What is the coverage gap for Medicare drug plans?

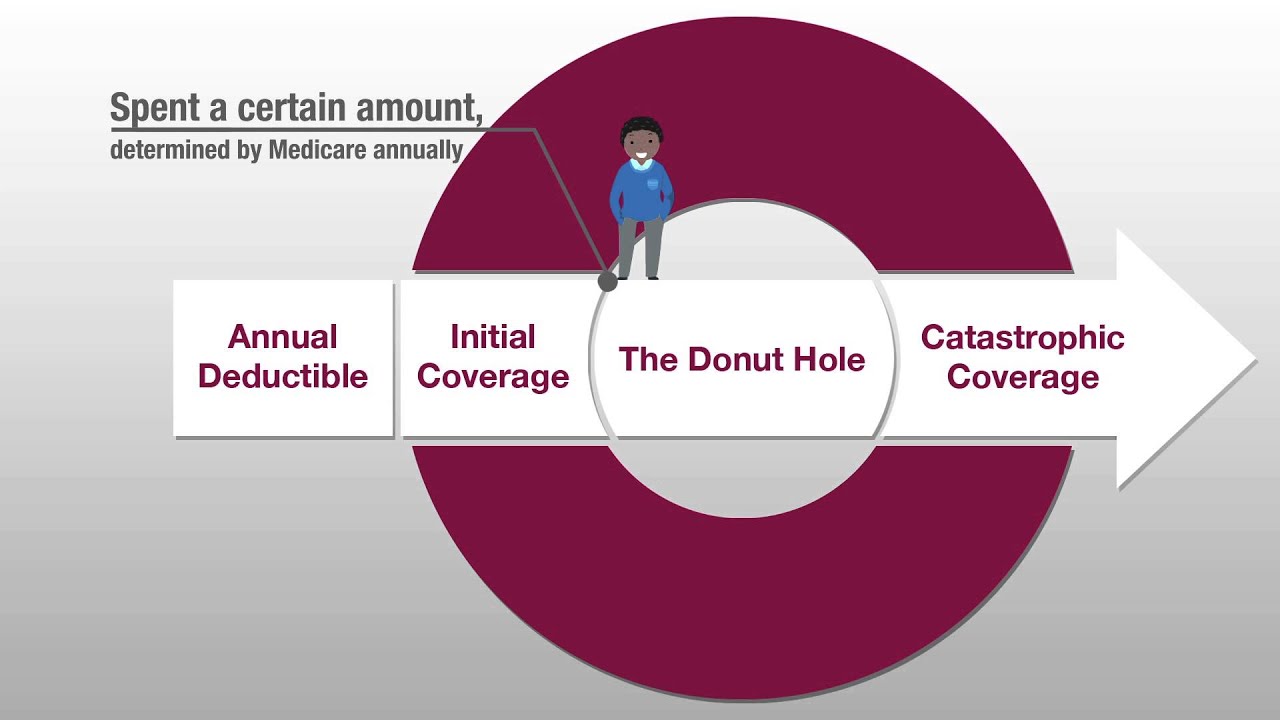

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs.

What is the Medicare Part D coverage gap for 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.” Most Medicare drug plans have a coverage gap (also called the "donut hole").

How do I get Out of the coverage gap for 2020?

Once you've spent $6,350 out-of-pocket in 2020, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small Coinsurance amount or Copayment for covered drugs for the rest of the year.

Does Medicare Part D Phase 3 have a coverage gap?

Phase 3 – coverage gap Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What was the donut hole in 2019?

In 2019, discounts meant that beneficiaries paid 25% of the cost for any brand-name medication, officially closing the donut hole, and 37% for generics. Then, in 2020, the donut hole for generic drugs is also closed. So, the donut hole has closed for all medications.

Does the donut hole end in 2020?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people with Medicare won't pay anything once they pass the Initial Coverage Period spending threshold.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will there be a Medicare donut hole in 2022?

Q: Are there changes in the Medicare Part D prescription drug coverage for 2022? A: Yes. The maximum deductible will be slightly higher, and the upper and lower thresholds for the “donut hole” will change again.

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

Did the Affordable Care Act close the donut hole?

The Affordable Care Act is closing the “donut hole” over time, by first providing a one-time $250 check for those that reached the “donut hole” in 2010, then by providing discounts on brand-name drugs for those in the “donut hole” beginning in 2011, and additional savings each year until the coverage gap is closed in ...

Do all Medicare Part D plans have a donut hole?

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

How long do you stay in the donut hole?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

What is the coverage gap for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

What is the Medicare coverage gap?

As of 2019, Medicare beneficiaries enrolled in Part D prescription drug plans will no longer be exposed to a coverage gap, sometimes called the “donut hole”, when they fill their brand-name medications. The coverage gap was included in the initial design of the Part D drug benefit in the Medicare Modernization Act of 2003 in order to reduce ...

When did Medicare Part D coverage gap start?

Under the original design of the Medicare Part D benefit, created by the Medicare Modernization Act of 2003, when Part D enrollees’ total drug spending exceeded the initial coverage limit (ICL), they entered a coverage gap. Enrollees who did not receive low-income subsidies ...

What is the out of pocket spending threshold for 2020?

Between 2019 and 2020, the annual out-of-pocket spending threshold—the amount beneficiaries must spend before the coverage gap ends and catastrophic coverage begins—is projected to increase by $1,250. This is due to the expiration of the ACA provision that slowed the growth rate of this threshold between 2014 and 2019.

How did the ACA phase out the coverage gap?

The Affordable Care Act (ACA) included a provision to phase out the coverage gap by gradually reducing the share of total drug costs paid by non-LIS Part D enrollees in the coverage gap, from 100 percent before 2011 to 25 percent in 2020. The ACA required plans to pay a gradually larger share of total drug costs, and also required drug manufacturers to provide a 50 percent discount on the price of brand-name drugs in the coverage gap, beginning in 2011. The ACA stipulated that the value of this discount would count towards a beneficiary’s annual out-of-pocket spending.

How much did Part D drug spending increase?

With total Part D drug spending increasing over time and more non-LIS beneficiaries reaching the coverage gap, the aggregate discount that Part D enrollees have received on brand-name drugs has also increased—from $2.2 billion in 2011 to $5.7 billion in 2016.

Will the BBA change the coverage gap?

There are efforts underway in Congress to modify the coverage gap changes made by the BBA, while also preventing the upcoming steep increase in the out-of-pocket spending threshold. The effort to modify the BBA changes would reallocate payer liability in the coverage gap, motivated in part by pharmaceutical industry concerns about the requirement that they provide a larger discount on brand-name drugs starting in 2019. In addition, there is some concern that the reduced share of brand-name drug costs paid by plans in the coverage gap will weaken their financial incentive to manage enrollees’ costs once they cross the initial coverage limit and enter the coverage gap phase of the benefit.

Will there be a coverage gap for generic drugs?

As of 2019, there will no longer be a coverage gap for brand-name drugs, as a result of changes in the BBA. Beneficiary coinsurance for brands in the gap will be 25 percent in 2019, the same share of costs that they face for brands under the standard benefit design before they reach the coverage gap. The coverage gap for generic drugs will not be fully closed until 2020, as scheduled in the ACA. In 2019, beneficiaries will pay 37 percent of the cost of generic drugs, and plans will pay the remaining 63 percent.

What is a Medicare Part D gap?

When Medicare Part D prescription drug plans first became available, there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them ...

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

What is the limit for Part D coverage in 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.”.

How much is a deductible for 2021?

The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445.

How much will you pay for prescription drugs in 2021?

For 2021, once you've spent $6,550 out of pocket, you're out of the coverage gap and move into phase 4—catastrophic ...