Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

What amount is currently deducted from your pay for Medicare?

Your employer also withholds Social Security and Medicare taxes, known as FICA payroll taxes. Generally, 6.2% of your income is taken out for Social Security taxes and 1.45% is taken out for Medicare taxes. But, if you’re a high earner, you might not pay Social Security taxes on your entire paycheck.

How much is the Medicare yearly deductible?

- Medicare Part D premiums

- Annual Medicare Part D deductible

- Copayments (flat fee per prescription)

- Coinsurance (a percentage of actual medication costs)

Does Medicare have a yearly deductible?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022 ($445 in 2021). Some Medicare drug plans don't have a deductible.

Do I have to pay the annual Medicare deductible?

Medicare Advantage plans may have their own deductible, but you will not be responsible for the Medicare Part B deductible if you are enrolled in a Medicare Advantage plan. You will only be responsible for paying your Medicare Advantage plan deductible.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What was the Medicare deductible for 2018?

$183 for 2018The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What is the deductible for Medicare each year?

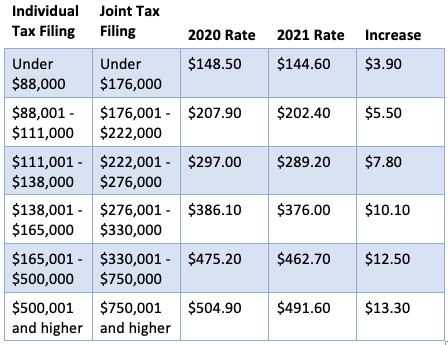

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How do I find my Medicare deductible?

You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What was the Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What is the Medicare Plan G deductible for 2022?

$2,490$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

What is the Medicare Part A deductible for 2022?

$1,556The Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year 2022, to $1,556, the Centers for Medicare & Medicaid Services announced Friday.

What is the deductible for Medicare Part B 2021?

$203.00 per yearThe standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

Does everyone on Medicare have a deductible?

Summary: Medicare Part A and Part B have deductibles you may have to pay. Medicare Part C and Part D may or may not have deductibles, depending on the plan. Original Medicare has two parts: Part A for hospital insurance and Part B for medical insurance.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

Is the Medicare deduction the same for everyone?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Premiums and Deductibles for 2017

Medicare beneficiaries are required to pay monthly premiums and annual deductibles like most individuals enrolled in other health insurance plans. Medicare coverage is separated into four “parts”, each covering different health care products and services.

Tara O'Neill Hayes

Tara O'Neill Hayes is the Director of Human Welfare Policy at the American Action Forum.

Tara O'Neill Hayes

Tara O'Neill Hayes is the Director of Human Welfare Policy at the American Action Forum.

More on the Part B Premium. This was taken directly from Medicare.gov

The standard Part B premium amount in 2017 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits.

In other words

If you’re currently getting your premium deducted from your Social Security check, this number is not what you will pay. You will actually pay less. The Social Security office will inform you of your rate. This is because the part B premium increase was more than the Social Security cost of living increase.

Comments?

These numbers will be updated on the Medicare section of this website ( https://simpleseniorhealth.com/starting-point/what-is-medicare) when the new year starts. Please comment below. What are your thoughts on these changes? Find out events and other news at our Facebook page. Don’t forget to like us!

Part A Costs

Most people don't pay a monthly premium for Medicare Part A (hospital insurance). But if you have to pay for Part A because you or your spouse doesn't have a long enough work history, you'll pay between $227 (for 30-39 work credits) and $413 (for fewer than 30 work credits).

Part B Costs

Most people pay a Part B premium of $109 each month (up from $104.90 in 2016). But if you first enroll in Medicare Part B during 2017, or you are not collecting Social Security benefits, your premium will be $134 per month (up from $121.80 in 2016).

Part D Costs

Part D premiums vary depending on the plan you choose. The Part D deductible for 2017 is $400 per year (though some plans waive the deductible).

What are the costs of Medicare?

Some of the Medicare out-of-pocket costs that you can expect to pay in 2018 include: 1 Medicare Part A deductible: $1,340 per benefit period 2 Medicare Part B deductible: $183 per year 3 Part A coinsurance: $0 for days 1-60 spent in a hospital, $335 per day for days 61-90, $670 per each "lifetime reserve day" after day 90, all costs beyond lifetime reserve days 4 Part B coinsurance: 20% of Medicare approved amount for services after deductible is met

Does Medicare cover hospital costs?

Original Medicare helps cover numerous hospital and medical costs, but leaves some costs to you. These are known as out-of-pocket costs, and include deductibles, copayments, coinsurance and more. Your Medicare out-of-pocket costs can increase each year, so it's important to reevaluate your coverage regularly.

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

What is Part D insurance?

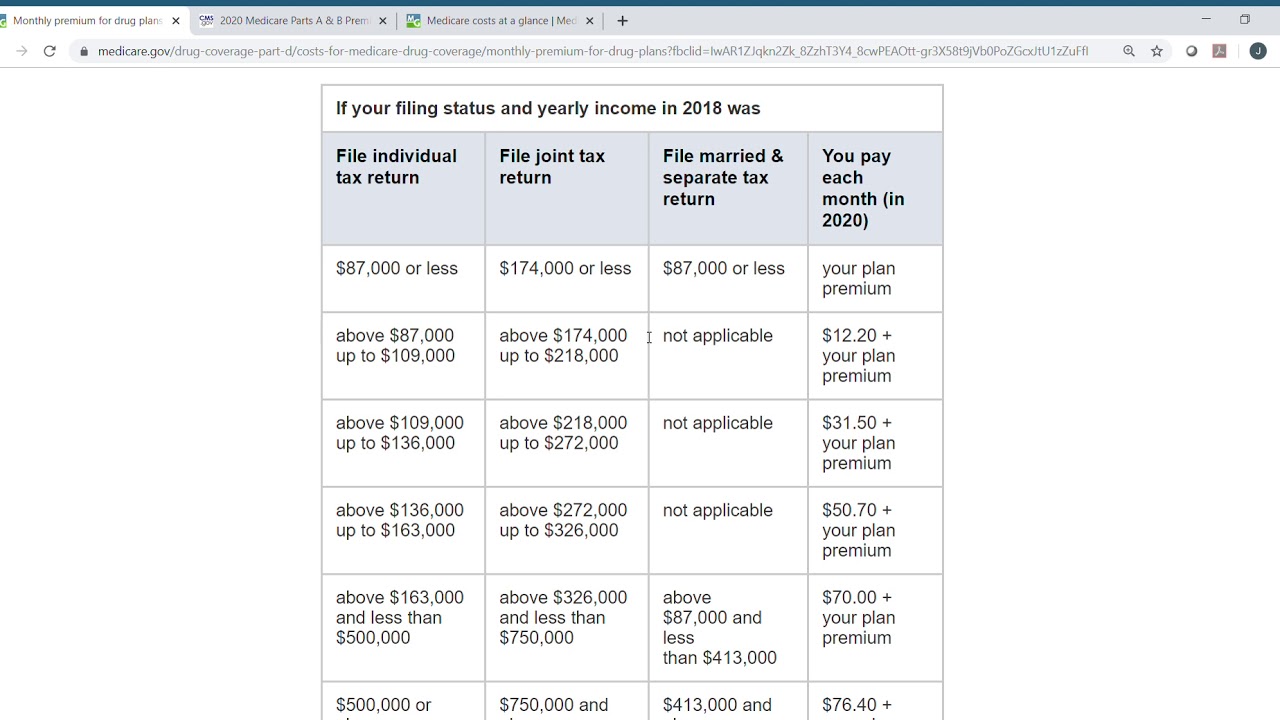

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.