How much will your Social Security tax be in 2018?

| Salary | Social Security Taxes | Medicare Taxes | Total Taxes |

| $20,000 | $1,240 | $290 | $1,530 |

| $30,000 | $1,860 | $435 | $2,295 |

| $40,000 | $2,480 | $580 | $3,060 |

| $50,000 | $3,100 | $725 | $3,825 |

What is the Medicare tax rate for 2018?

The Medicare portion (HI) is 1.45% on all earnings. Also, as of January 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in Medicare taxes. The tax rates shown above do not include the 0.9 percent. 2017 2018 Maximum Taxable Earnings.

What is the maximum Social Security tax for 2018?

While the maximum Social Security tax for 2018 is $7,960, only a small percentage of taxpayers have incomes high enough to pay the maximum.

What is the Medicare Part a hospital deductible for 2018?

Also, the Medicare Part A inpatient hospital deductible in 2018 will increase for everyone by $24, to $1,340.

What is Medicare Part A in 2018?

Medicare Part A In 2018. Original Medicare comprises Parts A and B. Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare.

Is there a cap on Medicare tax?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the maximum wage limit for Medicare taxes?

There is no wage limit for Medicare tax, which is currently 1.45% and applied to all covered wages paid. Both employees and employers have to pay this rate—the self-employed owe all 2.9%.

How is Medicare tax calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

Is there a cap on Medicare tax 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Medicare?

(Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

What is the maximum pretax contribution for 2018?

The maximum employee pretax contribution increases to $18,500 in 2018. The “catch-up” contribution limit remains at $6,000 in 2018 for individuals who are age 50 or older.

How much is withheld from a full retirement?

In the year an employee reaches full retirement age, $1 in benefits will be withheld for each $3 they earn above $45,360 until the month the employee reaches full retirement age . Once an employee reaches full retirement age or older, their benefits are not reduced regardless of how much they earn.

What is the effective tax rate for 2018?

The effective tax rate for 2018 is 0.6%.

What age do you have to be to pay FICA?

Household Employment – Domestic Workers. Household employers are required to withhold and pay FICA for domestic workers (age 18 and older) if paid cash wages of $2,100 or more in 2018. The $1,000 per calendar quarter threshold continues to apply for FUTA.

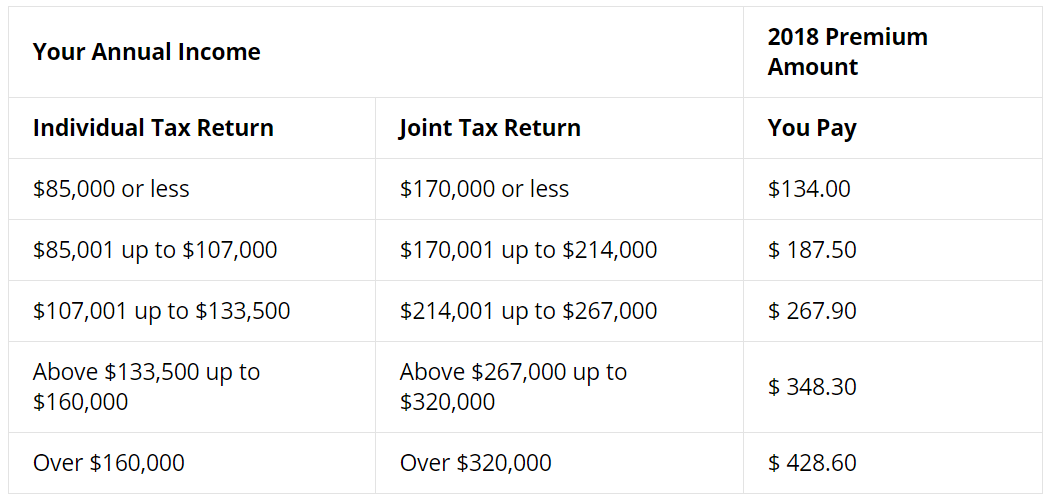

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

Why is Medicare holding harmless?

The reason is rooted in the "hold harmless" provision, which prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits —if their premiums are automatically deducted from their Social Security checks. This applies to about 70% of Medicare enrollees.

How much will hold harmless pay for Medicare?

Another 28% of Part B enrollees who are covered by the hold-harmless provision will pay less than $134 because the 2% increase in their Social Security benefits will not be large enough to cover the full Part B premium increase. Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security ...

How much did people pay for hold harmless in 2017?

The cost-of-living adjustment for Social Security benefits for this year was so low (just 0.3%) that people covered by the hold-harmless provision paid about $109 per month, on average, for Medicare premiums in 2017. But Social Security benefits will be increasing by 2% in 2018, which will cover more of the increase for people protected by ...

How much is the Part B premium?

Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover the additional Part B premiums.

Can you contest Medicare extra tax?

You may be able to contest the extra charge if your income has gone down since your last tax return on file. For more information, see FAQs about Medicare.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

How much is Medicare tax?

In addition to Social Security taxes, workers also pay a Medicare tax of 1.45%. The earnings subject to the Medicare tax are not capped, so employees pay this 1.45% on their entire incomes.

What is the maximum Social Security tax?

While the maximum Social Security tax for 2018 is $7,960, only a small percentage of taxpayers have incomes high enough to pay the maximum. In 2015, for example, just 6% of workers earned more than the capped amount, according to the National Academy of Social Insurance.

What happens to the money that is paid into Social Security?

Many taxpayers are rightfully concerned about what's happening to the thousands of dollars they -- and their employers -- pay into Social Security each year. While money paid in is invested in a Social Security trust fund and used to buy securities issued by the U.S. Treasury, the problem is that this invested money isn't just being kept safely invested in securities until the person who paid it retires. Instead, the Social Security Administration sells securities regularly to pay current beneficiaries.

Why do employees pay only a portion of their Social Security and Medicare taxes?

Employees pay only a portion of their Social Security and Medicare taxes because employers pick up the other half of the tab. For example, for a worker who earns that maximum $128,400, the actual amount paid into Social Security on their behalf is $15,921.60.

How to calculate Social Security tax?

If your income is below the cap, the amount you pay will be less. To calculate the amount you'll be taxed, multiply your taxable earnings by 6.2%. This table also shows the maximum Social Security taxes that will be paid in 2018 by employees at different income levels.

How much does an employer pay for Social Security?

Employers also pay Social Security taxes on your behalf. While employees pay a tax equal to 6.2% of their wages for Social Security and 1.45% of their wages for Medicare, this is not the total amount of Social Security tax collected for each worker.

How much money did Social Security give in 2017?

Close to 62 million Americans received an estimated $955 billion in Social Security benefits in 2017. Money for Social Security retirement benefits comes from the Social Security trust fund, which is funded by tax dollars and invested in special-issue securities issued by the U.S. Treasury.

How much tax do you pay on Social Security?

You pay into it while you work, and it pays you back once you stow your briefcase for good. For most salaried employees, the tax you pay is 6.2%. However, that only applies to income you earn up to $132,900; income in excess of that Social Security Wage Base won’t be subject to the tax.

What is the maximum amount you can earn in 2019?

For workers that have yet to reach their full retirement age (FRA), the 2019 earning limit is $17,640, up $600 from the 2018 amount. If your earnings exceed that limit, you’ll lose ...

What happens if you exceed your FRA limit?

If your earnings exceed that limit, you’ll lose $1 in benefits for every $2 you earn above the limit. The earning limit for the year you reach your FRA also increased in 2019 to $46,920. This limit only applies to income you earn during the months before you reach your FRA.

What is the Medicare tax rate for OASDI?

Keep in mind that this income limit applies only to the old-age, survivors and disability (OASDI) tax of 6.2%. The other payroll tax is a Medicare tax of 1.45%, and you’ll have to pay that for all income you earn. In fact, for income over $200,000 ($250,000 for couples filing jointly), the Medicare tax rate rises to 2.35%.

How much do you lose if you earn over the FRA limit?

You’ll lose $1 in benefits for every $3 you earn over the limit. After you reach your FRA, there will be no penalty for working and receiving benefits concurrently. The Takeaway. social security tax limit.

What is the increase in Social Security in 2019?

The Social Security Administration (SSA) made a few other tweaks the program in 2019, including a 2.8% increase in retirement benefits due to a cost-of-living adjustment (COLA). The SSA will typically provide a COLA if there is a significant increase in the Consumer Price Index (CPI). Earning limits for retirement benefits also increased in 2019.

How much is Social Security tax?

social security tax limit. Most of us are familiar with the Social Security tax, since we see it right on our paychecks. There is a payroll tax of 6.20% that goes directly toward funding the program; if you’re self-employed, you’ll pay twice that (though you can deduct half). That money is your way of paying ...

How much Social Security do you have to pay in 2018?

For 2018, the maximum amount of Social Security taxes you'll have to pay as an employee is $7,960.80. To understand where this number comes from, it's important to understand how Social Security taxes work.

What is the maximum Social Security benefit?

The maximum benefit that's available to retirees from Social Security in 2018 is just $2,788. This would provide an income of $33,456 -- which is below what the average American retiree is spending . With high healthcare costs and Social Security not keeping pace with actual increases in cost of living for seniors, it's imperative you have investment income to keep you going through retirement.

How to calculate Social Security tax?

If your income is below the cap, the amount you pay will be less. To calculate the amount you'll be taxed, multiply your taxable earnings by 6.2%. This table also shows the maximum Social Security taxes that will be paid in 2018 by employees at different income levels.

What happens to the money that is paid into Social Security?

Many taxpayers are rightfully concerned about what's happening to the thousands of dollars they -- and their employers -- pay into Social Security each year. While money paid in is invested in a Social Security trust fund and used to buy securities issued by the U.S. Treasury, the problem is that this invested money isn't just being kept safely invested in securities until the person who paid it retires. Instead, the Social Security Administration sells securities regularly to pay current beneficiaries.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are the taxes that are withheld from paychecks?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

What is the additional tax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer.

Who can help with Medicare enrollment?

If you’d like more information about Medicare, including your Medicare enrollment options, a licensed insurance agent can help.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.