. You can view the standard Initial Coverage Limits for the past several years here: https://q1medicare.com/2022 At times, the Initial Coverage Limit can also vary between Medicare Part D plan providers.

What is the initial coverage limit for 2021?

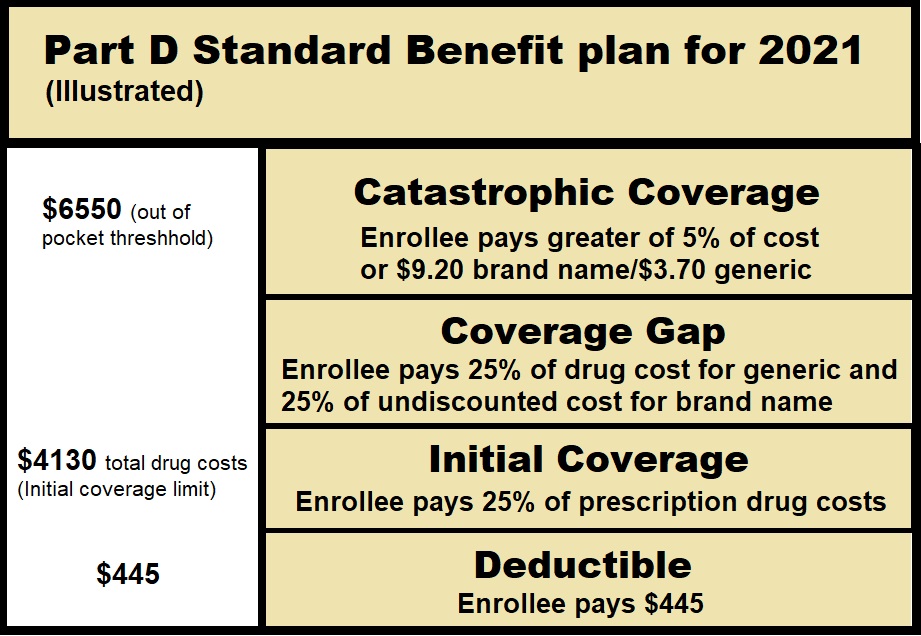

$4,130For 2021, the Part D initial coverage limit is $4,130, up from $4,020 in 2020. For 2021, the OOP threshold is $6,550, up from $6,350 in 2020. In addition, if you reach the donut hole phase, your drug discount for brand name and generic drugs is 75%.Jul 15, 2020

What is Part D initial coverage?

Initial Coverage Your plan pays for a portion of each prescription drug you purchase, as long as that medication is covered under the plan's formulary (list of covered drugs). You pay the other portion, which is either a copayment (a set dollar amount) or coinsurance (a percentage of the drug's cost).Oct 1, 2021

What does annual initial coverage limit mean?

The Initial Coverage Limit is the measured by the retail cost of your drug purchases and is used to determine when you leave your Medicare plan's Initial Coverage Phase and enter the Donut Hole or Coverage Gap portion of your Medicare Part D prescription drug plan.Feb 2, 2021

What is the out-of-pocket threshold on Medicare Part D for 2021?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).Oct 13, 2021

Does Medicare Part D have an out-of-pocket maximum?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.Nov 24, 2021

How Does Part D coverage work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

What is the 2022 Medicare Part D deductible?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

What is the plan D deductible for 2022?

Most Part D PDP enrollees who remain in the same plan in 2022 will be in a plan with the standard (maximum) $480 deductible and will face much higher cost sharing for brands than for generic drugs, including as much as 50% coinsurance for non-preferred drugs.Nov 2, 2021

What is the 2022 Part D initial coverage limit?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

Does Medicare cover prescription drugs?

Keep in mind, Medicare prescription drug policies and Medicare Advantage drug plans vary in terms of the particular medications they cover as well as the costs the beneficiary pays. This is despite the prescription drugs being the same.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

How to calculate out of pocket expenses?

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: 1 Your prescription drug plan’s yearly deductible 2 The amount you pay for your prescription medications 3 The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

Do manufacturer discounts count towards catastrophic coverage?

Additionally, manufacturer discounts for brand-name drugs count towards reaching the spending limit that begins catastrophic coverage. If your plan requires you to get your prescription drugs from a participating pharmacy, make sure you do so, or else the costs may not apply towards getting out of the coverage gap.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

What is the Medicare Part D coverage gap?

The Part D Coverage Gap, aka the Donut Hole. After meeting your plan’s deductible and initial coverage limit, but prior to reaching the TrOOP limit and catastrophic coverage, you’ll fall into the Medicare Part D coverage gap, also called the donut hole. Once your out-of-pocket costs reach the initial coverage limit — $4,130 in 2021 — your plan ...

How much will you pay for generic drugs in 2021?

For 2021, you’re expected to pay 25 percent of both the brand-name and generic drug costs. Previously, you paid more for generic drug costs, but in 2020, the coverage gap “closed,” meaning it bottomed out at you paying 25 percent for both brand-name and generic drugs, the same rate as you do in your initial coverage phase.

What is a TROOP?

What is TrOOP? If you have a Medicare Part D plan, you do have a special MOOP limit, called the TrOOP, short for True Out-of-Pocket limit. Each Medicare Part D plan has a TrOOP limit that is there to regulate the amount of out-of-pocket costs you have through your drug plan in a year. Once you’ve reached your TrOOP limit, ...

Does Medicare cover out of pocket prescriptions?

This means Medicare and your plan will start covering most of your out-of-pocket costs for applicable prescriptions. While these limits are set by the Centers for Medicare & Medicaid Services (CMS), there are other ways you can save money depending on your Medicare Part D plan.

What is the difference between generic and name brand drugs?

The amount you pay counts toward the TrOOP limit, but the major difference between name-brand drugs and generic drugs is that for generic drugs, only the amount you pay counts toward your TrOOP. For name-brand drugs, the discount payment your plan makes also adds up toward your limit. So, if you’re paying 25 percent and your plan’s discount is 70 ...

What happens if you reach your TROOP limit?

Don’t worry, it’s not as scary as it sounds! Once you’ve automatically entered catastrophic coverage for reaching the TrOOP limit, your drug costs are almost completely covered, except for a small coinsurance or copayment for covered drugs.

Is Medicare Advantage a MOOP?

Of all the reasons to enroll in Medicare coverage, making health care more affordable is perhaps the biggest for millions of beneficiaries. One of the benefits found in Medicare Advantage plans is a maximum-out-of-pocket (MOOP) limit, but is there anything similar that will help with out-of-pocket costs for Medicare Part D?

How many phases are there in Part D?

There are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

What is the coverage gap for drugs?

Coverage gap: After your total drug costs reach a certain amount ($4,130 for most plans), you enter the coverage gap, also known as the donut hole. The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs.

How much does catastrophic coverage cost?

Catastrophic coverage: In all Part D plans, you enter catastrophic coverage after you reach $6,550 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay.

What is catastrophic coverage?

Catastrophic coverage: In all Part D plans, you enter catastrophic coverage after you reach $6,550 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay. During this period, you pay significantly lower copays or coinsurance for your covered drugs for the remainder of the year. The out-of-pocket costs that help you reach catastrophic coverage include:#N#Your deductible#N#What you paid during the initial coverage period#N#Almost the full cost of brand-name drugs (including the manufacturer’s discount) purchased during the coverage gap#N#Amounts paid by others, including family members, most charities, and other persons on your behalf#N#Amounts paid by State Pharmaceutical Assistance Programs (SPAPs), AIDS Drug Assistance Programs, and the Indian Health Service 1 Your deductible 2 What you paid during the initial coverage period 3 Almost the full cost of brand-name drugs (including the manufacturer’s discount) purchased during the coverage gap 4 Amounts paid by others, including family members, most charities, and other persons on your behalf 5 Amounts paid by State Pharmaceutical Assistance Programs (SPAPs), AIDS Drug Assistance Programs, and the Indian Health Service