The Value-Based Payment Modifier Program adjusts the Medicare Physician Fee Schedule

Medicare Sustainable Growth Rate

The Medicare Sustainable Growth Rate was a method used by the Centers for Medicare and Medicaid Services in the United States to control spending by Medicare on physician services. President Barack Obama signed a bill into law on April 16, 2015, the Medicare Access and CHIP Reauthorization Act of 2015, which ended use of the SGR. The measure went into effect in July 2015.

What is value based modifier (VBM)?

Value Based Modifier (VBM) The VPM provides for differential payment to a physician or group of physicians under the Medicare Physician Fee Schedule (MPFS) based upon the quality of care furnished compared to the cost of care during a performance period. It is an adjustment made to payments for items and services under the MPFS.

What is a Medicare physician fee schedule adjustment?

The VPM provides for differential payment to a physician or group of physicians under the Medicare Physician Fee Schedule (MPFS) based upon the quality of care furnished compared to the cost of care during a performance period. It is an adjustment made to payments for items and services under the MPFS.

What is the Medicare value modifier?

The Value Modifier was an adjustment made to Medicare payments for items and services under the Medicare PFS.

What replaced the value modifier program under the quality payment program?

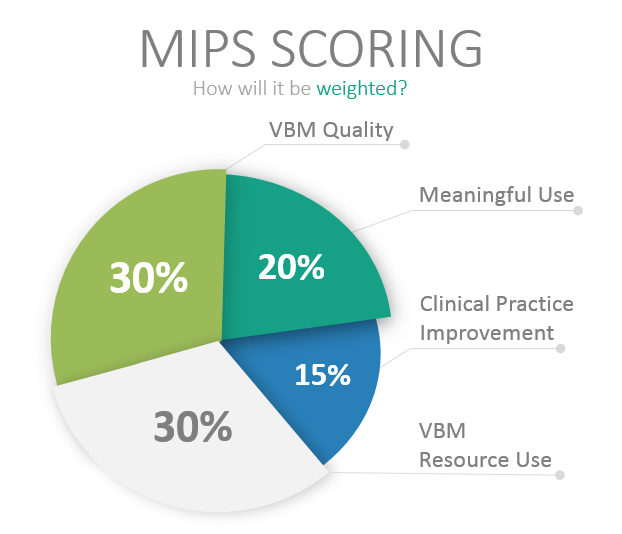

The Merit-based Incentive Payment System (MIPS) under the Quality Payment Program replaced the Physician Feedback/Value-Based Payment Modifier (Value Modifier) program on January 1, 2019. Calendar Year 2018 (2018) was the final payment adjustment period under the Value Modifier program based on performance in Calendar Year 2016.

What is the value modifier program?

The Value Modifier (VM) program assesses both the quality of care furnished and the cost of that care under the Medicare Physician Fee Schedule. CMS began phase-in of the VM in 2015, based on 2013 reporting, for groups of 100+ EP.

What is the Medicare conversion factor for 2020?

$36.09The CY 2020 Medicare Physician Fee Schedule (PFS) conversion factor is $36.09 (CY 2019 conversion factor was $36.04). The conversion factor update of +0.14 percent reflects a budget neutrality adjustment for reductions in relative values for individual services in 2020.

What is the CMS conversion factor for 2021?

34.8931CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the formula for the Medicare allowed amount?

Calculating 95 percent of 115 percent of an amount is equivalent to multiplying the amount by a factor of 1.0925 (or 109.25 percent). Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925.

How is the Medicare conversion factor calculated?

Basically, the relative value of a procedure multiplied by the number of dollars per Relative Value Unit (RVU) is the fee paid by Medicare for the procedure (RVUW = physician work, RVUPE = practice expense, RVUMP = malpractice). The Conversion Factor (CF) is the number of dollars assigned to an RVU.

What is the Medicare conversion factor for 2022?

$34.6062In implementing S. 610, the Centers for Medicare & Medicaid Services (CMS) released an updated 2022 Medicare physician fee schedule conversion factor (i.e., the amount Medicare pays per relative value unit) of $34.6062.

What does Medicare conversion factor mean?

The conversion factor is the multiplier that Medicare applies to relative value units (RVUs) to calculate reimbursement for a particular service or procedure under Medicare's fee-for-service system.

What is the current RVU conversion factor?

For each year, work RVUs and conversion factors of that specific year were applied to the formula, $36.04 for 2019 and $32.41 for 2021.

What is the Medicare Economic Index for 2021?

The 2021 MEI percentage released by CMS on October 29, 2020, lists RHCs at 1.4% while the 2021 MEI percentage released by CMS on December 4, 2020, lists FQHCs at 1.7%. Healthy Blue will update our systems to reflect the new rates by July 30, 2021.

How is Medicare secondary payment calculated?

As secondary payer, Medicare pays the lowest of the following amounts: (1) Excess of actual charge minus the primary payment: $175−120 = $55. (2) Amount Medicare would pay if the services were not covered by a primary payer: . 80 × $125 = $100.

What are the three components of the relative value unit?

Medicare Reimbursement in Calculated To understand this more fully, the calculations can be broken into three components – RVUs, the geographical adjustment and the conversion factor.

What is the Medicare reimbursement rate?

roughly 80 percentAccording to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

What is value based modifier?

The value-based modifier builds on the Physician Feedback Program that was authorized by the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA) and expanded by the Affordable Care Act. Under this program, CMS provides confidential feedback reports to physicians and physician group practices about the resource use and quality ...

When did CMS issue the final rule?

The Centers for Medicare & Medicaid Services (CMS) issued a final rule with comment period on Nov. 1, 2011 that updates payment policies and Medicare payment rates for services furnished by physicians, nonphysician practitioners (NPPs), and other suppliers that are paid under the Medicare Physician Fee Schedule (MPFS) in calendar year (CY) 2012.

What is value based payment modifier?

The value-based payment modifier stems from the 2010 Patient Protection and Affordable Care Act (ACA), which mandates that the U.S. Department of Health & Human Services establish a system to provide tiered payments under the Medicare Physician Fee Schedule.

What happens when value based payment modifier is implemented?

As the value-based payment modifier is implemented, the penalties will be much greater because any reductions under the value-based modifier are in addition to penalties for failing to participate in PQRS.

Why is the Value Based Payment Modifier Program budget neutral?

The reason is that the Value-based Payment Modifier Program must be budget neutral, which means that the total amount paid out in upward adjustments cannot exceed the total amount Medicare reduces payments for the providers receiving a penalty. The number of groups receiving the penalty cannot be determined until after the close ...

What is MPFS adjustment?

Adjustment is made on a per claim basis. It is applied only to assigned claims for procedures that have a MPFS allowed amount. It is applied to paid amount after deductible is taken; it is not applied to allowed/fee schedule amount. It is applied at Taxpayer Identification Number (TIN) level.

What is VPM in Medicare?

The VPM provides for differential payment to a physician or group of physicians under the Medicare Physician Fee Schedule (MPFS) based upon the quality of care furnished compared to the cost of care during a performance period. It is an adjustment made to payments for items and services under the MPFS.

How the Value-Based Modifier Works

Because the Value Modifier (VM) program uses PQRS data, those providers who report PQRS data will not need to report additional data.

Who Does the Value-Based Payment Modifier Program Affect?

In the 2014 performance year (thus the 2016 payment year) only groups of 10 or more were affected by the VBM program. A group size of 100+ was faced with a -4% non-reporting penalty (for PQRS and VM) but if they did report they were given upward, neutral or downward payment adjustments based on the VBM benchmark comparison.

What is a value modifier in Medicare?

Section 1848(p) of the Social Security Act (Act) requires that Medicare establish a value-based payment modifier (Value Modifier) that provides for differential payment under the Medicare Physician Fee Schedule (PFS) based upon the quality of care furnished compared to cost during a performance period. Section 1848(p) requires that the Value Modifier be applied to specific physicians and groups of physicians the Secretary determines appropriate starting January 1, 2015, and to all physicians and groups of physicians by January 1, 2017. The statute requires the Value Modifier to be budget neutral. Budget-neutrality means that, in aggregate, the increased payments to high performing physicians and groups of physicians equal the reduced payments to low performing physicians and groups of physicians.

What is the 1848 P-3?

Section 1848(p)(3) of the Act requires us to evaluate costs, to the extent practicable, based on a composite of appropriate measures of costs. We adopted five per capita cost measures in the quality-tiering election for the Value Modifier: