If your break in skilled care lasts for at least 60 days in a row, this ends your current benefit period and renews your SNF benefits. This means that the maximum coverage available would be up to 100 days of SNF benefits.

Does Medicare cover 100 days of care in a skilled nursing facility?

Receive updates about Medicare Interactive and special discounts for MI Pro courses, webinars, and more. Medicare covers up to 100 days of care in a skilled nursing facility (SNF) each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket.

Does skilled nursing insurance have lifetime reserve days?

Note that skilled nursing coverage doesn’t have lifetime reserve days. Once you hit day 101 in each benefit period, you’ll have to pay for the cost of care yourself for however long you need it.

What are Medicare’s “lifetime reserve days”?

After 90 days, Medicare gives you 60 additional days of inpatient hospital care to use during your lifetime. For each of these “lifetime reserve days” you use in 2021, you’ll pay a daily coinsurance of $742.

How many days can you stay in a skilled nursing facility?

Medicare covers up to 100 days of care in a skilled nursing facility (SNF) each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket. If your care is ending because you are running out of days, the facility is not required to provide written notice.

What is the 60 day Medicare rule?

A benefit period begins the day you are admitted to a hospital as an inpatient, or to a SNF, and ends the day you have been out of the hospital or SNF for 60 days in a row. After you meet your deductible, Original Medicare pays in full for days 1 to 60 that you are in a hospital.

Can Medicare lifetime reserve days be used for SNF?

The lifetime reserve days do not apply to stays at skilled nursing facilities and stays at psychiatric hospitals.

Do Medicare lifetime reserve days reset?

Your lifetime reserve days are additional days that Medicare Part A will pay for if you have an inpatient hospital stay that lasts longer than 90 days. You only get a total of 60 reserve days to use during your lifetime; they don't reset, and you can't earn more.

What does lifetime reserve mean in Medicare?

Lifetime reserve days are additional days in the hospital that Original Medicare pays for if you are hospitalized for more than 90 days. You have only 60 of these days over the course of your lifetime. Medicare pays all covered costs for each lifetime reserve day, but you have to pay daily coinsurance.

How do lifetime reserve days work?

Original Medicare covers up to 90 days of inpatient hospital care each benefit period. You also have an additional 60 days of coverage, called lifetime reserve days. These 60 days can be used only once, and you will pay a coinsurance for each one ($778 per day in 2022).

How many days is lifetime reserve for Medicare?

60 reserve daysYou have a total of 60 reserve days that can be used during your lifetime. For each lifetime reserve day, Medicare pays all covered costs except for a daily coinsurance.

What service would prevent the 60 day wellness period count?

An emergency room visit without an admission to the hospital will not interrupt the 60-day spell of wellness count.

What is the meaning of lifetime reserve days?

Lifetime reserve days are the number of days of hospital stay that an insurance policy covers beyond the number of days allotted per benefit period. Lifetime reserve days are most commonly associated with Medicare policies. As of 2022, Medicare Part A offered 60 lifetime reserve days during a patient's lifetime. 2.

What costs are billed to Medicare Part A beneficiaries for hospital stays the first 60 days of each benefit period?

1. Inpatient Hospital CareDeductible of $1,556 for the first day you are a hospital inpatient. ... Copayment of $389 per day for days 61-90 (after you have been in the hospital for 60 days)Copayment of $778 per day for days 91-150 (after you have been in the hospital for 90 days; these are your 60 lifetime reserve days)

How do you count Medicare days?

A part of a day, including the day of admission and day on which a patient returns from leave of absence, counts as a full day. However, the day of discharge, death, or a day on which a patient begins a leave of absence is not counted as a day unless discharge or death occur on the day of admission.

Can Medicare benefits be exhausted?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What happens after Medicare runs out?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

How long does a break in skilled care last?

If your break in skilled care lasts for at least 60 days in a row, this ends your current benefit period and renews your SNF benefits. This means that the maximum coverage available would be up to 100 days of SNF benefits.

What happens if you refuse skilled care?

Refusing care. If you refuse your daily skilled care or therapy, you may lose your Medicare SNF coverage. If your condition won't allow you to get skilled care (like if you get the flu), you may be able to continue to get Medicare coverage temporarily.

What happens if you leave SNF?

If you stop getting skilled care in the SNF, or leave the SNF altogether, your SNF coverage may be affected depending on how long your break in SNF care lasts.

Does Medicare cover skilled nursing?

Medicare covers skilled nursing facility (SNF) care. There are some situations that may impact your coverage and costs.

Can you be readmitted to the hospital if you are in a SNF?

If you're in a SNF, there may be situations where you need to be readmitted to the hospital. If this happens, there's no guarantee that a bed will be available for you at the same SNF if you need more skilled care after your hospital stay. Ask the SNF if it will hold a bed for you if you must go back to the hospital.

How many days can you use Medicare for a lifetime reserve?

If you again need to stay in the hospital longer than 90 days, you’ll have only 40 lifetime reserve days left to use, assuming you decided to use 20 during your first stay. The hospital will notify you as you get close to using up your 90 days of coverage under Medicare Part A. At that point, you can let the hospital know if you want to save ...

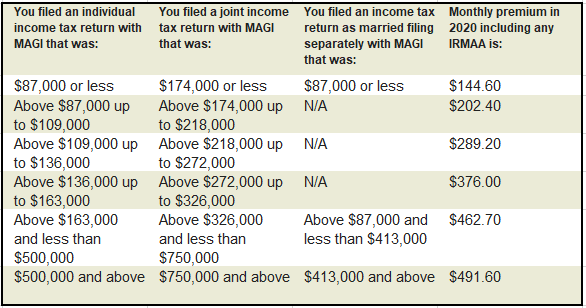

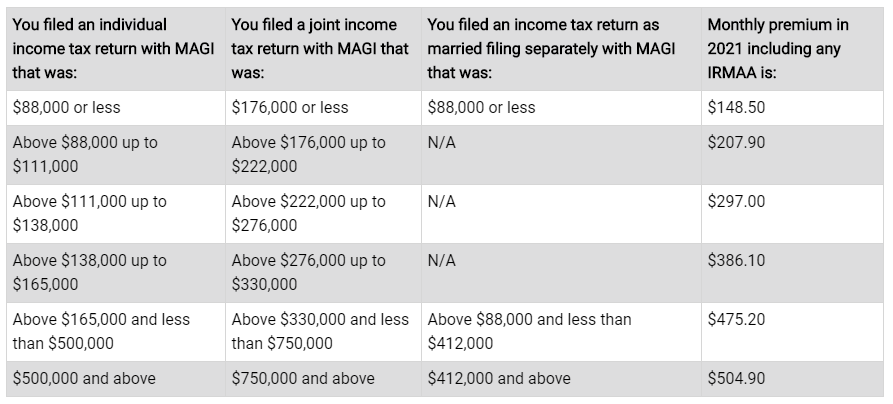

How much will Medicare pay for lifetime reserve days in 2021?

For each of these “lifetime reserve days” you use in 2021, you’ll pay a daily coinsurance of $742. When you’re sick or injured and your doctor admits you to a hospital or long-term care facility, it’s important to understand what your costs and coverage will look like. If you have original Medicare, Part A will cover your hospital stay, ...

How much is the Medicare deductible per benefit period?

This is in addition to your Medicare Part A deductible of $1,484 per benefit period. If you think you may need more coverage, you can purchase a Medigap policy, which can provide additional lifetime reserve days or pay for your Part A deductible.

How much is the coinsurance for Medicare 2021?

When you use lifetime reserve days, you pay a coinsurance fee of $742 per day in 2021. This is in addition to your Medicare Part A deductible of $1,484 per benefit period.

How long is a lifetime reserve day?

What are lifetime reserve days? If you’re admitted to a hospital or long-term care facility for inpatient care, Medicare Part A covers up to 90 days of treatment during each benefit period. If you need to remain in the hospital after those 90 days are up, you have an additional 60 days of coverage, known as lifetime reserve days.

What is the term for the extra 60 days of inpatient care?

These are called lifetime reserve days.

How to contact Medicare for lifetime reserve days?

For additional help understanding your Medicare lifetime reserve days or other benefits, try these resources: You can contact Medicare directly at 800-MEDICARE (800-633-4227). Get help from trained, impartial counselors through your local State Health Insurance Assistance Program (SHIP).

How long does Medicare cover after SNF?

After you’ve spent 100 days in an SNF or hospital, your Medicare coverage ends for that specific benefit period. To get Medicare coverage for an SNF stays once again, you have to begin a new benefit period.

How long is the benefit period for SNF?

For example, say you stayed at an SNF for 100 days and then went home. Let’s call this benefit period A. Benefit period A ends 60 consecutive days after your discharge from the SNF. If you’re admitted as an inpatient to a hospital on day 61, you begin a new benefit period (benefit period B). If you’re then admitted as an inpatient at a skilled nursing facility, you follow the same coverage schedule as you did in the previous benefit period (benefit period A): your first 20 days at the SNF are fully covered, you pay a per-day coinsurance for days 21 to 100, and you pay all costs after that.

What is the benefit period for Medicare?

Under Medicare Part A (inpatient hospital or skilled nursing facility coverage), a benefit period starts on the day you’re admitted as an inpatient to a hospital or SNF and ends when you’ve left and haven’t received any inpatient care in a hospital or SNF for 60 days in a row.

What is coinsurance in Medicare?

The coinsurance cost is the amount you’re responsible for paying after Medicare has paid its portion and you have met your deductible. Along with premiums and deductibles, the coinsurance rate is adjusted yearly, so it may vary from one year to the next. Your coinsurance and other costs may be covered if you have a Medigap or Medicare Advantage policy, depending on the specifics of your plan.

How long does it take to get admitted to a SNF?

Typically, you must be admitted to an SNF within 30 days of leaving the hospital.

When does the benefit period start for a second hospital stay?

If you’re an inpatient in a hospital or skilled nursing facility again after a benefit period has ended, a new benefit period begins for your second inpatient stay, even if the second stay is related to the first one. For example, let’s say you were an inpatient in the hospital for 10 days and then found yourself back in the hospital 70 days after you were discharged—a new benefit period would begin with your second hospital admission.

Does YourMedicare.com sell Medicare?

YourMedicare. com takes pride in providing you as much information as possible concerning your Medicare options, but only a health insurance broker licensed to sell Medicare can help you compare your plan options from various insurance companies. When you’re ready, we recommend you discuss your needs with a YourMedicare.com Licensed Sales Agent.

How long do you have to be in hospital before Medicare pays for SNF?

Before your benefit period can even start and before Medicare will cover your SNF care, you have to have spent three days as a hospital inpatient.

What happens after 90 days of Medicare?

After day 90 in a benefit period, and if the person has no more lifetime reserve days available to use, the Medicare recipient is responsible to pay all of the costs associated with their hospital stay. After you’ve spent 60 days out of the hospital, your benefit period will start all over again. At the start of each new period, you will receive ...

How many days do you have to be out of the hospital to get Medicare?

In order to help you make better sense of this, here’s a breakdown. 60 days: How many days you are required to be out of the hospital or after-care facility to become eligible for another hospital benefit period. 60 days: The maximum number of days that Medicare will pay for all of your inpatient hospital care once you’ve paid your deductible ...

How long do you have to stay in a hospital?

In an Original Medicare plan, you have to stay for a minimum of three days, or more than two nights, to officially be admitted as a patient in a hospital. Only then will Medicare start to pay for your care in a skilled nursing center for additional treatment, like physical therapy or for regular IV injections. The amount of time you spend in the hospital as well as the skilled nursing center will be counted as part of your hospital benefit period. Furthermore, you are required to have spent 60 days out of each in order to be eligible for another benefit period.#N#However, the portion you are expected to pay for the costs of a skilled nursing center differs from the portion you pay for hospital care. In facilities like these, you must pay in any given benefit period: 1 $0 for your room, bed, food and care for all days up to day 20 2 A daily coinsurance rate of $161 for days 21 through 100 3 All costs starting on day 101

What is Medicare Supplemental Insurance?

As for Medicare supplemental insurance, also known as Medigap, it’s a supplemental policy that you can buy to help offset the costs of Original Medicare.

How much is Medicare coinsurance?

The Medicare recipient is charged a daily coinsurance for any lifetime reserve days used. The standard coinsurance amount is $682 per day. If you’re enrolled in a supplemental Medicare insurance program, also known as “Medigap,” you will receive another 365 days in your lifetime reserve with no additional copayments.

How much is the hospital stay deductible for Medicare?

You will be expected to pay for the initial cost of your hospital stay up to a limit of $1,364. This is your hospital deductible for Medicare Part A. As opposed to other Medicare deductibles, it begins anew with every hospital benefit period, rather than your first admission to the hospital each year. After this deductible is met, Medicare will ...

How many days do you have to be hospitalized before you can be admitted to the SNF?

hospitalization for at least three consecutive days before being admitted to the SNF. 42 C.F.R. § 409.30 (a)/

Does Medicare cover skilled services?

In fact, Medicare law is explicit that continued coverage for “skilled services” at a SNF does not require that the patient have “restoration potential.” Indeed, federal regulations state that “restoration potential of a patient is not the deciding factor in determining whether skilled services are needed. Even if full recovery or medical improvement is not possible , a patient may need skilled services to prevent further deterioration or preserve current capabilities .” 42 C.F.R. § 409.32 (c). (Emphasis added)

How long do you have to be in a skilled nursing facility to qualify for Medicare?

The patient must go to a Skilled Nursing Facility that has a Medicare certification within thirty days ...

How long does it take for Medicare to cover nursing?

Medicare will cover 100% of your costs at a Skilled Nursing Facility for the first 20 days. Between 20-100 days, you’ll have to pay a coinsurance. After 100 days, you’ll have to pay 100% of the costs out of pocket.

What does it mean when Medicare says "full exhausted"?

Full exhausted benefits mean that the beneficiary doesn’t have any available days on their claim.

What is skilled nursing?

Skilled nursing services are specific skills that are provided by health care employees like physical therapists, nursing staff, pathologists, and physical therapists. Guidelines include doctor ordered care with certified health care employees. Also, they must treat current conditions or any new condition that occurs during your stay ...

How long does a SNF stay in a hospital?

The 3-day rule ensures that the beneficiary has a medically necessary stay of 3 consecutive days as an inpatient in a hospital facility.

How many days of care does Part A cover?

Part A benefits cover 20 days of care in a Skilled Nursing Facility.

Does Medicare cover hospice in a skilled nursing facility?

Does Medicare pay for hospice in a skilled nursing facility? Yes, Medicare will cover hospice at a Skilled Nursing Facility as long as they are a Medicare-certified hospice center. However, Medicare will not cover room and board. What does Medicare consider skilled nursing?