Are there any costs associated with the MAB products q0239 and q0243?

Q4051. Splint supplies, miscellaneous (includes thermoplastics, strapping, fasteners, padding and other supplies) Miscellaneous Services (Temporary Codes) Q4051 is a valid 2022 HCPCS code for Splint supplies, miscellaneous (includes thermoplastics, strapping, fasteners, padding and other supplies) or just “ Splint supplies misc ” for short, used in Surgical dressings or other …

How much does Medicare Part B cost in 2021?

Payment shall be 115% of Tennessee Medicare allowable amount. If the invoice amounts exceed the Medicare payments amounts at the time of delivery, the payment for orthotics and prosthetics shall be the higher of invoice amounts or 115% of the Tennessee Medicare allowable amount and coded using the HCPCS code.

What is the Cy 2021 Medicare physician fee schedule final rule?

medicare allowable units. max allowables per month. a4338 (indwelling/foley catheter) 1 unit. 1 ea per month. a4340 indwelling/foley catheter coude tip*** 1 unit. 1 ea per month. a4310 insertion tray. 1 unit. 1 ea per month. a4331 extension tube. only for patients using a5112. 1 unit. 1 ea per month. a4349 male external catheter. 35 unit. 35 ea per month

What is the income-related monthly adjustment amount for Medicare?

Nov 15, 2021 · Fee Schedules - General Information. A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis. CMS develops fee schedules for physicians, ambulance services, clinical ...

What is CPT code Q4051?

| HCPCS Level II Code Miscellaneous Services (Temporary Codes) Search | |

|---|---|

| HCPCS Code | Q4051 |

| Description | Long description: Splint supplies, miscellaneous (includes thermoplastics, strapping, fasteners, padding and other supplies) Short description: Splint supplies misc |

| HCPCS Modifier1 | |

Does Medicare pay for casting supplies?

How do you bill for cast supplies?

What is the Medicare allowable for 99213?

Can you bill for cast removal?

Does Medicare pay for A4590?

Which code represents cyclophosphamide 100mg?

What are L codes?

What is the HCPCS code for adult fiberglass short arm cast?

Is 99203 covered by Medicare?

...

CPT CODE 2016 Fee 2017 FEE.

| 99201 | $35.96 $43.6 |

|---|---|

| 99203 | $89.52 $108.3 |

| 99204 | $135.38 $165.7 |

| 99205 | $169.54 $208.2 |

| 99211 | $20.07 $19.63 |

How do I find Medicare allowable rates?

What is Medicare allowable?

How much does a CPT code 99408 cost?

If a provider assesses, counsels or provides behavioral intervention to a Workers’ Compensation patient for substance and/or alcohol use, or for substance and/or Alcohol use disorder, the provider may charge for the extra time involved using CPT® code 99408 (or CPT® codes 96150-96155, if appropriate) up to a maximum of eighty dollars ($80) in addition to a standard E/M code. An assessment by structured screening must be documented. The code may only be charged if the patient is on a long term (over 90 days) Schedule II medication or a combination of one or more Schedule II, Ill, and/or IV medications. The Medicare allowable fee does not apply to this service. See Rule 0800-02-17-.15.

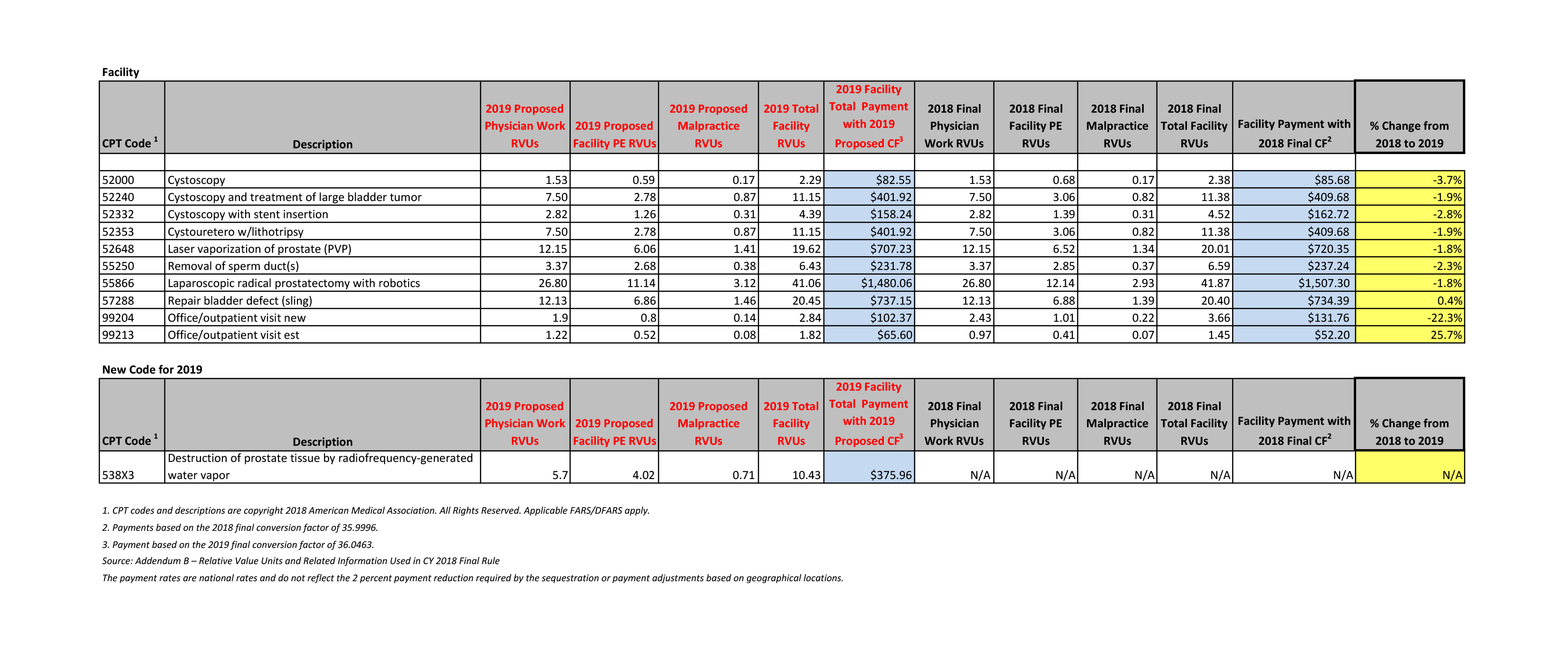

What is CF in Medicare?

The CF, a national dollar multiplier, is used to “convert” the geographically adjusted RVU to determine the Medicare-allowed payment amount for a particular physician service. The CF is used separately to price facility and nonfacility payment amounts. Facility pricing typically covers services provided to inpatients or in a hospital outpatient clinic setting or other off-site hospital facilities. Nonfacility pricing covers services gen erally provided in a physician office or other freestanding setting such as an Independent Diagnostic Testing Facility.

What is Medicare negotiated rate?

Maximum amount on which payment is based for covered health care services. This may be called “eligible expense,” “payment allowance” or “negotiated rate.” If your provider charges more than the medicare allowed amount, patient no need to pay that amount when they are participating with Medicare insurance.

How many hours per day for CPT?

Work Hardening/Conditioning Programs using the approved CPT® codes shall be billed at usual and customary hourly charges for a maximum of 6 hours per day or 60 hour maximum and are subject to utilization review prior approval. Payment is 80% of the billed charges.

Does the Allowed amount cover all charges?

Allowed amount may not cover all the provider’s charges. In some cases, subscribers may have to pay the difference.

Is Wisconsin Physicians Service Insurance Corporation a Medicare agency?

This is an advertisement for insurance. Neither Wisconsin Physicians Service Insurance Corporation nor its agents are connected with the federal Medicare program. Our products are not connected with or endorsed by the United States government or the federal Medicare program.

Medicare Allowables

Below is a list of current Medicare allowable for ostomy supplies, urological supplies and wound care supplies . If you have any questions, reach out to our team today! We’re happy to help.

Wound Care Allowables

PLEASE NOTE: AMOUNT SENT IS BASED ON CHANGING FREQUENCY, NUMBER OF WOUNDS, AND DOCTORS ORDERS.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

When will CMS accept comments on the proposed rule?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: ...

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.