You could reduce your monthly check (but not necessarily your lifetime benefits) by filing early If you want to max out your monthly Social Security check, you must wait until age 70 to claim benefits. Claiming any time before 70 will result in reduced monthly income.

Full Answer

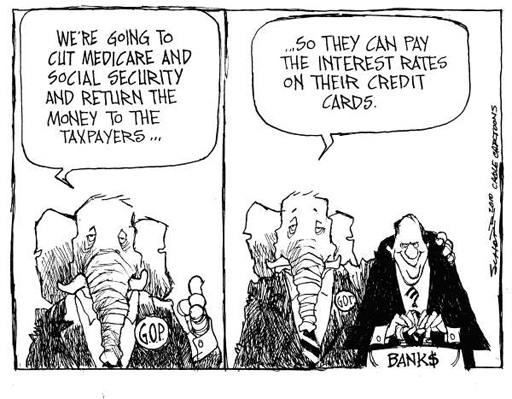

Does the Senate Republicans’ plan end Social Security and Medicare?

The Democratic Senatorial Campaign Committee claimed that the "Senate Republicans’ plan" would "end Social Security" and "end Medicare." The ad refers not to a plan from Senate Republicans but from one Republican, Scott. The plan would sunset all federal laws after five years, requiring Congress to renew the laws it wants to keep.

How can the government reduce Social Security benefits?

Switch the inflationary tether to the Chained CPI A sneaky way the government could choose to reduce Social Security benefits is by switching the tether that measures inflation and therefore determines the annual cost-of-living adjustments (COLA).

What would happen to Medicare and Medicaid if Congress reversed Obamacare?

Congress would have to renew the laws it wants to keep. As the New York Times reported: "Taken literally, that would leave the fate of Medicare, Medicaid and Social Security to the whims of a Congress that rarely passes anything so expansive."

How would Scott’s plan affect social security?

Under Scott’s plan, all federal laws, including those creating Social Security and Medicare, would expire after five years. Congress would have to renew the laws it wants to keep.

Will Social Security benefits be reduced in the future?

Introduction. As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

What president took money from the Social Security fund?

3. The financing should be soundly funded through the Social Security system....President Lyndon B. Johnson.1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Will the Medicare age be lowered to 60?

Regardless of the outcome, the eligibility age for Medicare will not change overnight. Lowering the eligibility age is no longer part of the U.S. Government's budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

Did Congress steal from Social Security?

The Social Security Administration (SSA) says the notion is a myth and misinformation. "There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government," the agency said.

How much has Congress borrowed from Social Security?

The total amount borrowed was $17.5 billion.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much is the Medicare deductible for 2022?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Will Medicare drop to age 62?

Summary: No, you don't qualify for Medicare until age 65 unless you're eligible due to disability, as we'll explain below. For most people, Medicare coverage starts at age 65.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Is Medicare changing to 62?

More than 125 House lawmakers introduced legislation Friday that lowers the Medicare eligibility age to 60 from 65. The Improving Medicare Coverage Act — led by Reps.

How can the federal government reduce Social Security benefits?

Image source: Getty Images. 4. Freeze the purchasing power of benefits for some, or all, beneficiaries. A fourth way the federal government could reduce Social Security benefits is by freezing the purchasing power of benefits for some, or all, beneficiaries .

How much is Social Security shortfall?

One of the most commonly suggested solutions by Republicans for resolving Social Security's long-term (75-year) cash shortfall of $13.2 trillion, as estimated by the latest Trustees report, is to raise the full retirement age.

How much would a 12 week absence reduce your benefits?

An analysis from the Urban Institute, a think tank, found that a single 12-week leave could reduce lifetime benefits by 3%. For a family with four kids, four 12-week absences would reduce lifetime payouts by a whopping 10%. Image source: Getty Images.

What is the second idea of Social Security?

The second idea was simply to apply it to all Social Security beneficiaries. Both methods, as noted, would reduce the purchasing power of Social Security income over time, but also reduce long-term expenditures for Social Security. Image source: Getty Images. 5.

What is the retirement age in 2040?

Rather than simply picking a number out of thin air and saying that by 2040 the full retirement age will be 69 , lawmakers would index the full retirement age to U.S. life expectancies so that it changes each year to reflect increasing or decreasing longevity.

Will Social Security be cut in 2034?

If Congress doesn't figure out a way to raise additional revenue or cut expenditures in time, an across-the-board benefits cut of up to 21% may be needed by 2034. Though no one wants to see their Social Security benefit cut, the federal government sure does have a plethora of options to do just that.

Is Medicare more important than Social Security?

There's arguably no program more important to senior citizens during retirement than Social Security. Though Medicare's importance is growing over time, no social program tops the guaranteed monthly payout that nearly all seniors receive from Social Security in retirement. And 62% of aged beneficiaries lean on this benefit to provide ...

What percentage of salary does an employer contribute to Social Security?

While the employee contributes 6.2% and 1.45% percent of salary (up to limits for SS) to the government, the employer must make the same contribution for employee’s salary.

How much is Social Security taxed in 2017?

For 2017, you are taxed 6.2% of your income for Social Security up to a salary limit of $127,200. In addition, Medicare is taxed at 1.45% of wages with no ceiling. Let’s say that for 2018, you have Family HSA insurance which has an ( ever-changing) contribution limit of $6,900.

What is a cafeteria plan?

This often takes the form of a Cafeteria Plan, which is an automated contribution plan on behalf of the employee. This is an important distinction, because per IRS Form 15, only pre-tax contributions using a cafeteria plan can avoid Social Security and Medicare taxes: However, HSA contributions made under a salary reduction arrangement in ...

Is HSA a salary reduction?

However, HSA contributions made under a salary reduction arrangement in a section 125 cafeteria plan aren’t wages and aren’t subject to employment taxes or (Social Security, Medicare) withholding.

Can you get your Social Security back on Form 8889?

Unfortunately, since those dollars likely came from an employer you would have already paid income, social security, and Medicare taxes. The income tax will be “returned” to you when you file Form 8889, but the Social Security and Medicare taxes are gone and cannot be credited back.

Is HSA contribution tax deductible?

The fact is that HSA contributions can be payroll tax deductible as well. In the term “payroll tax” I lump the various taxes often described as FICA taxes which include Social Security, Medicare, and Unemployment Insurance. This is on top of the exclusion to income tax as shown in #1 above.

Does HSA reduce Medicare?

Reduce Social Security and Medicare Taxes with an HSA. We all know that one of the reasons people open Health Savings Accounts is the triple tax advantage, which, simply stated, means: HSA contributions are tax free. HSA earnings grow tax free. HSA distributions for qualified medical expenses are tax free.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

How much would a 4% tax rate bring in?

Raising that tax rate to 4% (and including in the tax base income from some small businesses and limited partnerships) would bring in more than $490 billion in new revenue for the trust fund over 10 years, estimates Richard Frank, professor of health economics at Harvard Medical School and Thomas McGuire, professor of health economics, Harvard University.

When will the Congressional Budget Office deplete?

Last September, the Congressional Budget Office (CBO) forecast depletion in 2024. In February 2021, the CBO pushed back that date to 2026 due to improved prospects for stronger economic growth and higher employment rates.

Is Medicare insolvency a new issue?

Medicare Insolvency Issues Aren't New. The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).

More from Life Changes

Here’s a look at other stories offering a financial angle on important lifetime milestones.

Seeking bipartisan support

The plan also integrates a couple of elements that might help draw support from across the aisle.

Scott’s ’11-Point Plan’

Other Democratic Attacks

- On April 28, the Democratic Senatorial Campaign Committee tweetedthat the “Senate Republicans’ plan would END” Social Security. The tweet includes a video that starts with an edited clip of Fox News anchor John Roberts asking Scott about his plan. “You recently put out an 11-point plan to rescue America,” Roberts said. “That would raise taxes on ha...

Scott on Social Security, Medicare

- In the same “Fox News Sunday” interviewfeatured in the DSCC ad and tweet, Scott went on to say that he had no intention of eliminating Social Security, Medicare or Medicaid. “Here’s what’s happening,” Scott said. “No one that I know of wants to sunset Medicare or Social Security, but what we’re doing is we don’t even talk about it. Medicare goes bankrupt in four years. Social Sec…