What is the Medicare levy for 2020 2021?

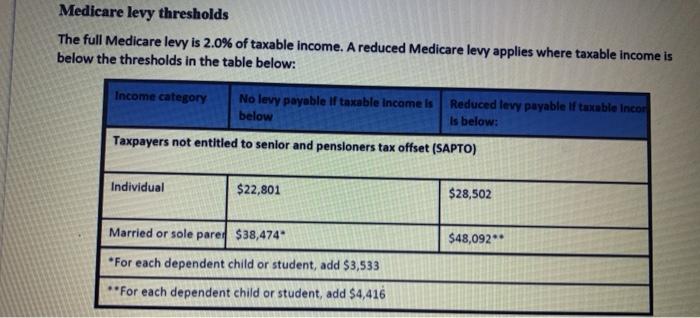

The current full basic levy is 2.0%, subject to low income tests and some exemptions. Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2020-21 year. The threshold for singles will be increased from $22,801 to $23,226 The family threshold will be increased from $38,474 to $39,167

What is the Medicare levy threshold for 2019 20?

2019-20 Medicare Levy Income Thresholds Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2019-20 year. The threshold for singles will be increased from $22,398 to $22,801 The family threshold will be increased from $37,794 to $38,474

What are the 2020-21 Medicare low-income thresholds?

Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2020-21 year. The threshold for singles will be increased from $22,801 to $23,226 The family threshold will be increased from $38,474 to $39,167

How often are Medicare levy thresholds adjusted for inflation?

Medicare Levy Income Thresholds. Medicare levy low-income thresholds are typically adjusted for inflation once a year and published in the Federal Budget which is usually in May of the current tax year.

What is the threshold for the Medicare levy?

Medicare levy reduction eligibility In 2020–21, you do not have to pay the Medicare levy if: you are single, and. your taxable income is equal to or less than $23,226 ($36,705 for seniors and pensioners entitled to the seniors and pensioners tax offset).

How much is the Medicare levy in Australia?

about 2%Medicare levy The levy is about 2% of your taxable income. You pay the levy on top of the tax you pay on your taxable income.

How much does Medicare cost Australia 2021?

Guaranteeing Medicare The Morrison Government will invest $125.7 billion over four years, an increase of over $6 billion since last year's Budget, in Medicare, including record funding of $29.7 billion in 2021–22, and $30.5 billion in 2022–23, $32 billion in 2023–24 and $33.5 billion in 2024–25.

Does everyone pay the 2% Medicare levy?

Not everyone is required to pay the Medicare levy surcharge, but if you're single and earning more than $90,000 or part of a family earning $180,000, you may be charged.

What is Medicare levy?

Medicare levy. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances.

How is Medicare levy collected?

The Medicare levy is collected from you in the same way as income tax. Generally, the pay as you go amount your employer withholds from your salary or wages includes an amount to cover the Medicare levy. We calculate your actual Medicare levy when you lodge your income tax return. Find out about:

Do I have to pay MLS for Medicare?

In addition to the Medicare levy, you may have to pay the Medicare levy surcharge (MLS ) if you, your spouse or dependant children don’t have an appropriate level of private patient hospital cover and your income is above a certain amount.

Can I get a reduction on my Medicare levy?

You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare levy.

When do you have to pay Medicare levy 2021?

If you have to pay the surcharge for the whole period 1 July 2020 to 30 June 2021, enter 0. You have completed the Medicare levy surcharge section. If you had private patient hospital cover for any part of the year, go to the Private health insurance section.

What is Medicare levy surcharge?

The Medicare levy surcharge (MLS) is in addition to the Medicare levy. You may have to pay MLS for any period during the income year that: income for MLS purposes (including your spouse's income if relevant) is above the relevant thresholds.

How much is the family surcharge for 2021?

had a spouse or any dependent children, so you can apply the family surcharge threshold of $180,000, plus $1,500 for each dependent child after the first, to your income for MLS purposes. your combined family income using the relevant family income threshold if you had a spouse on 30 June 2021, or.

Is Michael liable for MLS?

Michael is not liable for MLS for this period because his $69,000 income for MLS purposes was less than $90,000. Entering Number of days you do not have to pay the surcharge: Michelle writes 104 being the number of days in the first period when she was not liable for MLS.

Do Jill and Kevin have to pay MLS?

Jill and Kevin do not have to pay MLS for the time the whole family had private patient hospital cover – from 10 January 2021 to 30 June 2021. That was 172 days. Jill and Kevin would both enter 172 at Number of days you do not have to pay the surcharge and complete Private health insurance section. End of example.

Is Medicare levy surcharge exempt from MLS?

Medicare levy surcharge exemption categories. If you fit into one of the following categories, you are exempt from MLS for the whole of 2020–21. For the whole of 2020–21, you and all your dependants (if you had any) either: had an appropriate level of private patient hospital cover, or.

What is the Medicare levy for 2019-20?

Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2019-20 year. The threshold for singles will be increased from $22,398 to $22,801. The family threshold will be increased from $37,794 to $38,474.

When is Medicare levy low income adjusted?

Medicare levy low-income thresholds are typically adjusted for inflation once a year and published in the Federal Budget which is usually in May of the current tax year.

Why do pensioners not pay Medicare levy?

Pensioners below Age Pension age do not pay the Medicare levy when they have no tax to pay

When did Medicare levy increase?

The current rate of 2% medicare levy has been in place since 1 July 2014. An earlier proposal to increase the levy to 2.5% from 1 July 2019 for the 2019-20 and following years was abandoned.

Is Medicare levy payable on income?

Once the minimum income threshold is reached, the levy is payable on the entire income unless a reduction or exemption is available.

Does Medicare reduce your taxable income?

Medicare levy reduction for low-income earners. The amount of Medicare levy you pay is reduced if your taxable income is below a certain threshold. In some cases, you may not have to pay the levy at all. The thresholds are higher for low-income earners, seniors and pensioners. If your taxable income is above the thresholds, ...

Can I get a Medicare levy reduction if my income is above the threshold?

If your taxable income is above the thresholds, you may still qualify for a reduction based on your family taxable income. You can use the Medicare levy calculator to work out your Medicare levy payable.

Do I have to pay Medicare levy 2020?

In 2020–21, you do not have to pay the Medicare levy if: your taxable income is equal to or less than $23,226 ($36,705 for seniors and pensioners entitled to the seniors and pensioners tax offset). The amount of Medicare levy you pay will be reduced if: your taxable income is between $23,226 and $29,033 ...

Can you get a Medicare levy reduction if you don't qualify?

If you do not qualify for a reduction in the Medicare levy, you may still qualify for a Medicare levy exemption. Your Medicare levy is reduced if your taxable income is below a certain threshold.

What is the Medicare levy for 2020?

up to your low-rate cap for 2020–21, which is $215,000.

What is Medicare levy reduction?

A Medicare levy reduction is based on your taxable income. A Medicare levy exemption is based on specific categories. You need to consider your eligibility for a reduction or an exemption separately. The first part of this question deals with Medicare levy reduction.

What is category 2 exemption?

Category 2: Foreign resident. If you were a foreign resident for tax purposes for the whole of 2020–21, you can claim a full exemption (365 days). If you were a foreign resident for only a period in 2020–21, you can claim a full exemption for that period if: you did not have any dependants for that period, or.

When are you married in 2020?

You were married at any time during 2020–21 but. during 2020–21, you then separated from, or were deserted by, your spouse, and. for the remainder of 2020–21 , you were not in a de facto relationship. Your spouse was in prison for a sentence of 12 months or more.

Can you claim a full exemption for a period for which you have a Medicare entitlement statement from Services Australia?

You can claim a full exemption for any period for which you have a Medicare entitlement statement from Services Australia showing you were not entitled to Medicare benefits because you were a temporary resident for Medicare purposes , and either:

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

What is the low income singles rate?

Low income singles rates are: Do not pay: Income equal to or less than $22,801 (or $36,056 if entitled to the seniors and pensioners tax offset). Medicare Levy Reduction: You qualify for a reduced rate if your income is between $22,802 and $28,501 (or $45,069 if entitled to the seniors and pensioners tax offset) Reduction for families.

How much Medicare does a part time employee pay?

Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000. An employee earning $100,000 pays $2,000 in Medicare Levy. These amounts are all in addition to your regular income taxes based on your tax bracket.

What is Medicare entitlement statement?

This is a statement the Department of Human Services issues to people who are not entitled to received Medicare benefits based on their visa type. You can apply for a statement if you fit any one of the following categories:

How much will Part D cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.