What Are the Medicare Income Limits in 2021?

- There are no income limits to receive Medicare benefits.

- You may pay more for your premiums based on your level of income.

- If you have limited income, you might qualify for assistance in paying Medicare premiums.

What is the maximum income taxed for Medicare?

Nov 11, 2021 · In 2021, IRMAA surcharges apply to individual Medicare beneficiaries who earn more than $88,000, and to couples who earn more than $176,000. For 2022, these limits are projected to increase to $91,000 and $182,000, respectively.

Are there limits to my Medicare coverage?

Nov 16, 2021 · For married couples, the limit is less than $1,472 monthly and less than $11,960 in total. You won’t be responsible for the costs of premiums, deductibles, copayments, or coinsurance amounts under...

What are the limits of Medicare coverage?

Qualified Medicare Beneficiaries Program (QMB) You may qualify for the QMB program if your monthly income is less than $1,084 and your total assets are less than $7,860. The maximum is less than $1,457 per month for married couples and less than $11,800 total.

What is the monthly income limit for Medicaid?

Nov 17, 2021 · There are no Medicare income limits that pertain to eligibility, but income can decide some monthly costs. Those with higher incomes must pay higher monthly premiums for two Medicare programs....

What is the Medicare earnings limit for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

What is the Medicare earnings limit for 2020?

The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

What is modified adjusted gross income for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

How are Medicare wages calculated?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

Can low income people get Medicare?

Medicare beneficiaries with a low income may be eligible for financial assistance. Low-income individuals may be eligible for help with the costs of original Medicare and Part D. Medicare savings programs cover premiums, deductibles, coinsurance, and other expenses.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much will prescriptions cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

Does medicaid cover medical expenses?

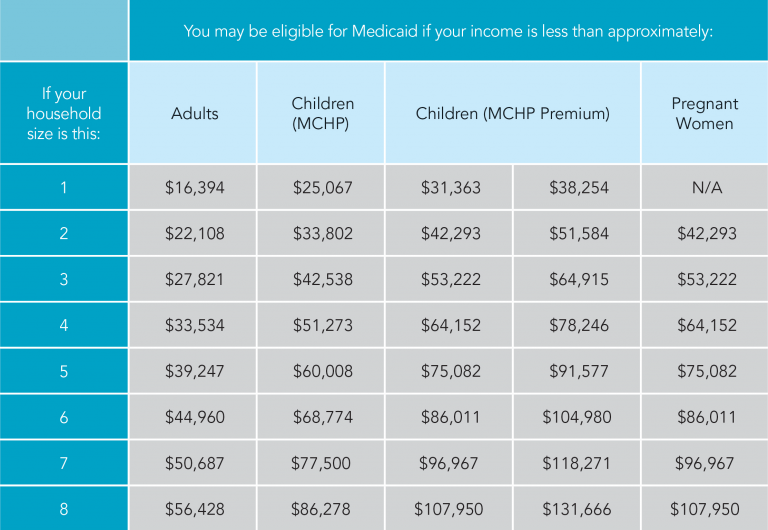

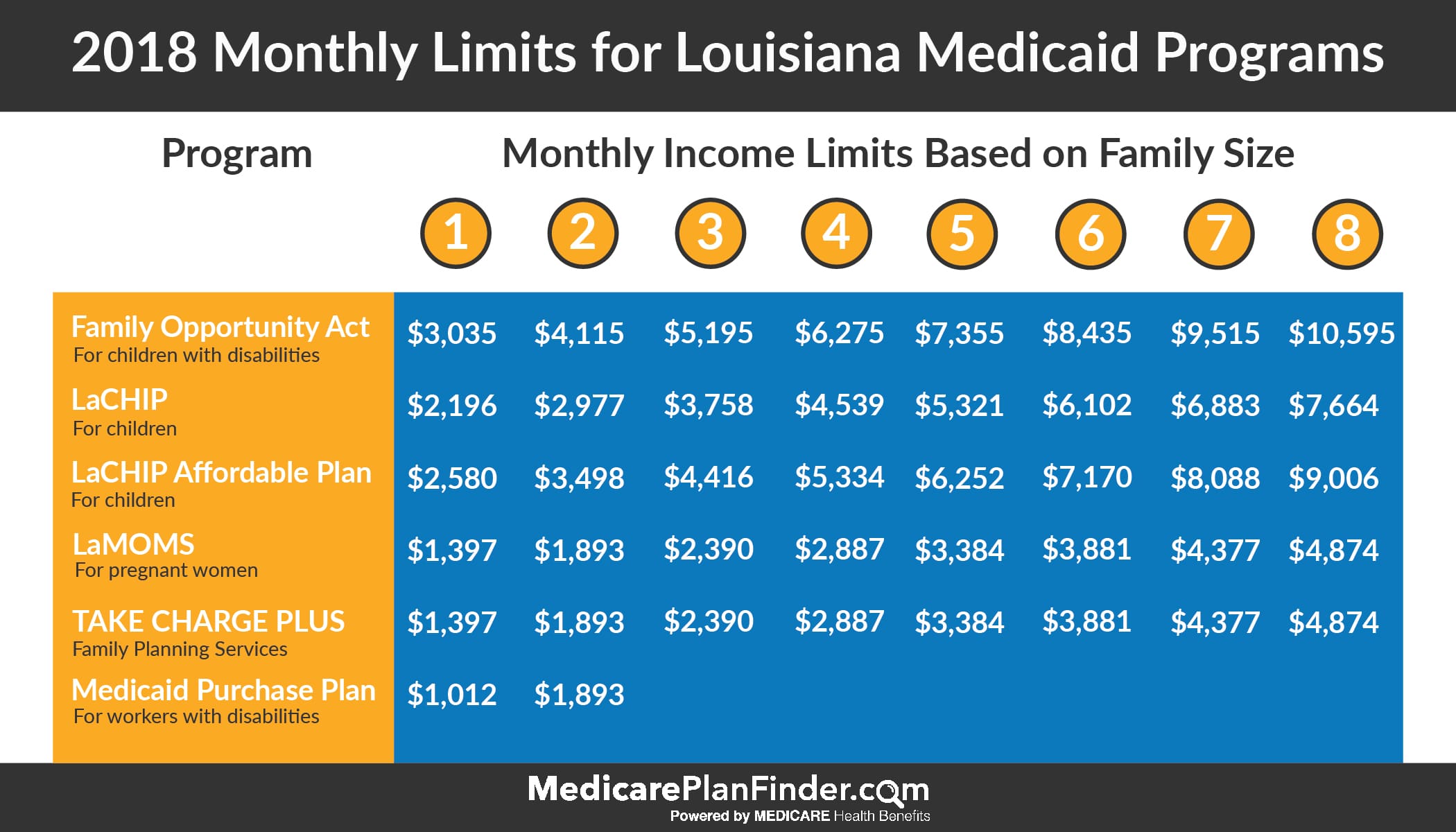

If you become eligible for Medicaid, It will cover your expenses. You will not be responsible for premiums or other plan costs. Medicaid qualifying criteria differ from state to state. Use the Health Insurance Marketplace’s tool to see if you qualify for Medicaid in your State.

Will Medicare Part B be paid in 2021?

The majority of consumers will pay the usual Medicare Part B premium in 2021. The premium for the Part D plan you select is your responsibility. Depending on your income, you may be required to pay an additional amount to Medicare. There are different tax brackets for married couples who file their taxes separately.

What is Medicare Supplement?

Medigap , which is Medicare supplement insurance. This plan is available for purchase to a person with original Medicare. Private insurance companies administer both Medicare Advantage and Medigap plans.

When will Medicare be taxed in 2021?

In figuring the premiums of beneficiaries for 2021, Medicare uses tax returns from 2019, which is the most recent year the IRS provides to Social Security. Most of the income thresholds for premium adjustments are subject to change.

What is the Medicare premium for 2021?

The majority of people fall into the income range associated with the standard rate, which in 2021 is $148.50. This amount can change each year. The higher premium costs apply to less than 5% of Medicare beneficiaries, according to Social Security.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

Is there a limit on Medicare out of pocket?

Is there a limit on out-of-pocket Medicare spending? There is no out-of-pocket spending limit with Original Medicare (Medicare Part A and Part B). Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

What Are Medicare Income Limits?

- Put in place in 2007, Medicare income limits (quite literally) limit the amount of money you can make to qualify for Medicare. Individuals aged 65 and over generally qualify for the healthcare program, as do young people with disabilities and those with end-stage renal disease. However, the portion you pay for Medicare varies, depending upon your i...

Why Do They Exist?

- While there are several reasons why Medicare income limits exist, the main reason is to ensure fairness—and longevity of the program.“These rules were put in place to ensure that beneficiaries with higher incomes would pay a larger portion of the cost of their coverage,” Norris says. “Medicare’s income limits are similar to the tax brackets used by the IRS to tax income,” Christia…

Who Is Affected by The 2021 Change, Implemented at The Beginning of The Year?

- Medicare beneficiaries earning more than $88,000 and couples earning more than $176,000 were affected by the 2021 change. “Medicare’s 2021 income limits and corresponding surcharges apply to all beneficiaries with part B and/or part D coverage,” Worstelltells Parade. “To determine eligibility, Medicare will use 2019 tax data for the 2021 plan year. “ That said, it’s important to not…

How Much Can You Expect to Pay For Medicare Coverage?

- Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B. Individuals making between $88,000 and $111,000 and couples making between $176,000 to $222,000 will pay $207.90 a month, and the rates increase from there. A fu…

Sources

- “Medicare Income Limits: What to Know.” Medical News Today.

- “Who Relies on Medicare? A Profile of the Medicare Population.” AARP.

- Louise Norris, a licensed broker and analyst

- Christian Worstell,a senior staff writer with Medicare Advantage and licensed health insurance agent