| IRMAA Table | 2020 |

|---|---|

| More than $174,000 but less than or equal to $218,000 | $202.40 |

| More than $218,000 but less than or equal to $272,000 | $289.20 |

| More than $272,000 but less than or equal to $326,000 | $376.00 |

| More than $326,000 but less than $750,000 | $462.70 |

Will irmaa costs impact your Medicare premiums in 2020?

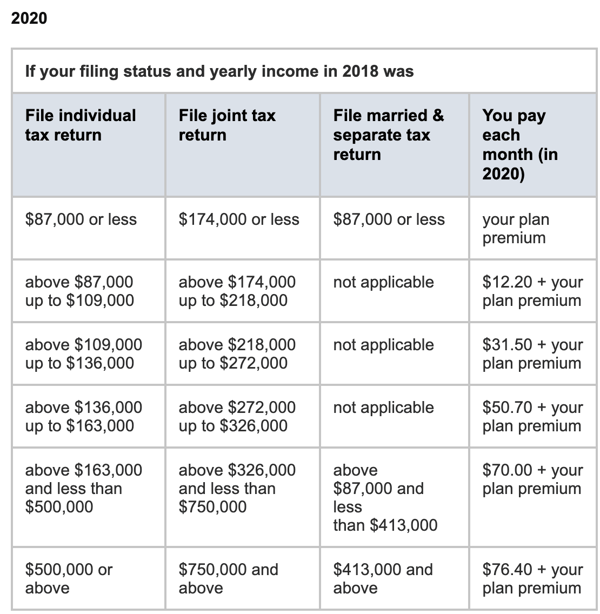

Feb 15, 2022 · For 2020 information, continue reading below. It’s not uncommon for Medicare premiums to increase every year. But for some higher-earning Medicare Part B and Part D beneficiaries, a 2020 change to Medicare Income-Related Monthly Adjust Amounts (IRMAA) could result in savings on their Part B and/or Part D premiums.

Who will be subject to irmaa surcharges in 2020?

You pay each month (in 2020) no IRMAA only your plan premium $12.20 + your plan premium $31.50 + your plan premium $50_70 + your plan premium $70.00 + your plan premium $76.40 + your plan premium If Your Yearly Income Is Your Monthly Medicare Part B Premium about $135 S144 60 S202.40 S289 20 S376 oo S462.70 S491 60 2020 Medicare Part B IRMAA so oo

What is irmaa and how does it affect me?

Apr 22, 2021 · The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums. This IRMAA surcharge is in addition to the standard Part B premium and any premium associated with their Part D plan . 2020 IRMAA amounts were based on a beneficiary’s …

What is the irmaa Part B premium for 2021?

The standard Part B premium is $144.60 for folks just joining this year and depending where you are Part D may be $0 all the way to $100 or more a month. It completely depends on what type of secondary plan you choose and what County you live in. There are 6 tiers with IRMAA for 2020. We will go over the different amounts below.

What will Irmaa be in 2021?

The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.Nov 19, 2020

What income is Irmaa based on?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.Nov 11, 2021

What will Irmaa be in 2022?

What will the Medicare IRMAA be in 2022?2022 (based on 2020 individual tax return)2022 (based on 2020 joint tax return)More than $142,000 up to $170,000More than $284,000 and up to $340,000More than $170,000 up to $500,000More than $340,000 up to $750,000More $500,000More than $750,0003 more rows•Feb 15, 2022

Is Irmaa based on adjusted gross income?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it's specific to Medicare.

Does Social Security income count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•Mar 28, 2022

How do you calculate Magi for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).Jan 25, 2022

When should I file SSA 44?

You should fill out Form SSA-44 if you experience any life-changing event that reduces your income. Life-changing events that qualify are marriage, divorce, death of a spouse, work stoppage, work reduction, loss of income-producing property, loss of pension income and employer settlement payment.Mar 11, 2022

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA??

If you are joining Medicare you may get a letter with these letters on it, IRMAA. So what does it mean? How long does it last? Is there anything you can do about it? What are the Medicare costs for 2020?

How is IRMAA calculated?

The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Which means that for most people, IRMAA is not a permanent thing. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

Who has to pay IRMAA

As noted above, only individuals who earn more than $87,000 and married couples filing jointly who earn more than $174,000 are required to pay IRMAA.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Who is Jae Oh?

Jae W. Oh is a nationally recognized Medicare expert, frequently quoted in the national press, including on USA Today, Dow Jones, CNBC, and Nasdaq.com, as well as on radio talk shows nationwide. His book, Maximize Your Medicare, is available in print and ebook formats.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Do mutual funds distribute dividends?

At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums.

A. Policy for IRMAA Medicare Part B and prescription drug coverage premiums sliding scale tables

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher the beneficiary’s range of modified adjusted gross income (MAGI), the higher the IRMAA. There are three sets of tables.

B. Medicare Part B and Part D Prescription Drug coverage for year 2021 IRMAA tables

1. Single, head–of–household, or qualifying widow (er) with dependent child tax filing status

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...