Full Answer

How big is the Medicare Donut Hole?

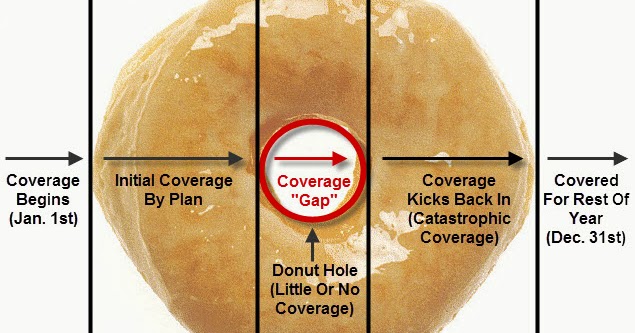

Most Medicare drug plans have a Coverage Gap (also called the “donut hole”). This means there’s a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the Coverage Gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs.

How does doughnut hole coverage gap work?

Feb 10, 2022 · The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

What is part D coverage gap?

Dec 12, 2019 · The Medicare Part D Coverage Gap (“Donut Hole”) Made Simple. Last Updated : 12/12/2019 7 min read. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug …

What is the Social Security Donut Hole?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022, you're in …

What is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

What is the donut hole in Medicare for 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

Is the donut hole ending in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.Mar 28, 2022

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will the donut hole ever go away?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Why didn't the donut hole go away?

The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump. Are you looking for Medicare Part D prescription drug coverage?Feb 22, 2021

Does Medigap cover the donut hole?

There is not a Medicare plan that covers the donut hole. You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare.Dec 2, 2021

What is the donut hole with Humana?

Stage 3—Coverage Gap Most Medicare drug plans have a Coverage Gap (also called the “donut hole”). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the Coverage Gap, and it doesn't apply to members who get Extra Help to pay for their Part D costs.Dec 22, 2021

How does Medicare Part D calculate donut holes?

3The Donut Hole (Coverage Gap Stage)25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.25% of the cost of Part D brand name medications.

How does Medicare avoid the donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

How do you get out of the Medicare donut hole?

How Do I Get Out of the Donut Hole? You'll get out of the gap when your costs for prescriptions during the gap period reach $7,050. You're fully responsible for reaching this amount, but your drugs are also discounted while in the donut hole. Once you reach the limit, catastrophic drug coverage kicks in automatically.Feb 14, 2022

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

How to calculate out of pocket expenses?

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: 1 Your prescription drug plan’s yearly deductible 2 The amount you pay for your prescription medications 3 The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

Do manufacturer discounts count towards catastrophic coverage?

Additionally, manufacturer discounts for brand-name drugs count towards reaching the spending limit that begins catastrophic coverage. If your plan requires you to get your prescription drugs from a participating pharmacy, make sure you do so, or else the costs may not apply towards getting out of the coverage gap.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is out of pocket cost?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

Does Medicare cover gap?

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the drug's price. The discount for brand-name drugs will apply to the remaining amount that you owe.

How much do you pay for a drug deductible?

You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your drugs reaches $2,800.

What is Medicare for people over 65?

If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have the option of paying a monthly premium for outpatient prescription drug coverage.

Does Medicare Part D cover prescriptions?

Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan. If you would like more information on the one-time rebate check, feel free to call 1-800-MEDICARE.

Does Medicare have a donut hole?

For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs. Needless to say, for most people with Medicare Part D, the donut hole presents serious financial challenges.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

What is the Medicare coverage gap in 2021?

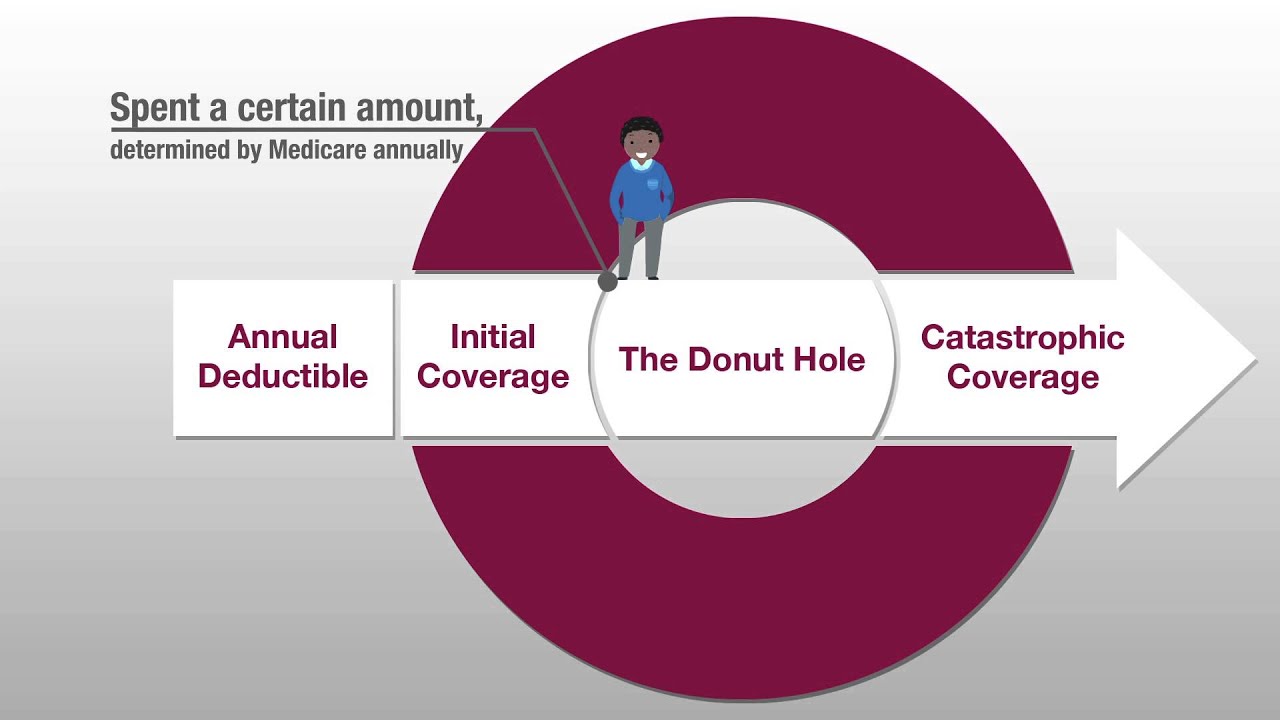

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

When did Medicare Part D start?

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

How much does Medicare pay for generic drugs?

However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs. Previously, when Medicare Part D was first rolled out in 2007 ...

What is the donut hole?

Once you and your prescription drug plan have spent this amount on covered drugs, you enter the coverage gap called the donut hole. Ever since 2020, Medicare Part D plan beneficiaries pay 25 percent of their brand name and generic drug costs while they’re in this coverage gap, or "donut hole.".

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is extra help?

Extra Help is an assistance program that helps lower the cost of Part D premiums, deductibles, coinsurance and copayments. There is no coverage gap for Medicare beneficiaries who receive Extra Help.

How much will you pay for generic drugs in 2021?

In 2021, you’ll pay no more than 25 percent of the price for brand name drugs and generic drugs while you’re in the donut hole. You remain in this Part D donut hole coverage gap until you have paid $6,550 in out-of-pocket costs for covered drugs in 2021. You then enter the catastrophic coverage phase.

Does Medicare Part D have a deductible?

Some (but not all) Medicare Part D plans have a deductible, which is the amount of money you must spend on covered drugs before your Medicare drug plan coverage kicks in. For example, if you have a Part D plan with a $200 deductible, you’re required to pay the first $200 of costs for covered drugs in a calendar year out of your own pocket.