What are the pros and cons of delaying Medicare enrollment?

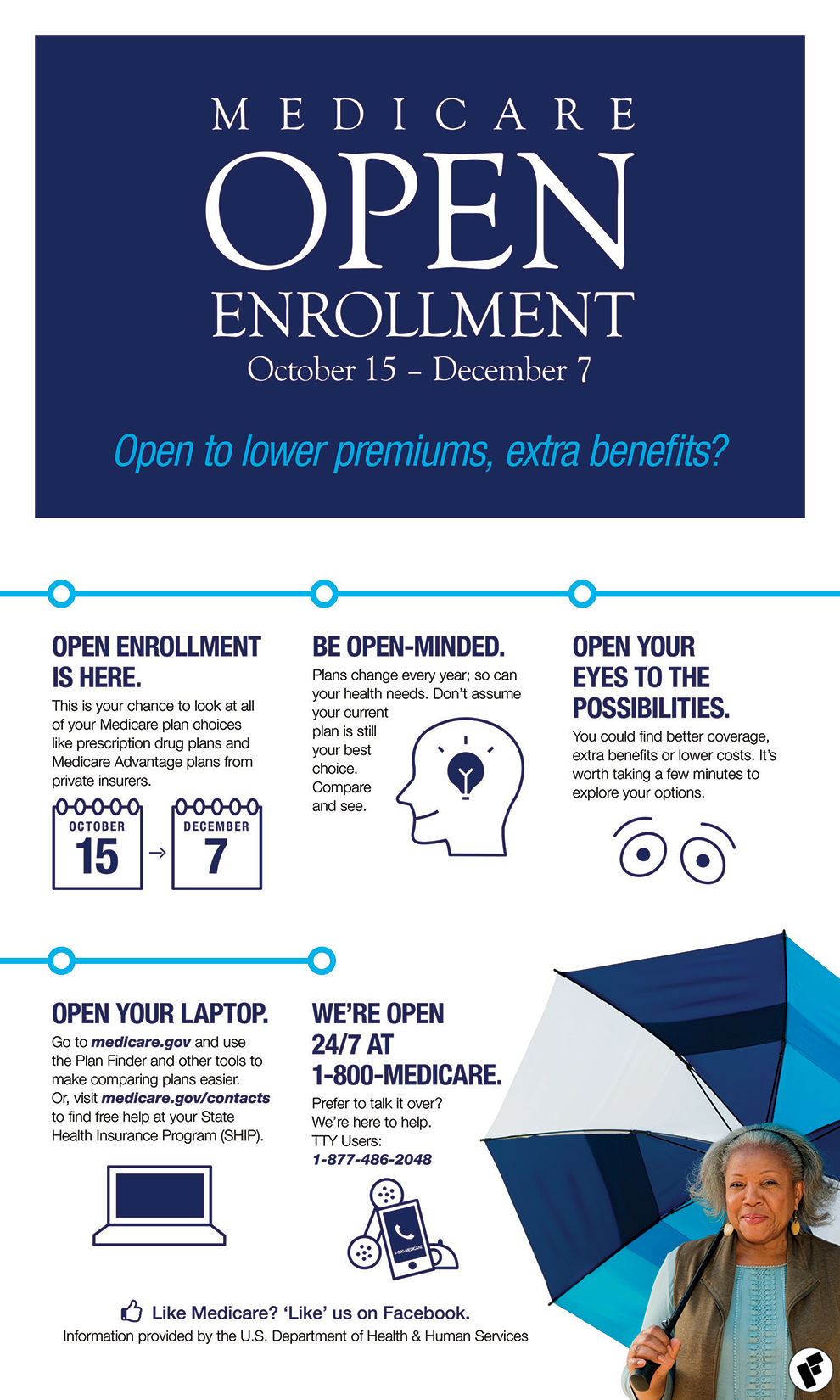

Jun 15, 2020 · If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan. During this time each year, you can also drop or switch your plan coverage.

How to time your Medicare enrollment?

Aug 09, 2021 · You can make changes to your Medicare coverage during the annual open enrollment period, from Oct. 15 to Dec. 7. Medicare Advantage Plan participants can switch plans from Jan. 1 to March 31 each...

What is the initial enrollment period for Medicare?

5 rows · Medicare General Enrollment Period. If you don't sign up during your Initial Enrollment Period ...

What happens if I delay enrolling in Medicare?

The annual Medicare Open Enrollment Period runs from October 15th through December 7th. Learn more about the deadline and why you should take a look at your coverage now.

What is the Medicare deadline for 2021?

You can enroll in Medicare health and drug plans from October 15 – December 7. Get ready for Medicare's Open Enrollment with these 5 tips: Check your mail. You may get important notices from Medicare or Social Security.Oct 1, 2021

What happens if I miss Medicare open enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

What happens if you don't enroll in Medicare in time?

Specifically, if you fail to sign up for Medicare on time, you'll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible. (Since Medicare Part A is usually free, a late enrollment penalty doesn't apply for most people.)

What is the time frame to apply for Medicare?

Generally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What happens if someone misses their opportunity to enroll in Medicare during their initial enrollment period or special enrollment period?

Special Situations (Special Enrollment Period) If you don't sign up during your Special Enrollment Period, you'll have to wait for the next General Enrollment Period and you might have to pay a monthly late enrollment penalty.

What is Medicare open enrollment vs enrollment?

Medicare Annual Enrollment is when anyone who has Medicare can make coverage changes for the upcoming year, while Medicare Advantage Open Enrollment is only for people who are currently enrolled in a Medicare Advantage plan.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

How do I delay Medicare enrollment?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

Why do you have to wait 24 months for Medicare?

The original purposes of the 24month waiting period were to limit costs to the Medicare trust funds at a time when many workers might have other health insurance coverage and to ensure that Medicare protection is extended only to persons whose disabilities are severe and long lasting.

How do I know if I am automatically enrolled in Medicare?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

When is the Medicare Advantage open enrollment deadline?

Medicare Advantage Plan participants can switch to another Medicare Advantage Plan or drop their Medicare Advantage Plan and return to original Medicare, including purchasing a Medicare Part D plan, from Jan. 1 to March 31 each year.

When can I sign up for Medicare if I don't have Medicare?

If you don't enroll in Medicare during the initial enrollment period around your 65th birthday, you can sign up during the general enrollment period between Jan. 1 and March 31 each year for coverage that will begin July 1. However, you could be charged a late enrollment penalty when your benefit starts. Monthly Part B premiums increase by 10% ...

How long does Medicare Part D coverage last?

Medicare Part D prescription drug coverage has the same initial enrollment period of the seven months around your 65th birthday as Medicare parts A and B, but the penalty is different. The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility and rounding to the nearest 10 cents. This amount is added to the Medicare Part D plan you select each year. And as the national base beneficiary premium increases, your penalty also grows.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans can be used to pay for some of Medicare's cost-sharing requirements and sometimes services traditional Medicare doesn't cover. The Medicare Supplement Insurance plans' enrollment period is different than the other parts of Medicare. It's a six-month period that begins when you are 65 or older and enrolled in Medicare Part B. During this open enrollment period, private health insurance companies are required by the government to sell you a Medicare Supplement Insurance plan regardless of health conditions.

How to enroll in Medicare Supplement?

The Medicare enrollment period is: 1 You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. 2 If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties. 3 The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B. 4 You can make changes to your Medicare coverage during the annual open enrollment period, from Oct. 15 to Dec. 7. 5 Medicare Advantage Plan participants can switch plans from Jan. 1 to March 31 each year.

How much is the late enrollment penalty for Medicare?

The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility ...

What happens if you don't sign up for Medicare?

If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty for as long as you have Medicare. The Medicare enrollment period is: You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. If you continue to work past age 65, sign up ...

When does Medicare open enrollment end?

The Medicare Advantage Open Enrollment Period starts January 1 and ends March 31 every year. During this period, you can switch Medicare Advantage plans or leave a Medicare Advantage plan and return to Original Medicare.

How long does Medicare initial enrollment last?

Your Initial Enrollment period lasts for seven months : It begins three months before you turn 65.

How long does Medicare last?

It includes your birth month. It extends for another three months after your birth month. If you are under 65 and qualify for Medicare due to dis ability, the 7-month period is based around your 25th month of disability benefits.

What happens if you don't sign up for Medicare?

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period , the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

When is the best time to enroll in Medicare Supplement?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period .

How long does it take to switch back to Medicare?

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Can you qualify for a special enrollment period?

Depending on your circumstances, you may also qualify for a Special Enrollment Period (SEP). Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

1. Current enrollees

Open enrollment is only for seniors who are already receiving health coverage through Medicare, not for those signing up for the first time.

2. Think about your Medicare coverage for 2022

Carefully review your current Medicare coverage, and note any upcoming changes to your costs or benefits.

3. Review your 2022 Medicare & You handbook

The Medicare & You handbook has information about Medicare coverage and Medicare plans in your area.

4. Preview 2022 health and prescription drug plans

Medicare helps you compare coverage options and shop for health plans.

5. When your coverage starts

For existing Medicare enrollees, from October 15 to December 7 of each year, you can join, switch, or drop a plan.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

How much will Medicare cost in 2021?

The standard Part B premium for 2021 is $148.50 per month. The increase in the Part B premiums was limited by the short-term government spending bill that was signed into law on October 1, 2020. The Part B premium for most enrollees was $144.60/month in 2020, and the spending bill capped the increase for 2021 at a quarter of what it would otherwise have been. Earlier in 2020, the Medicare Trustees Report had projected a Part B premiums of $153.30 per month for most enrollees in 2021. The actual price that people pay can also also be limited by the Social Security cost of living adjustment (COLA) that beneficiaries receive, but the 1.3% COLA for 2021 was adequate to allow the full standard Part B premium to be deducted from most beneficiaries’ Social Security checks.

How much is coinsurance for skilled nursing in 2021?

After the first 20 days, your skilled nursing facility coinsurance in 2021 is $185.50 per day for days 21-100 (after that, Medicare no longer covers skilled nursing facility charges, so you’ll pay the full cost). Supplemental coverage, including Medigap plans, is designed to pay the Part A coinsurance on your behalf.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

How much is Part A coinsurance for 2021?

2021 Part A coinsurance: $371 per inpatient day (days 61-90 in the benefit period for which the deductible applied; up from $352 per day in 2020) $742 per inpatient day for day 91 and beyond during the benefit period (up from $704 per day in 2020).

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.