The income limit is 200 percent of the federal poverty level or $2,126 a month if living alone and $2,873 a month if living with one other person. MSP asset limits: Kentucky uses federal asset limits for QMB, SLMB and QI: $7,860 if single and $11,800 if married. The QDWI asset limit is $4,000 if single and $6,000 if living with others.

What is the income limit for Medicaid in KY?

The Kentucky Medicaid program provides medical assistance to individuals meeting income, resource and technical eligibility requirements. The income limit is $217 and resource limit is $2,000 for an individual. If an individual’s income exceeds $217, spenddown eligibility may apply.

What are the requirements for Medicaid in Kentucky?

The requirements for eligibility for Medicaid in Kentucky include:

- Children aged 18 years or under with a family income of 159 percent of the Federal Poverty Level (FPL) or below

- Children aged 1 year or younger with a family income of 195 percent of the FPL or below

- Pregnant women with a family income of 195 percent of the FPL or below

How to qualify for Medicaid in KY?

MEDICAID COVID-19 INFORMATION . During the COVID-19 public health emergency, individuals younger than 65 without medical insurance should complete the Healthcare Coverage Application to request temporary coverage under Kentucky Medicaid presumptive eligibility. By completing this application you attest that you do not have medical insurance that covers doctors, pharmacy or hospital visits.

How do you apply for Medicaid in Kentucky?

Visit DisasterAssistance.gov, call 800-621-3362, or download and use the FEMA mobile app . You also may apply at a Disaster Recovery Center. To find one near you, visit fema.gov/drc. For more information on state help available, go to https://governor.ky.gov/tornadoresources.

What is the maximum income to qualify for Medicare in KY?

Qualified Medicare Beneficiary (QMB) pays for Part A and B cost sharing, Part B premiums, and Part A premiums (if a beneficiary owes them). The income limit is $1,063 a month if single or $1,437 a month if married. Specified Low-Income Medicare Beneficiary (SLMB) pays for Part B premiums.

What is the monthly income limit for Medicaid in KY?

The Kentucky Medicaid program provides medical assistance to individuals meeting income, resource and technical eligibility requirements. The income limit is $217 and resource limit is $2,000 for an individual. If an individual's income exceeds $217, spenddown eligibility may apply.

Is there a cap on Medicare income?

Medicare plan options and costs are subject to change each year. There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

How much money can you make before it affects your Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Qualifying Individual (QI) policy helps pay your Medicare Part B premium.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

What is the monthly income limit for food stamps in Kentucky?

SNAP Max Income for Food Stamps Oct. 1, 2019, through Sept. 30, 2020Household SizeGross Monthly Income Limits (130% of poverty)Net Monthly Income Limits (100% of poverty)1$1,354$1,0412$1,832$1,4103$2,311$1,7784$2,790$2,1465 more rows

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What is the Medicare tax rate for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

What is the maximum amount you can earn while collecting Social Security in 2021?

Under full retirement age $18,960 For every $2 over the limit, $1 is withheld from benefits. $19,560 For every $2 over the limit, $1 is withheld from benefits. In the year you reach full retirement age $50,520 For every $3 over the limit, $1 is withheld from benefits until the month you reach full retirement age.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

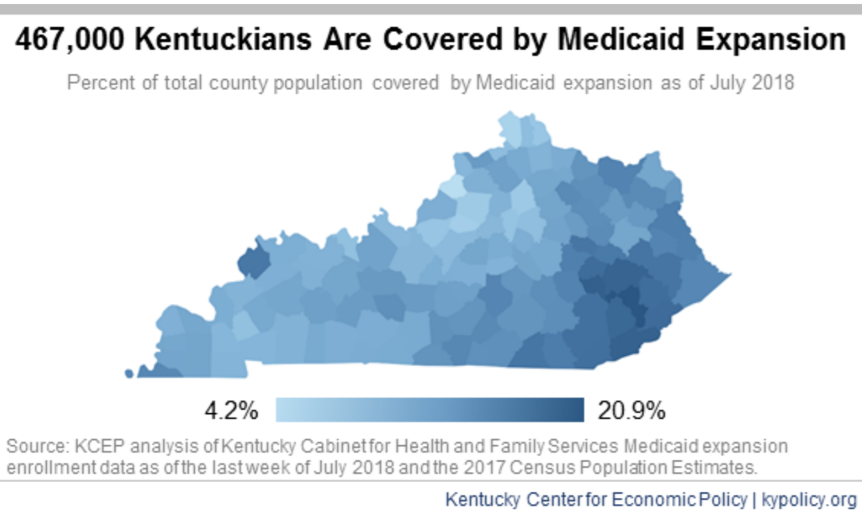

How many people are covered by Medicaid in Kentucky?

As of 2020, the program, along with the Children’s Health Insurance Program (CHIP) covered 1.5 million people. This includes 598,000 children as shown by the image below.

When is the Kentucky Medicaid income limit for 2021?

Kentucky Medicaid Income Limits – 2021. April 27, 2021. April 27, 2021. The Medicaid Income Limit is the most important criteria for deciding whether you qualify for Medicaid in your state. In this post, we are going to explain in detail the Kentucky Medicaid Income Limits for 2021. Medicaid in Kentucky is also called KyHealth Choices.

What is the DMS in Kentucky?

In Kentucky, the Kentucky Cabinet for Health and Family Services’ Department for Medicaid Services ( DMS) is the agency that administers the state’s Medicaid program.

What percentage of FPL is pregnant?

Pregnant women with family income up to 195 percent of FPL. Parents of minor children with family income up to 22 percent of FPL. Individuals who are elderly, blind, and disabled with family income up to 74% of the FPL. Adults without dependents under Medicaid expansion with income up to 133% of the FPL.

How to contact Kentucky Medicaid?

Here’s how to contact the Kentucky Medicaid Agency: Locate or call your local office – Department for Community Based Services – (855) 306-8959. Cabinet for Health and Family Services Ombudsman – (877) 807-4027.

How much is the increase in cervical cancer screenings?

3 percent increase in cervical cancer screenings. 16 percent increase in colorectal cancer screening. 37 percent increase in adult dental visits. According to the Center for Medicaid, as of July 2019, 450,700 Kentucky residents gained eligibility and gained health insurance coverage under the ACA’s Medicaid expansion.

How many people are on medicaid in 2020?

According to the Centers for Medicare & Medicaid Services, as of November 2020, here are the number of people enrolled in Medicaid and Chip in the entire United States: 78,521,263 individuals were enrolled in Medicaid and CHIP. 72,204,587 individuals were enrolled in Medicaid. 6,695,834 individuals were enrolled in CHIP.

How many Medicare Advantage Plans are there in Kentucky?

In addition to the Original Medicare program, Kentucky has 120 Medicare Advantage Plans as an alternative for those looking for more comprehensive coverage. Keep reading to learn more about Medicare choices in Kentucky.

How many people are on Medicare in Kentucky in 2021?

Medicare in Kentucky. Updated: June 18, 2021. Medicare is a federal health insurance program that you can sign up for when you turn 65. In Kentucky, over 570,000 people are enrolled in Original Medicare. Most people don’t pay for Part A, or hospital coverage, although premiums may be as high as $471 per month depending on whether or ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, helps fill in the gaps to make your medical expenses more affordable. Medigap plans help cover health care costs that Original Medicare Part A doesn’t, such as copayments and deductibles.

What are the different types of Medicare Advantage Plans?

There are several types of Medicare Advantage Plans, including HMOs, PPOs, PFFS plans, and SNPs. Costs and rules regarding choosing primary care doctors and getting referrals to see specialists vary.

What is the Kentucky Department of Insurance?

Kentucky Department of Insurance. The Kentucky Department of Insurance governs the insurance market in the state and enforces regulations to protect consumers. Through this department, you can get in-depth information on available Medigap policies, Medicare Advantage Plans, and long-term care insurance.

What is Kentucky legal aid?

Kentucky Legal Aid is a statewide program that provides free civil legal services to those aged 60 and over. Through this legal agency, you can connect with SHIP counselors who can help you make informed decisions about your health insurance. Benefits counselors can represent you if your Medicare policy is terminated, your benefits are reduced, a claim is denied, or you’re overcharged for benefits. Counselors can also help you access public benefits that you’re eligible for, including Supplement Security Income, Medicaid, and Social Security.

What are the Agencies on Aging in Kentucky?

Kentucky has a network of 15 Area Agencies on Aging, each of which serves seniors within their service area. These nonprofit agencies are funded through the Older Americans Act and serve as a single point of contact for those accessing services and benefits, such as Medicare. Through your local agency, you can connect with a SHIP counselor who can answer your Medicare questions and help you assess your health care needs. AAAs also provide services, such as transportation, home-delivered and congregate meals, health and wellness services, and legal assistance.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Question 2

When figuring out your income do not include $20, the first $20 does not count against you.

Question 3

Resources include but are not limited to, checking accounts, savings accounts, stocks, bonds, certificates of deposit, annuities, trusts and life insurance policies. Some resources may be excluded if they fall under the exemption criteria for Medicaid eligibility.

View Another State

Explore key characteristics of Medicaid and CHIP in , including documents and information relevant to how the programs have been implemented by within federal guidelines.

Eligibility in

Information about how determines whether a person is eligible for Medicaid and CHIP.

Enrollment in

Information about efforts to enroll eligible individuals in Medicaid and CHIP in .

Quality of Care in

Information about performance on frequently-reported health care quality measures in the CMS Medicaid/CHIP Child and Adult Core Sets in .

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

Medicaid Income Limits by State

See the Medicaid income limit for every state and learn more about qualifying for Medicaid health insurance where you live. While Medicaid is a federal program, eligibility requirements can be different in each state.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.