Out-of-pocket maximums for Medicare Advantage

- Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. ...

- Out-of-pocket limit levels. Plans may have two different out-of-pocket maximum levels — one for in-network providers and another for out-of-network providers.

- Fees that count toward out-of-pocket maximums. Deductibles, copayments, and coinsurance costs you pay as part of your Medicare Advantage plan count toward the out-of-pocket maximum.

Full Answer

Do premiums count towards out of pocket maximum?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

Is there a cap on out of pocket for Medicare?

May 16, 2020 · For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount.

Does Medicare have a standard "out-of-pocket maximum"?

This means there is an automatic limit on the amount of money you will spend for covered healthcare during any given year. For in-network services in 2021, the highest Medicare out-of-pocket maximum a Part C plan could allow was $7,550. Many Part C plans also offer lower out-of-pocket limits of $6,000 or less.

Should you buy a Medigap or Medicare Advantage plan?

In 2022, the MOOP for Medicare Advantage Plans is $7,550, but plans may set lower limits. If you are in a plan that covers services you receive from out-of-network providers, such as a PPO, your plan will set two annual limits on your out-of-pocket costs.

What is the out-of-pocket maximum for Medicare Advantage plans for 2021?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

Do Medicare Advantage plans have a maximum out-of-pocket?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

How does Medicare Advantage out-of-pocket maximum work?

It is the highest yearly amount you will have to pay out of pocket for covered health-care services. The out-of-pocket maximum for Medicare Advantage plans is different from a deductible. Out of pocket maximum is the highest yearly amount you will have to pay out of pocket for covered health-care services.Dec 18, 2021

What counts toward out-of-pocket maximum?

The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums. It typically includes your deductible, coinsurance and copays, but this can vary by plan.

Does Medicare Advantage pay 100 percent?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.Jan 7, 2022

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the coverage gap for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.Oct 30, 2021

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is the maximum out of pocket amount for health insurance?

For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019.

How much is the out of pocket maximum for 2019?

These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount. The opposite is also true, as lower out-of-pocket maximums often carry higher premium payments. Some people may qualify for reduced out-of-pocket maximum payments ...

What is copayment in healthcare?

Copayments are set dollar amounts that are associated with specific visits or treatments, and coinsurance costs are a percentage of care that you are responsible for paying. You will continue to be responsible for paying all coinsurance and copayment amounts until they total an additional $1,500 in payments.

What is Medicare Advantage?

Once a person meets their maximum, your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses. Having an out-of-pocket maximum offers protection for both the policy holder and the health insurance company. For the recipient, a maximum provides a cap for their share of the healthcare costs.

Does Medicare cover annual checkups?

This care can include annual checkups, routine screenings, flu shots, other vaccinations, and more. The good news is that many of these expenses are covered in full by Medicare to begin with, but you are not able to add these fees towards your maximum .

Does preventative care count towards the maximum?

Insurance companies can also restrict the services that they will cover. For example, certain cosmetic procedures, weight loss surgeries, or alternative medicine therapies may not be covered and will not count towards the maximum. Most preventative care does not contribute towards the maximum either.

Do health insurance premiums count towards out of pocket?

This means that you may end up paying more than your maximum amount each year. If you have a monthly premium payment, this amount does not contribute towards your out-of-pocket maximum.

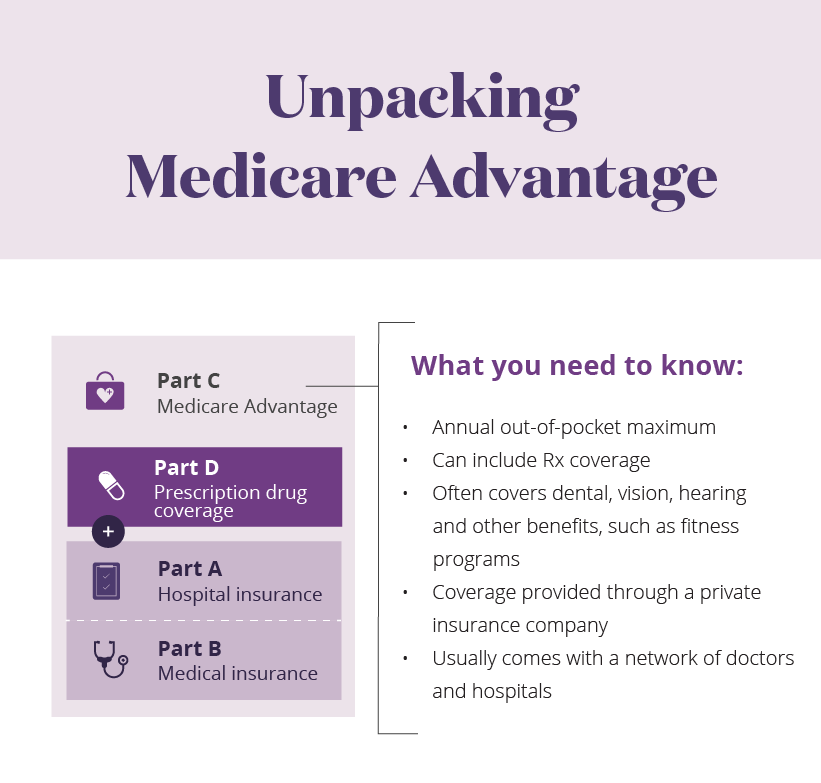

What is Medicare Advantage?

Medicare Advantage plans are another way to get your Medicare Part A and Part B benefits from a private insurance company contracted with Medicare. Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) cover with the exception of hospice care, which is still covered by Part A.

What is Medicare Advantage Plan Premium?

Medicare Advantage plans out of pocket cost: Premium. A premium is the amount you pay monthly or annually to have the plan, whether or not you receive services. Some Medicare Advantage plans have premiums as low as $0 but you must continue to pay your Medicare Part B premium.

What is a deductible for Medicare?

A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

What factors affect how much you pay out of pocket?

Other factors that could affect how much you pay out of pocket are: Whether you go out of network to get care. Whether you need extra benefits. Whether your doctor accepts Medicare assignment if you do go out of network. Whether you have Medicaid or other financial help. What the plan’s yearly out of pocket limit is.

What is coinsurance and copayment?

Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Coinsurance is usually a percentage and a copayment is a set dollar amount. For example, you could pay a $15 copayment every time you visit the doctor.

Does Medicare Advantage have out of pocket limits?

Unlike Original Medicare, Medicare Advantage plans have out of pocket limits, capping what you spend yearly on covered medical services. Medicare Advantage plans may save you money overall but they also generally come with some out of pocket costs. Medicare Advantage plans out of pocket costs include: premiums, deductibles. coinsurance/copayments.