Can I deduct my Medicare premiums on my tax return?

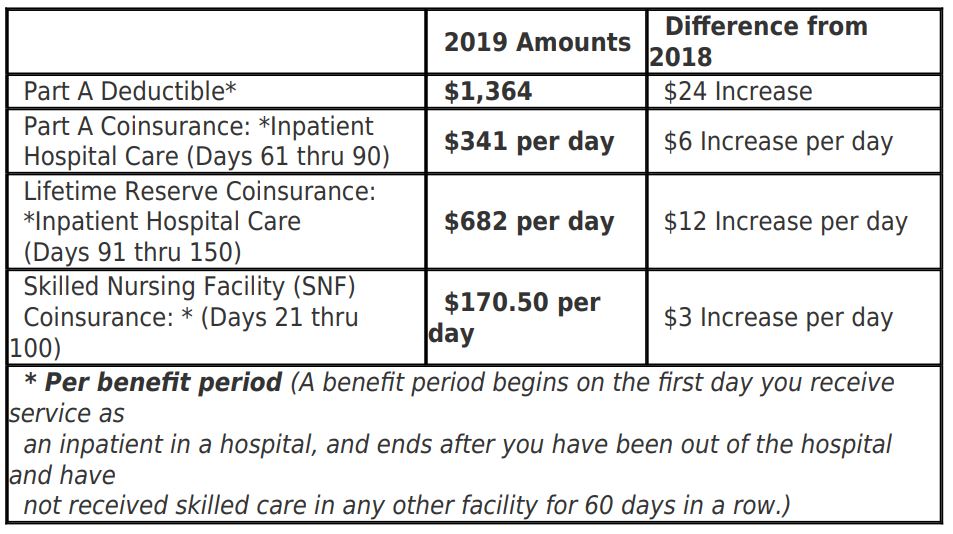

Nov 08, 2019 · The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,408 in 2020, an increase of $44 from $1,364 in 2019. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Is Medicare Part B payments tax deductible?

Dec 29, 2021 · The deductible generally increases each year, and is $1,556 in 2022, up from $1,484 in 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible. Read Also: Does Medicare Cover Mental Health Visits Heres What Medicare Plan G Covers

Are there deductibles for Medicare?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will …

What is the monthly premium for Medicare Part B?

Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime. It also includes inpatient care you get as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is the inpatient deductible for Medicare?

$1,556Medicare Part A Premium and Deductible The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.Nov 12, 2021

What is the Medicare annual deductible for 2020?

Medicare Advantage deductible in 2021 According to eHealth research, the average Medicare Advantage plan annual deductible went down from $145 in 2018, to $133 in 2019, to $129 in 2020.Dec 20, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Can you write off Medicare Part B premiums from your taxes?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

How much is Medicare Part A 2020?

The Medicare Part A Deductible is increasing by 3.23% for the calendar year 2020. This $44.00 increase will put the Part A deductible at $1,408.

Does Medicare Part A cover home health?

It covers a few other skilled services I never want to use like hospice, home health, and skilled nursing care. Unfortunately, Medicare Part A doesn’t cover the entire cost ...

How long does Medicare last?

The benefit period only lasts for 60 inpatient days. So once the Medicare beneficiary ‘fills up’ their $1,408 bucket, Medicare covers them the rest of the way until they hit day 61. If the hospital stay goes on beyond 60 days, things get a little more complicated.

Does Medicare cover hospital stays?

Unfortunately, Medicare Part A doesn’t cover the entire cost of the inpatient hospital stay. They conveniently pass some of that cost onto the Medicare beneficiary. So an inpatient hospital stay will usually come hand-in-hand with the Medicare Part A Deductible.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What is general nursing?

General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What is a critical access hospital?

Critical access hospitals. Inpatient rehabilitation facilities. Inpatient psychiatric facilities. Long-term care hospitals. Inpatient care as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is the 2020 Medicare deductible?

A deductible is the amount you must pay before your Medicare coverage “kicks in.”.

How much is Medicare Part B 2020?

The 2020 Medicare Part B deductible is $198 per year. But your Part B costs don’t end just because you’ve met the deductible. In addition to a Part B deductible, you must also pay coinsurance. Part B coinsurance is 20% of the Medicare-approved amount of the services you receive.

Is Medicare free for seniors?

Medicare coverage is essential for most seniors — but it’s not free, and it doesn’ t cover every healthcare need. Whether you are currently enrolled in Medicare or planning to enroll soon, you must understand the coverage gaps in Original Medicare and the out-of-pocket costs you’ll face.

What is Medicare approved amount?

The Medicare-approved amount is the amount a doctor has agreed to charge Medicare patients — it is often less than their usual or customary rate. Example: A doctor typically charges $110 for an office visit. However, he has agreed to charge Medicare patients $85. Your coinsurance amount would be $17 (20% of $85).

Does Medicare cover blood pressure medication?

If you need one of those services, you’ll have to pay for the full cost. Surprisingly, many of the services Medicare doesn’t cover are necessary for seniors to stay in good health. For example, Original Medicare doesn’t cover : Drugs you take at home (blood pressure medication, pain medication, etc.)

What is Medicare Part D?

Many different Medicare Part D plans are available — the specific plans and costs depend on your location. For all plans, you’ll be responsible for out-of-pocket payments, including a premium and deductible. Before you decide on a Medicare Part D plan, gather a list of any medications you take and the dosage.

Does Medicare pay for custodial care?

Custodial care (someone in your home providing assistance with feeding, bathing, dressing, etc.) As you can see, there is a long list of items and services Medicare won’t pay for. And even if you pay for them out of pocket, those payments won’t go toward covering your Part A or Part B deductibles.