What is the current Medicare tax rate?

The thresholds are as follows:

- For two married individuals filing jointly, the threshold is $250 000.

- For a married individual filing separately, $125 000.

- The threshold for a single person is $200 000.

- For the head of a household, with a qualifying person – $200 000.

- For a widow (er) with dependent child/ren – $200 000.

How much Medicare tax do I pay?

Social Security and Medicare taxes together are commonly referred to as the “FICA” tax. This is a 7.65% tax both employees and employers pay into the FICA system. Your FICA tax gets automatically taken out of each paycheck, normally by your employer, and is reflected as such on your paystubs.

How much is Medicare tax rate?

You will pay more tax than normally as you are not paying a subsidised rate for Social Security and Medicare. When you are someone else's employee, you share that cost with your employer when paying your FICA (Federal Insurance Contributions Act).

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

What was the Medicare tax rate in 2016?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

What is the FICA limit for 2016?

$118,500Specifically, the Social Security and Medicare (FICA) tax rates will not change for 2016. Employers and employees will each continue to pay the Social Security tax rate of 6.2% on all wages up to the $118,500 wage base. The maximum Social Security tax employees and employers will each pay in 2016 will remain $7,347.

How much are Social Security taxes and Medicare taxes?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What was the Medicare tax rate in 2014?

1.45 percentFor 2014, the social security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent.

Is there a cap on Medicare tax?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the maximum Social Security tax anyone could have paid in the year 2016?

During most years, the maximum Social Security tax rises slightly, but for 2016, taxpayers got a rare break, as the amount remained the same, at $7,347 for employees and $14,694 for self-employed individuals. Let's look at how the Social Security tax works and why the maximum stayed the same for 2016.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

Does federal tax rate include SS and Medicare?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

How much percent is Social Security tax?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What was the FICA rate in 2015?

7.65 percentThe FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Did Social Security tax go up?

The amount of the benefits received by individuals and couples rose to 5.9%. The largest social security tax increase was in 2021 but 2022 is high as well. The cost-of-living adjustment and the retirement earnings exempt amounts are other important changes that can affect an individual's Social Security benefits.

What is the Medicare tax rate for 2022?

1.45%For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

Find out how much your paycheck will suffer

One of the first things you notice when you get your first paycheck is that your take-home pay is less than your wage or salary would suggest. That's because part of your earnings gets withheld to cover taxes, and a big part of that withholding goes toward Social Security and Medicare taxes.

Social Security, Medicare, and FICA

Tax withholding can appear on your paycheck in different ways depending on how your employer handles its payroll. Some employers break out Social Security taxes separately from Medicare taxes. Others lump them into one big category called FICA, which stands for the Federal Insurance Contributions Act.

Are changes coming to payroll tax withholding?

Tax increases are rarely popular. However, when it comes to Social Security and Medicare taxes, some policymakers believe that there's an opportunity to change the payroll tax withholding system in a way that will generate more tax revenue.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is the Social Security earnings limit for 2016?

Earnings Limit Unchanged. The annual earnings limit for those who both work and claim Social Security benefits will stay at $15,720 in 2016 for individuals who opt to receive benefits early (ages 62 through 65). For those who turn 66 in 2016, the earning limit remains at $41,880.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings. Source: Social Security Administration.

What is the Medicare payroll tax rate?

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

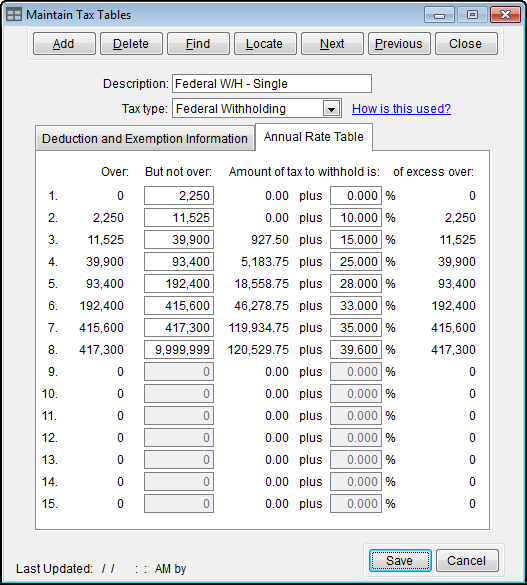

When was Revenue Procedure 2015-53 issued?

The IRS issued Revenue Procedure 2015-53 at the end of October 2015, with annual inflation adjustments for income tax provisions including 2016 taxable income ranges for singles, married (filing jointly), married (filing separately), and heads of households. While there was no statutory increase in tax rates for 2016, ...

Will HR adjust payroll taxes in 2016?

HR professionals won’t have to adjust their payroll tax systems in 2016 for a Social Security FICA increase, as the amount of earned income subject to Social Security taxes won’t change, given the absence of inflation and tepid wage increases over the past year. But the modest amount of inflation this year was enough to cause small upward ...

Is there a Social Security increase for 2016?

On Oct. 15, 2015, the Social Security Administration (SSA) announced that there will be no increase in monthly Social Security benefits in 2016, and that the maximum amount of wages subject to Social Security taxes will also remain unchanged at $118,500. Earnings above this amount are not subject to the Social Security portion ...

Did the CPI increase in 2016?

While there was no statutory increase in tax rates for 2016, the modest CPI increase did nudge income tax brackets slightly upward, which could mean lower taxes for employees whose income stayed flat. (For a look back at 2015 tax brackets, see 2015 Income Tax Rates and Ranges .) 2016 Tax Rates: Single Filing Individual Return.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

What is the wage base limit for 2020?

The 2020 wage-base limit is $118,500. If you earn more than that with one employer, you should only have Social Security taxes withheld up to that amount. If you have more than one employer and you earn more than that amount, you’ll receive an adjustment of any overpaid Social Security taxes on your return. The employee tax rate for Medicare is ...

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.