When will Medicare become insolvent?

Mar 05, 2021 · Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that. Spending for Medicare, the...

What happens when Medicare runs out of money?

Mar 01, 2021 · Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that. Credit: Photo by Allen J....

Is Medicare going to run out of money?

Sep 01, 2021 · CBO finds COVID-19 puts Medicare trust fund insolvency just 4 years away By Rebecca Pifer • Sept. 4, 2020. Medicare still expected to grow to 6% of GDP by 2026, but COVID-19 could speed ...

When does Medicare go broke?

The Budget Control Act of 2011 ushered in an era of automatic Medicare payment cuts, which Congress continues to suspend, doing so through December 31, 2021 in the most recent COVID-19 relief law. How to Address Medicare’s Finances

What year is Medicare going to run out of money?

Is Medicare going broke in 2026?

Does Medicare go broke by 2030?

What will happen to Medicare in the future?

Is Medicare about to collapse?

Will we lose Medicare?

What would happen if Medicare ended?

Is Medicare financially stable?

What will happen when Social Security runs out of money?

If no changes are made before the fund runs out, the most likely result will be a reduction in the benefits that are paid out. If the only funds available to Social Security in 2033 are the current wage taxes being paid in, the administration would still be able to pay around 75% of promised benefits.

What does Medicare insolvency mean?

What is the future of Social Security and Medicare?

Is the future of Social Security at risk?

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

Why is Medicare Hospital Insurance Trust Fund insolvent?

The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's COVID-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

How much will Medicare raise in 10 years?

Marilyn Moon, visiting scholar at the nonpartisan Center for Medicare Advocacy, estimates that $400 billion could be raised over 10 years with gradual increases eventually hiking the overall Medicare payroll tax from 1.45% to 1.95% each for employees and employers. "If phased in gradually, it would not create large increases in tax burdens in any ...

What is the foundation of financial security for older Americans?

With the insolvency clock ticking, the Biden administration and Congress will need to act soon. Medicare, along with Social Security, is the foundation of financial security for older Americans.

When will hospital trust fund insolvency happen?

The forecast is noteworthy given another more drastic outlook from the Congressional Budget Office issued last September estimated the pandemic had shaved two years off the expected lifespan of the hospital insurance trust fund, with insolvency expected in 2024 instead of 2026.

How much will Medicare cost in 2045?

Spending in Medicare is expected to balloon from 4% of the country's gross domestic product to 6.2% by 2045, after which costs are expected to rise more slowly before leveling off at around 6.5% of the GDP, according to the report.

Will Medicare expand to dental?

Despite such warnings, part of the $3.5 trillion budget plan approved by the House last week would expand Medicare to include dental, vision and hearing coverage. If passed by the full Congress, the additional benefits would close a major coverage gap, but also additionally stress Medicare's finances without a corresponding bump in funding, policy experts say.

Is Medicare trust fund depleted?

To date, lawmakers have not allowed the Medicare trust fund to become depleted, though watchdogs and deficit hawks warn the situation is getting increasingly precarious. Congress has largely kicked the can on the issue, following bipartisan efforts to lower spending in the early 2010s that proved fruitless.

Is the Hospital Insurance Trust Fund running out of money?

The new forecast released Tuesday is somewhat of a bright spot for the otherwise grim financial prospects of the program, as some experts predicted COVID-19 would result in the Hospital Insurance Trust Fund, which finances Medicare Part A, running out of money faster than earlier expected. However, the trustees, who include HHS Secretary Xavier Becerra and CMS Administrator Chiquita Brooks-LaSure, still expect the fund to run dry by 2026 — the same estimate as 2018, 2019 and 2020's reports due to policy inaction from Washington.

Is Medicare going to be volatile in 2020?

Though the pandemic has injected volatility into most aspects of healthcare spending since early 2020, the long-term financial status of the trust funds backing Medicare funding hasn't really changed from past estimates, according to the new report.

When will the Affordable Care Act be in effect?

Other health-care-related goals include extending the expanded premium subsidies for health-care insurance through the Affordable Care Act’s public marketplace — now in effect for just 2021 and 2022 — and, in states that have not expanded Medicaid, providing coverage for eligible individuals.

What is the age limit for Medicare?

In addition to adding Medicare benefits, some Democrats want to include a lower eligibility age for Medicare (currently age 65 ).

When will Medicare begin to cover hearing and vision?

It remains unclear whether the legislation that ends up being voted on will include everything being debated — or whether current details of various provisions will end up modified. For the expanded Medicare benefits, the House measure would implement vision and hearing coverage in 2022 and 2023, respectively, while dental benefits would not begin until 2028.

When will the Part A fund be short?

In simple terms, it’s the Part A trust fund that is facing a shortfall beginning in 2026, according to the latest trustees report. Unless Congress intervenes before then, the fund would only be able to pay roughly 91% of claims under Part A beginning that year.

Does the expansion of Part B affect the solvency challenges facing the Part A hospital insurance trust fund?

The expansion of benefits under Part B would have no direct impact on the solvency challenges facing the Part A hospital insurance trust fund.

Do Democrats want to expand Medicare?

It’s a situation that appears incongruous: Congressional Democrats want to expand Medicare’s benefits while a trust fund that supports the program is facing insolvency.

Can Medicare negotiate with drug manufacturers?

However, also included in Democrats’ current spending plan is the goal of allowing Medicare to negotiate with drug manufacturers — which currently is prohibited — as a potential way to help pay for the expanded benefits.

When will Medicare phase out?

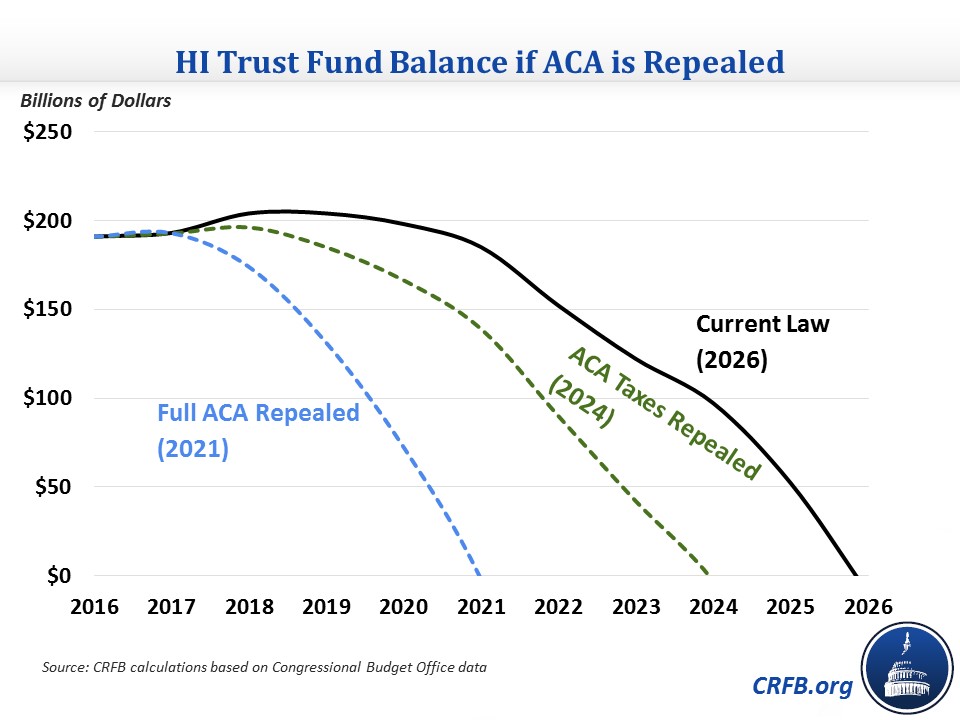

Each year, beginning in 2010, the Centers for Medicare & Medicaid Services (CMS) actuaries have issued an illustrative alternative scenario that has assumed that certain ACA changes that reduce Part A provider reimbursements would be gradually phased out.21As the 2020 alternative scenario assumes that this phaseout would begin in 2028, after the projected 2026 HI insolvency date, this alternative analysis assumes the same 2026 date of insolvency.

When will the HI trust fund become insolvent?

The 2005 Medicare Trustees Report projected that the HI trust fund would become insolvent one year later than projected in 2004, in 2020. The revision reflected slightly higher income and slightly lower costs in 2004 than previously estimated. The 2006 report moved the insolvency date forward again, to 2018. The revision reflected expectations of slightly higher costs and increased utilization of HI services. Both the 2007 and 2008 reports projected a 2019 insolvency date, although the 2008 report indicated that insolvency would occur earlier in the year. The 2009 report moved the insolvency date forward to 2017, due primarily to lower payroll tax income resulting from the December 2007 to June 2009 economic recession (the “Great Recession”). The 2010 Medicare Trustees Report, issued subsequent to the enactment of the ACA, estimated that the combination of lower Part A costs and higher payroll-tax revenues expected to result from the ACA would postpone depletion of the HI trust fund’s assets until 2029, 12 years later than the date projected in the 2009 report.16However, the 2011 report projected that the HI trust fund would become insolvent in 2024, five years earlier than projected in the 2010 report. The worsening financial outlook was primarily due to lower-than-expected payroll taxes stemming from higher-than-expected unemployment, and slow wage growth in 2010 caused by the continuing effects of the 2007-2009 economic recession. The 2012 Medicare Trustees Report projected the same 2024 insolvency date. Although income from payroll taxes was expected to increase at a faster rate than expenditures through 2018 due to the projected economic recovery,

How does Medicare fund work?

The Part A program, which is financed mainly through payroll taxes levied on current workers, is accounted for through the HI trust fund. The Part B and Part D programs, which are funded primarily through general revenue and beneficiary premiums, are accounted for through the SMI trust fund.3Both funds are maintained by the Department of the Treasury and overseen by the Medicare Board of Trustees, which reports annually to Congress concerning the funds’ financial status.4Financial projections are made using economic assumptions based on current law, including estimates of consumer price index, workforce size, wage increases, and life expectancy. From its inception, the HI trust fund has faced a projected shortfall and eventual insolvency. Because of the way it is financed, the SMI trust fund cannot become insolvent; however, the Medicare trustees continue to express concerns about the rapid growth in SMI costs.5

What is Medicare Advantage?

Medicare is the nation’s health insurance program for persons aged 65 and older and certain disabled persons. Medicare consists of four distinct parts: Part A (Hospital Insurance, or HI); Part B (Supplementary Medical Insurance, or SMI); Part C (Medicare Advantage, or MA); and Part D (the outpatient prescription drug benefit). The Part A program is financed primarily through payroll taxes levied on current workers and their employers; these taxes are credited to the HI trust fund. The Part B program is financed through a combination of monthly premiums paid by current enrollees and general revenues. Income from these sources is credited to the SMI trust fund. As an alternative, beneficiaries can choose to receive all their Medicare services through private health plans under the MA program; payment is made on beneficiaries’ behalf in appropriate parts from the HI and SMI trust funds. The Part D drug benefit is funded through a separate account in the SMI trust fund and is financed through general revenues, state contributions, and beneficiary premiums. The HI and SMI trust funds are overseen by the Medicare Board of Trustees, which makes an annual report to Congress concerning the financial status of the funds. Since the inception of Medicare in 1966, the HI trust fund has always faced a projected shortfall. The insolvency date has been postponed a number of times, primarily due to legislative changes that have had the effect of restraining growth in program spending. The 2020 Medicare Trustees Report projects that, under intermediate assumptions, the HI trust fund will become insolvent in 2026, the same year as estimated in the prior two years’ reports. (The trustees’ estimate does not reflect potential effects of the COVID-19 pandemic on Medicare spending and financing. A discussion of potential COVID-19-related factors that could affect HI solvency may be found at the end of this CRS report.)

What tax was added by the ACA?

17The high-income payroll tax was added by the ACA. See “Medicare Hospital Insurance Financing.”

Is Medicare insolvency in 2026?

In their 2020 report,20the Medicare trustees project the same date of insolvency (2026) as in both their 2018 and 2019 reports. Although HI income is projected to be lower than estimated in the 2019 report due to expected lower payroll tax revenue, expenditures also are expected to be lower than last year’s estimates, because of lower-than-expected 2019 HI expenditures, lower-than- expected provider payment updates, and a change in the trustees’ projection methodology. Higher projected spending growth for Medicare Advantage is expected to partially offset the projected decrease in HI expenditures. Starting in 2008, expenditures in the HI trust fund exceeded income each year through 2015. Although the Medicare trustees reported small surpluses in 2016 and 2017, the HI trust fund again experienced deficits in 2018 and 2019. (See Table A-1.) The trustees project that, in all future years, expenditure growth will continue to outpace growth in income and trust fund assets will be used to make up the difference between income and expenditures until the assets are depleted in 2026. (See Figure 2.)

When is the Medicare 2020 report?

202020 Report of the Medicare Trustees, April 22, 2020. The trustees’ estimate does not reflect potential economic and healthcare impacts of the COVID-19 pandemic on the Medicare program.

When will Medicare be depleted?

Each year, Medicare’s actuaries provide an estimate of the year when the HI trust fund asset level is projected to be fully depleted. In the 2020 Medicare Trustees report, the actuaries projected that assets in the Part A trust fund will be depleted in 2026, just five years from now (Figure 3). A more recent projection from the Congressional Budget Office also estimated depletion of the HI trust fund in 2026.

How does Medicare affect the long term?

Over the longer term, Medicare faces financial pressures associated with higher health care costs and an aging population. To sustain Medicare for the long run, policymakers may consider adopting broader changes to the program that could include both reductions in payments to providers and plans or reductions in benefits, and additional revenues, such as payroll tax increases or new sources of tax revenue. Consideration of such changes would likely involve careful deliberations about the effects on federal expenditures, the Medicare program’s finances, and beneficiaries, health care providers, and taxpayers.

How much of Medicare will be covered in 2026?

Based on data from Medicare’s actuaries, in 2026, Medicare will be able to cover 94% of Part A benefits spending with revenues plus the small amount of assets remaining at the beginning of the year, and just under 90% with revenues alone in 2027 through 2029.

Where does Medicare get its money from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

How much of the federal budget is Medicare?

Medicare spending often plays a major role in federal health policy and budget discussions, since it accounts for 21% of national health care spending and 12% of the federal budget. Recent attention has focused on one specific measure of Medicare’s financial condition – the solvency of the Medicare Hospital Insurance (HI) trust fund, ...

How many years has the HI trust fund been depleted?

In the 30 years prior to 2021, the HI trust fund has come within five years of depletion only twice – in 1996 and again in 1997 (Figure 4). At that time, Congress enacted legislation to reduce Medicare spending obligations to improve the fiscal outlook of the trust fund.

How many people are covered by Medicare?

Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. Medicare spending often plays a major role in federal health policy and budget discussions, ...

When will Medicare be depleted?

Meanwhile, Medicare’s hospital insurance fund is expected to be depleted in 2026 — the same date that was projected a year ago. At that point, doctors, hospitals and nursing homes would not receive their full compensation from the program and patients could face more of the financial burden.

When will Social Security run out?

The program’s disability fund is now not expected to run out until 2052 — 20 years later than what was projected last year. Government officials said during a news briefing before the release ...

What is the annual report on the status of the programs?

An annual government report on the status of the programs painted a dire portrait of their solvency that will saddle the United States with more debt at a time when the economy is starting to cool and taxes have just been cut.

How much was cut in Social Security?

It also called for $26 billion less on Social Security programs, including a $10 billion cut to Social Security Disability Insurance, which provides benefits to disabled workers. Fiscal watchdog groups said on Monday that the new figures underscored the need for changes to the programs.

When will Social Security retirement income exceed income?

According to the report, the cost of Social Security, the federal retirement program, will exceed its income in 2020 for the first time since 1982.

Is Medicare and Social Security precarious?

WASHINGTON — The financial outlook for Medicare and Social Security, two of the nation’s most important social safety net programs, remains precarious, threatening to diminish retirement payments and increase health care costs for Americans in old age, the Trump administration said on Monday.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

What is Medicare report?

The report is an annual exercise designed to review the health of the nation’s biggest health insurance program. It looks in detail at each of Medicare’s pieces, including Part A inpatient hospital insurance; Part B coverage for outpatient hospital care, physician services, and the like; Part C Medicare Advantage plans; and Part D drug insurance.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

Will Medicare costs increase in the next 75 years?

So we face what the economists like to call an asymmetric risk: It is possible that future Medicare costs will grow more slowly than predicted, but it is more likely that they’ll be significantly higher than the trustees forecast .

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.