...

2013 Social Security and Medicare Tax Withholding Rates and Limits.

What is the maximum amount for Medicare tax withholding?

The imputed cost of coverage in excess of $50,000 is subject to social security and Medicare taxes, and to the extent that, in combination with other wages, it exceeds $200,000, it is also subject to Additional Medicare Tax withholding.

How do I correct the amount of additional Medicare tax withholding?

While the employer can not correct the tax by making an interest-free adjustment, the employer corrects the amount of wages and tips subject to Additional Medicare Tax withholding on the appropriate “X” form ( Form 941-X, Form 943-X, Form 944-X, or Form CT-1 X ).

What is the wage base limit for the additional Medicare tax?

For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. Wage Base Limits. Only the social security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800.

Is there a limit on the amount of earnings subject to Medicare?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Is there a limit on Medicare tax withholding?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Is there a limit on additional Medicare tax?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

How is the amount of Medicare tax withheld calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

At what income does the 3.8 surtax kick in?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.

How much is the Medicare surcharge?

How much is the Medicare Levy Surcharge? The levy is calculated based on your taxable income - the more you earn, the higher percentage you'll pay. As a single, you'll pay 1% if your taxable income is above $90,000, 1.25% if you earn over $105,000, and the maximum rate of 1.5% if you earn over $140,000.

What is the additional Medicare tax withholding 2021 wage limits?

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.

How is Medicare excess calculated?

Based on the Additional Medicare Tax law, all income for an individual above $200,000 is subject to an additional 0.9% tax. Therefore, his Additional Medicare Tax bill is $50,722 X 0.9% = $456. He has already paid (1.45% X $199,558) + (2.9% X $51,164) = $2,893.59 + $1,483.7 = $4,377.29 in Medicare taxes already.

Is there a cap on FICA?

The maximum taxable income for Social Security for 2022 is $147,000. If you make more than that from work, the excess won't be subject to FICA, the Federal Insurance Contributions Act, under which 6.2 percent of gross pay is withheld from your paycheck to fund Social Security.

How do I calculate Medicare wages?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What percentage of your gross earnings is taken by your employer for Medicare?

1.45%The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much did M receive in 2013?

M received $180,000 in wages through Nov. 30, 2013. On Dec. 1, 2013, M’s employer paid her a bonus of $50,000. M’s employer is required to withhold Additional Medicare Tax on $30,000 of the $50,000 bonus and may not withhold Additional Medicare Tax on the other $20,000.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

When did Medicare tax increase?

The increase in and expansion of the Medicare tax commenced January 1, 2013. The increase in the Medicare tax, as required under healthcare reform, has two significant components. The first component is an increase in the Medicare tax rate by 0.9%.

When did Medicare taxes become complicated?

Beginning January 1, 2013 the tax code became significantly more complicated with these new taxes. The federal tax code already required taxpayers to go through two layers of tax computation, the regular income tax and the Alternative Minimum Tax. Calculating the Medicare tax on net investment income is an entirely new calculation ...

What is the Medicare tax rate for self employed?

Some thoughts on the increase in the Medicare tax rate to wages: • The highest marginal Medicare tax rate will be 2.35%, or 3.8% for self-employed persons. • For married couples, wages are combined to determine if the additional surcharge is applied.

Is Medicare tax reduced by one half?

All of the additional Medicare taxes under the law are paid by the employee. • The new Medicare tax will not be reduced by one-half for self-employed persons.

How much Medicare tax is applied to a change in job?

Planning tip: An individual who changes jobs during the year (or begins work during the year) should determine whether the additional 0.9% Medicare tax will apply based on total expected earnings for the calendar year from all employers (including wages earned by a spouse, if applicable).

Does Medicare apply to M and S?

But because M and S file a joint income tax return and their total combined wages are less than the $250,000 threshold for married filing jointly, the additional 0.9% Medicare tax does not apply to them. The $270 will be credited against the total tax liability shown on their income tax return.

Is Medicare tax deductible?

Any tax not paid during the year (either through federal income tax withholding from an employer or estimated tax payments) is subject to an underpayment penalty. The additional 0.9% Medicare tax is not deductible for income tax purposes as part of the Sec. 164 (f) SE tax deduction (Sec. 164 (f) (1)).

What is the Medicare tax rate for 2013?

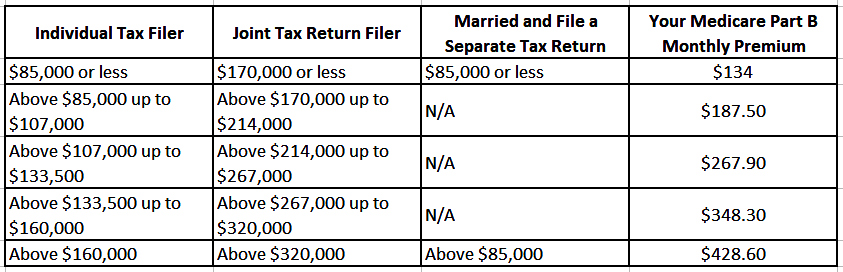

However, in 2013, the Medicare tax rate rises to 2.35 percent for single taxpayers with annual income of more than $200,000 and for married joint filers whose combined annual income exceeds $250,000, under a provision of the Patient Protection and Affordable Care Act. Medicare Premium Hike May Offset Benefit Increase.

How much did Social Security increase in 2013?

In addition, the SSA announced that monthly Social Security and Supplemental Security Income (SSI) benefits paid to nearly 62 million Americans will increase by 1.7 percent in 2013.

What is the FICA tax rate?

This results in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Those who are self-employed are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security + 2.9 percent Medicare).

How many people will pay higher taxes in 2013?

Of the estimated 163 million workers who will pay Social Security FICA taxes in 2013, nearly 10 million will pay higher taxes as a result of the increase in the taxable maximum, according to the SSA, which has published FAQs about these changes.

Why did the take home pay shrink in 2013?

Instead of a raise, some employees will see their take-home pay shrink in 2013 due to higher Social Security and Medicare taxes. The maximum amount of earnings subject to the Social Security tax (taxable maximum) increasedto $113,700 from $110,100 as of January 2013, the U.S. Social Security Administration (SSA) announced on Oct. 16, 2012.

When will payroll be adjusted for FICA?

By January 1, U.S. employers should have adjusted their payroll systems to account for the higher taxable maximum under the Social Security portion of FICA, and notified affected employees that more of their paychecks will be subject to FICA.

Does Social Security increase with Medicare?

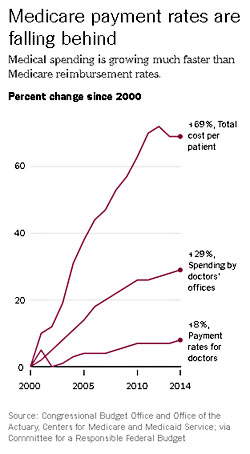

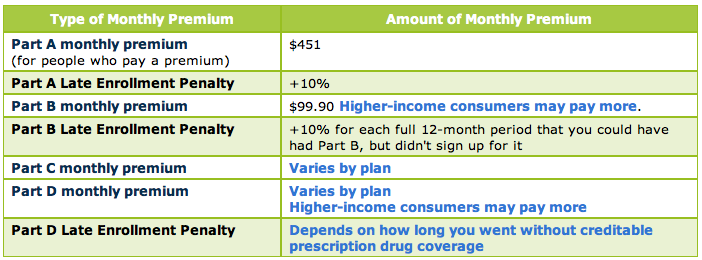

For many beneficiaries, however, their Social Security increase will be partially or completely offset by increases in Medicare Part B premiums, which typically are deducted from Social Security benefits.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.