What is the maximum income taxed for Medicare?

Nov 11, 2021 · In 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. So a Medicare beneficiary whose 2019 tax return showed an income above $88,000 would be paying the …

What income is subject to Medicare tax?

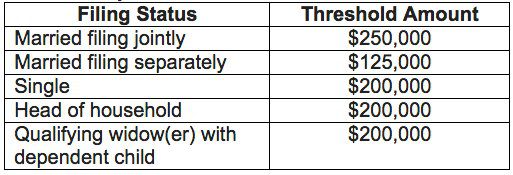

Mar 15, 2022 · Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period …

What is Medicare tax withheld for maximum salary?

Oct 15, 2021 · a self-employed worker will pay a total of $18,228 in social security tax ($142,800 x 12.4 percent). Additional Medicare Tax Higher-income workers may have to pay an additional Medicare tax of 0.9 percent. This tax applies to wages and self-employment income that exceed: $250,000 for married taxpayers who file a joint return;

What is exempt from Medicare tax?

Nov 16, 2021 · For married couples, the limit is less than $1,472 monthly and less than $11,960 in total. You won’t be responsible for the costs of premiums, deductibles, copayments, or coinsurance amounts under...

What is the max Medicare tax for 2021?

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

What is the maximum Medicare tax for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

At what income do you stop paying Medicare tax?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

Who pays the 3.8 Medicare tax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Which tax is usually the largest portion of tax withheld?

In the U.S., the largest payroll taxes are a 12.4 percent tax to fund Social Security and a 2.9 percent tax to fund Medicare, for a combined rate of 15.3 percent. Half of payroll taxes (7.65 percent) are remitted directly by employers, with the other half withheld from employees' paychecks.

What is the percentage of SS and Medicare tax?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

Do you still pay Medicare tax after 65?

Medicare Withholding after 65 As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired. If you have no earned income, you do not pay Social Security or Medicare taxes.

Do you have to pay Social Security tax if you are over 65?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.Apr 6, 2022

What income is subject to the 3.8 Medicare tax?

Income Tax Calculator: Estimate Your Taxes There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

What is the additional 3.8 tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount. As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT).

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Everyone Pay Medicare Tax?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Is There a Limit on Medicare Tax?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

Is there a higher income limit for Medicaid in Hawaii?

The income limits are higher in Alaska and Hawaii for all programs. Furthermore, even if your income is slightly above the cap, you may be eligible for these programs if it comes from a job and benefits. If you believe you may qualify for Medicaid, contact the Medicaid office in your state.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.