...

2020 Social Security and Medicare Tax Withholding Rates and Limits.

| Tax | 2019 Limit | 2020 Limit |

|---|---|---|

| Social Security gross | $132,900.00 | $137,700.00 |

What are the FICA tax limits?

For 2020, the maximum limit on earnings for withholding of Social Security (old-age, survivors, and disability insurance) tax is $137,700.00. The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax.

Why is there a cap on the FICA tax?

Mar 15, 2022 · Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period …

What is Medicare earnings limit?

Nov 08, 2019 · The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.

Is Medicare withholding deductible?

Jul 01, 2021 · The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare.

Is there a limit on Medicare tax withholding?

Only the employee portion of Medicare taxes is withheld from your paycheck. There's no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .

Is there a cap on Medicare tax 2021?

For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

How do you calculate additional Medicare tax in 2020?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

What is the extra Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

How much is Medicare tax leveraged?

For the first $200 000 of your income, a Medicare tax of 2.9 % is leveraged. For every dollar exceeding that amount, a further 0.9 % is leveraged. For example, if you earn $250 000 per year, your Medicare tax contribution will be: $200 000 x 2.9 % = $5 800 in Medicare tax (half is withheld, and half contributed by your employer.

What percentage of Medicare is withheld from wages?

The 0.9 % of the value over $200 000 is solely withheld from the wages by the employer. If you are self-employed, you should pay this additional Medicare tax as part of your quarterly estimated tax payments.

What is the Medicare tax rate for 2020?

The Medicare tax rate for 2020 is 2.9 % of all covered wages. 1.45 % contributed by the employer and 1.45 % withheld. In other words, contributed by the employee.

How much is FICA tax?

Every U.S. citizen that earns wages must pay FICA (Federal Insurance Contributions Act) taxes. These taxes comprise: 6.2 % Social Security. 1.45 % Medicare tax. These taxes are contributed by both the employee and the employer, so in fact a total of 15.3 % of an employee’s gross salary is taxed. If you are self-employed, you are responsible ...

When was Medicare surtax passed?

The Affordable Care Act was passed in 2010. However, the final regulations for the additional Medicare tax were only issued by the Internal Revenue Service (IRS) at the end of 2013. The surtax applies to wages, self-employment income, and compensation.

What is the maximum Social Security tax?

This means that the maximum Social Security tax that employers and employees will pay is $8 537.40. However, there is no income cap for the Medicare component of your FICA tax.

How much of FICA can you deduct on your taxes?

That is, 12.4 % for Social Security and 2.9 % for Medicare. The good news: You can usually deduct half of the FICA tax on your tax return at the end of the financial year.

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What is the Medicare premium for 2020?

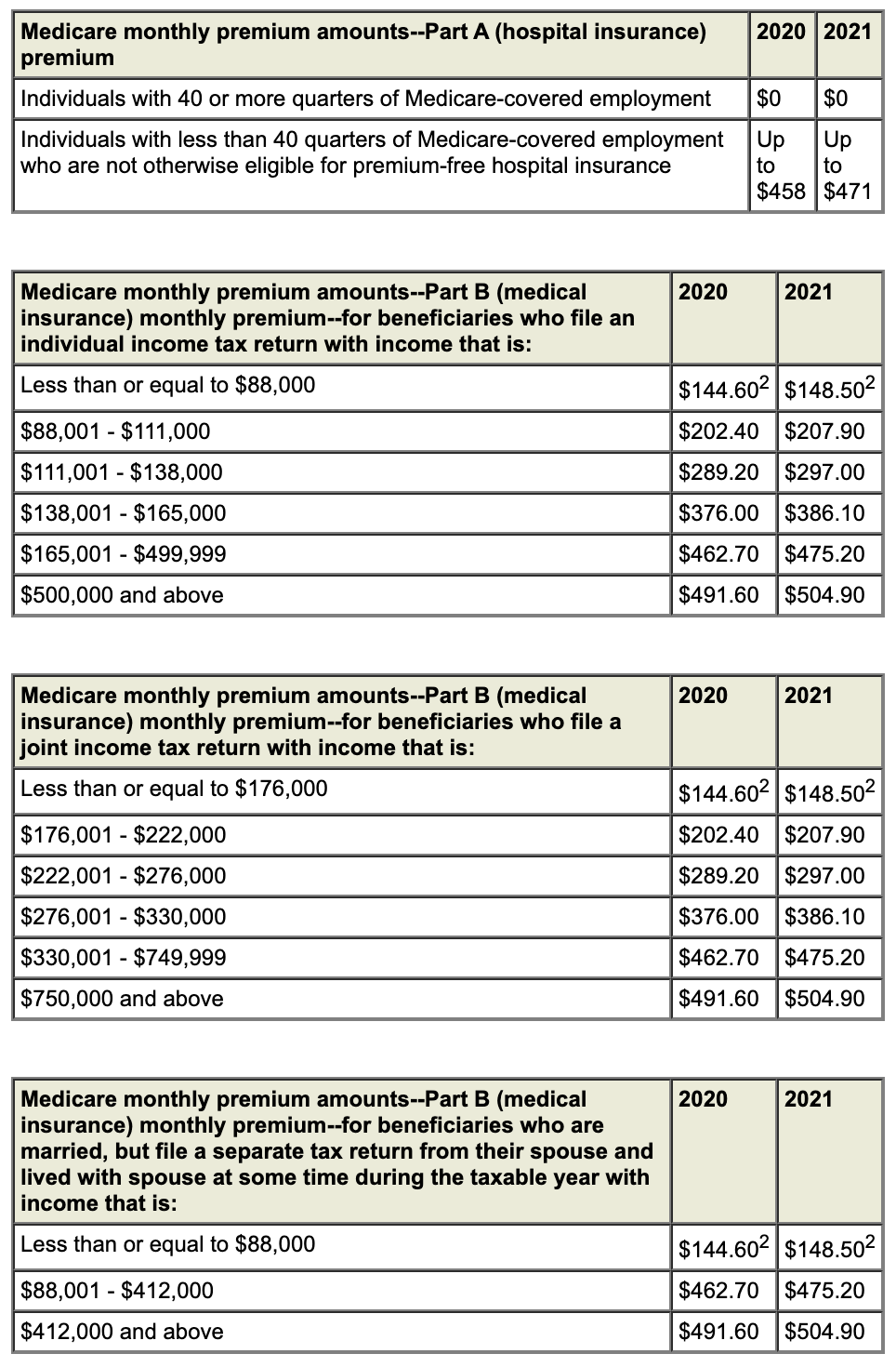

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part A premium?

491.60. Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is coinsurance for 2020?

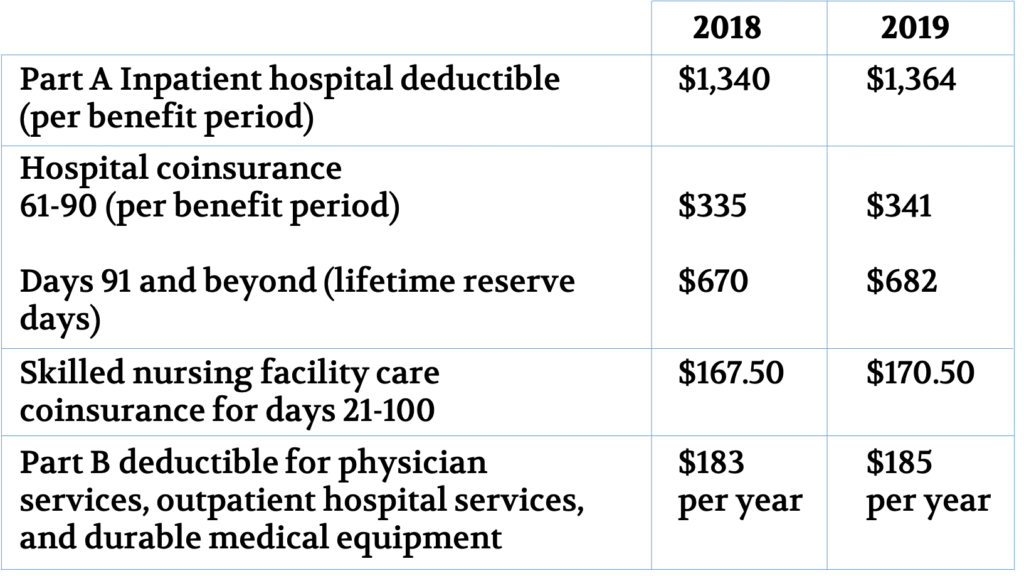

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Why is the Part B premium going up?

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one, President Trump has made it a top priority to lower drug prices.

Is Medicare Part B deductible higher in 2020?

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts.

What is the difference between Medicare and Social Security?

The Social Security tax is one of the payroll taxes paid by employees , employers, and self-employed individuals each year known as FICA (Federal Insurance Contributions Act) taxes . Medicare tax is the other tax in this package.

What happens if you get too much Social Security?

If too much Social Security tax has been withheld, you can claim a refund from the IRS of those Social Security taxes withheld that exceeded the maximum amount when you file your tax return the following year.

What is Social Security tax?

The Social Security tax is a federal tax imposed on employers, employees, and self-employed individuals. It is used to pay the cost of benefits for elderly recipients, survivors of recipients, and disabled individuals ( OASDI, or Old Age, Survivors and Disability Insurance ). The Social Security tax is one of the payroll taxes paid by employees, ...

Who must withhold Social Security and Medicare taxes from employees on pay subject to Social Security?

Employer. The employer must withhold Social Security and Medicare taxes from employees on pay subject to Social Security, up to the maximum amount each year. They must pay Social Security taxes for each employee for earnings up to the Social Security maximum.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Do self employed people have to include Medicare in their estimated taxes?

Self-employed taxpayers who are at or over the limits need to include this calculation in their estimated tax payments for the year. When you file taxes, you’ll calculate your Additional Medicare Tax liability for the year. In some cases, you might owe more, and in other cases, you might have paid too much.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is appealing an IRMAA?

Appealing an IRMAA. Lower income assistance. Takeaway. There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, ...

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

What is the IRS withholding checkup?

For employees, withholding is the amount of federal income tax withheld from your paycheck.

What percentage of income is taxed by a foreigner?

Foreign Persons. Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30 percent. The tax is generally withheld (Non-Resident Alien withholding) from the payment made to the foreign person. NRA Withholding.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Benefits

Summary

- The Social Security tax is a federal tax imposed on employers, employees and self-employed individuals. It is used to pay the cost of benefits for elderly recipients, survivors of recipients, and disabled individuals (OASDI Insurance). Social Security tax is one of the payroll taxes paid by employees, employers, and self-employed individuals each year. The Social Security withholdin…

Cost

- The maximum OASDI (Social Security) tax payable by an employee in 2019 would be $8239.80 ($132,900 x 6.2%). There is no maximum Social Security tax payable by an employer.

Terminology

- The term \"Social Security tax\" or \"OASDI\" is often confused with \"FICA taxes,\" which include both Social Security and Medicare taxes.

Statistics

- The Medicare tax rate is 1.45 percent for both employers and employees, with the self-employed Medicare rate at 3.3 percent. There is no limit on Medicare taxes; Medicare tax is payable on all income, without a maximum. For higher-income individuals, there is an additional Medicare tax of 0.9% on income over a specific maximum, depending on the ind...

Funding

- Income from both self-employment and from employment (wages and tips) are included in income for the Social Security maximum. The total self-employment tax rate is 15.3% of the net profit of the company owned by the individual, with the Social Security portion at 12.4% of that total.

Example

- If your only income is from self-employment, the social security maximum is still in effect. That is, the Social Security portion of your self-employment tax is capped at the maximum profit of the company, depending on the maximum for that year. For example, if you have only self-employment, and the net earnings on your Schedule C are $135,000 for 2019, you would only be …