How much does Medicare cover for a hospital stay?

Mar 19, 2021 · Last Updated : 03/19/2021 5 min read. If you are a Medicare beneficiary and you go to the hospital, the hospital cannot refuse to admit or treat you based on lack of payment of your Medicare Part A deductible. In 2021, this amount is $1,484. Additionally, if you seek emergency treatment, you will have access to emergency services regardless of ability to pay, …

Does Medicaid cover hospital stays?

Medicare Part A deductibles work as follows, during a hospital stay: - Beneficiary pays deductible of $1,100 during days 1-60 of hospital stay. - Beneficiary then pays $275 per day for days 61-90 of hospital stay. - Beneficiary then pays $550 per day for days 91-150 of hospital stay.

Does Medicare pay for rehab after hospital stay?

Jul 30, 2020 · In 2020, the Medicare Part A deductible is $1,408 per benefit period. Medicare Part A deductible Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means...

Will Medicare cover cost of hospital stay and rehabilitation?

May 29, 2020 · For 2020, the Medicare Part A deductible is $1,408 for each benefit period. A benefit period starts on the first day of hospitalization and ends 60 consecutive days after the person’s discharge...

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What is general nursing?

General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What is a critical access hospital?

Critical access hospitals. Inpatient rehabilitation facilities. Inpatient psychiatric facilities. Long-term care hospitals. Inpatient care as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is Medicare for seniors?

Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, ...

How long does Medicare Part A deductible last?

At the beginning of each benefit period, the Medicare Part A deductible must be paid by beneficiaries. A benefit period extends from the day a patient is admitted to the hospital until the final day treatment is received. If a beneficiary goes 60 days in a row without receiving treatment, the benefit period restarts and a deductible will have ...

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

Does Medicare cover hospital stays?

Medicare Part A can help provide coverage for hospital stays. You’ll still be responsible for deductibles and coinsurance. A stay at the hospital can make for one hefty bill. Without insurance, a single night there could cost thousands of dollars. Having insurance can help reduce that cost.

How much is coinsurance for 2020?

As of 2020, the daily coinsurance costs are $352. After 90 days, you’ve exhausted the Medicare benefits within the current benefit period. At that point, it’s up to you to pay for any other costs, unless you elect to use your lifetime reserve days. A more comprehensive breakdown of costs can be found below.

Does Medicare Part A cover inpatient care?

If you’re eligible for Medicare, Medicare Part A can provide some coverage for inpatient care and significantly reduce costs for extended hospital stays. But in order to receive the full scope of benefits, you may need to pay a portion of the bill. Keep reading to learn more about Medicare Part A, hospital costs, and more.

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Part A?

Medicare Part A. Out-of-pocket expenses. Length of stay. Eligible facilities. Reducing costs. Summary. Medicare is the federal health insurance program for adults aged 65 and older, as well as for some younger people. Medicare pays for inpatient hospital stays of a certain length. Medicare covers the first 60 days of a hospital stay after ...

How much is the deductible for Medicare 2020?

This amount changes each year. For 2020, the Medicare Part A deductible is $1,408 for each benefit period.

Does Medicare cover inpatient rehab?

Medicare covers an inpatient rehab stay if the doctor deems it medically necessary and expects it to improve the person’s health so that they can have more independent function. Out-of-pocket expenses are the same for people staying in rehabilitation facilities as they would be for those in inpatient hospitals.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How long does Medicare cover hospital stays?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual’s reserve days. Medicare provides 60 lifetime reserve days. The reserve days provide coverage after 90 days, but coinsurance costs still apply.

Does Medicare cover skilled nursing?

Days 101 and after: The patient pays all costs. Medicare Part A does not cover the costs of long-term stays at skilled nursing facilities. However, if a person is transferred from one of these facilities to an acute care hospital, Medicare coverage may resume.

What is Medicare Part A?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1 As a hospital inpatient 2 In a skilled nursing facility (SNF)

How long is a benefit period?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you haven’t been an inpatient in either type of facility for 60 straight days. Here’s an example of how Medicare Part A might cover hospital stays and skilled nursing facility ...

Does Medicare cover hospital stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – that means once you pay the annual deductible, your health plan may cover your medical ...

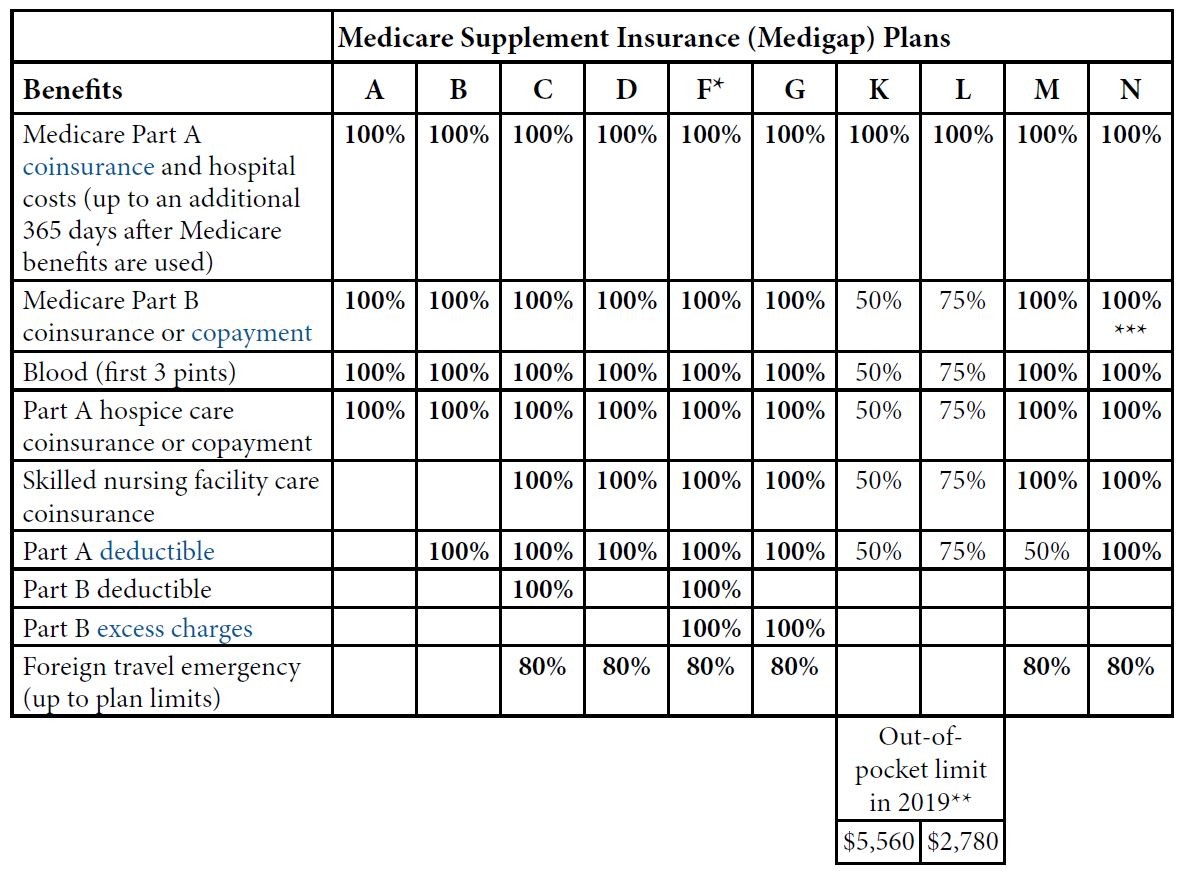

How many Medicare Supplement plans are there?

In most states, there are up to 10 different Medicare Supplement plans, standardized with lettered names (Plan A through Plan N). All Medicare Supplement plans A-N may cover your hospital stay for an additional 365 days after your Medicare benefits are used up.

Does Medicare cover SNF?

Generally, Medicare Part A may cover SNF care if you were a hospital inpatient for at least three days in a row before being moved to an SNF. Please note that just because you’re in a hospital doesn’t always mean you’re an inpatient – you need to be formally admitted.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.