How much is the deductible for Medicare Part A?

For Part A, the deductible is $1,364 for each benefit period. For Part B, the deductible is $197 per year, compared to $185 in 2019. For Part C (Medicare Advantage), which is private insurance, deductibles vary by plan. For Part D, again, the deductible varies by plan.

What is the Medicare Part a hospital deductible for 2018?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

What are the 2018 Medicare Part A and Part B premiums?

On November 17, 2017, the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

What is the deductible for Medicare Part C and D?

Additionally, Part C and Part D have deductibles that will vary from year to year and plan to plan. Some are as low as $0, while others are a few hundred.

What is the deductible per year for Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the annual Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the maximum Part D deductible for 2018?

The maximum Part D deductible for 2018 is $405 per year (though some plans waive the deductible). Also, if your adjusted gross income is over $85,000 (or $170,000 for a couple), you will pay a monthly adjustment amount to Medicare in addition to your monthly premium, as follows:

How much is deductible for hospital days 61-90?

Hospital days 61-90: $335 coinsurance per day of each benefit period.

How much does Medicare pay for a spouse?

Most people don't pay a monthly premium for Medicare Part A (hospital insurance). But if you have to pay for Part A because you or your spouse don't have a long enough work history, you'll pay between $232 (for 30-39 work credits) and $422 (for fewer than 30 work credits). In 2018, you'll also pay a $1,340 deductible for each benefit period in ...

How much does Medicare cost a month?

If you first enroll in Medicare Part B during 2018, or you are not collecting Social Security benefits, your premium will be $134 per month.

Is there a subsidy for Part D?

There are subsidies available to pay for Part D for those with low income (called Extra Help). See Nolo's article on Extra Help for Part D for eligibility numbers for 2018.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

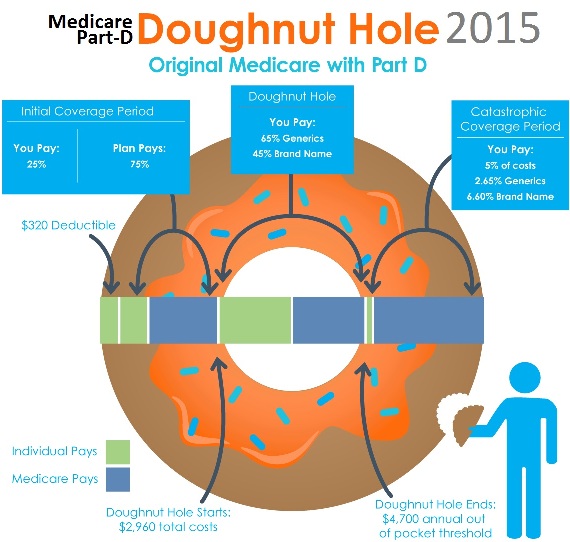

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

Does Medicare Part B have higher income?

Of course, higher-income enrollees are subject to even higher rates for Medicare Part B. If you earn above the standard income threshold, then you’ll be charged an “Income-Related Monthly Adjustment Amount” (IRMAA) along with the standard premium. When determining income, Medicare uses income information from the IRS, which dates two years back. In 2018, income determinations will be based on what you earned in 2016.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

How much is Medicare Part D deductible?

With the way it’s structured, no PDP may have a deductible more than $435 in 2020; in 2019, it was $415. While there is a cap in place that’s set by the government, some drug plans have no deductible at all. That’s why it’s important to shop and compare plans each year.

What is the Medicare deductible for 2020?

Members also qualify for countless other services and benefits, including: Screenings (for things like alcoholism, cardiovascular disease, cancer, depression, diabetes, HIV, obesity and sexually transmitted infections) The 2020 Medicare deductible for Part B is $197, which covers the whole year; in 2019, it was $185.

How much was the 2016 Part B premium increase?

However, Congress passed the Bipartisan Budget Act of 2015 (Public Law 114-74) into law on November 2, 2015. The result was that these enrollees only had a 16 percent increase in their 2016 Part B premiums and deductibles; $121.80, compared to $104.90 in 2015.

What is Medicare Part B?

Medicare Part B is used by most beneficiaries, most often for doctors’ visits. Part B provides medical insurance, including those services and supplies considered medically necessary, which are considered essential for the prevention, diagnosis or treatment of various conditions, illnesses, injuries or diseases and their symptoms. These services and supplies must also meet accepted medical standards. But Part B also applies to preventive services and supplies, those required to prevent or detect illness at an early stage when treatments are most likely to work.

What happens after you meet your Medicare deductible?

After you meet the deductible, your plan begins to pay. But as to what you’re actually paying for your 2019 Medicare deductibles, and why, the following will help to illustrate what each portion covers and the costs associated with each. Part A and Part B are together known as original Medicare.

How to contact Medicare for 2020?

For more information on Medicare, please call the number below to speak with a healthcare specialist: 1-800-810-1437 TTY 711 . Use the form below to obtain real time pricing for 2020 Medicare Supplement and Medicare Advantage Plans and Review 2020 Plan Deductibles. HN Forms.

What is the average Medicare premium for 2020?

It’s projected that that average base premium for Medicare Part D will be $33.80 in 2020. The Part D annual deductible will increase by $20 to $435 in 2020. Income brackets will also change again in 2020, leading Medicare enrollees in the highest income tiers with higher costs next year as well.

How much is Medicare Part A deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

What is the Medicare deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period , and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs.

What Is the Maximum Cost of Medicare Part B?

Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

What is Medicare Part A?

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What is deductible insurance?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

How long after your Medicare benefits end do you have to go back to the hospital?

Should you enter the hospital again at least 60 days after your benefit period has ended, you will begin a new benefit period and will once again have to pay the first $1,556 of covered care.

Does Medicare Advantage have a deductible?

Medicare Advantage plans are sold by private insurance companies and don’t have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.