Scroll for more

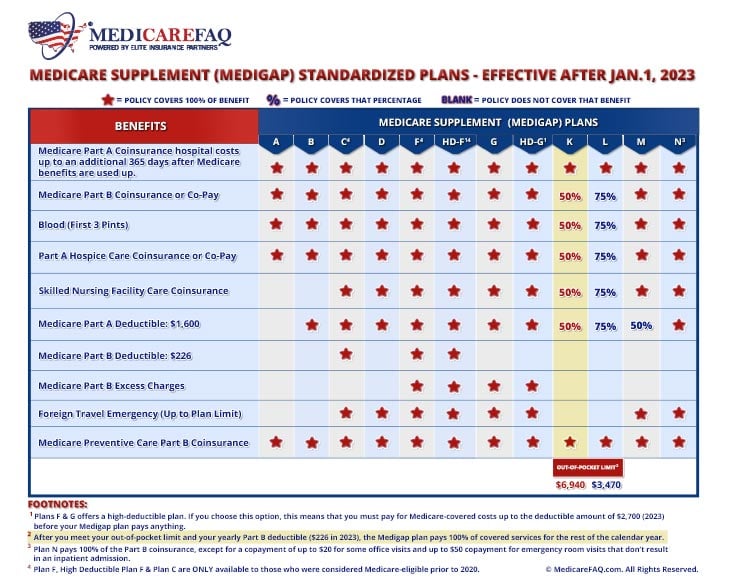

| Medicare Supplement Benefits | K 2 | L 3 | M |

| First 3 pints of blood | 50 % | 75 % | |

| Skilled nursing facility coinsurance | 50 % | 75 % | |

| Part A deductible | 50 % | 75 % | 50 % |

| Part B deductible |

Full Answer

Is skilled nursing covered by Medicare?

For days 1–20, Medicare pays the full cost for covered services. You pay nothing. For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services. The coinsurance is up to $170.50 per day in 2019.

What qualifies as skilled nursing care for Medicare?

Apr 16, 2021 · Medicare Part A only covers nursing care if skilled care is needed for your condition. You must require more than just custodial care (help with daily living tasks, such as bathing, dressing, etc.).

What does Medicare Part cover in skilled nursing facilities?

Apr 08, 2022 · What is Medicare Part A? Medicare Part A is hospital insurance. It pays for inpatient care at a hospital or a skilled nursing facility, as well as hospice care and home care. Medicare Part A, along with Medicare Part B, is sometimes called Original Medicare. Part B coverage pays for doctor visits, tests and some medical supplies.

Who pays for skilled nursing facility?

If you’re admitted to a skilled nursing facility, this is the breakdown of 2021 coinsurance costs: Days 1 to 20: $0 daily coinsurance Days 21 to 100: $185.50 daily coinsurance

What is the SNF coinsurance for 2020?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $176.00 in 2020 ($170.50 in 2019).Nov 8, 2019

What is the SNF coinsurance for 2021?

$176.00 $185.502021 Medicare Premiums & DeductiblesPart A Deductible & Coinsurance AmountsType of Cost Sharing20202021Daily Coinsurance for 61st - 90th Day$352.00$371.00Daily Coinsurance for Lifetime Reserve Days$704.00$742.00Skilled Nursing Facility Coinsurance$176.00$185.501 more row

Does Medicare Part A have a coinsurance?

Coinsurance refers to a percentage of the Medicare-approved cost of your health care services that you're expected to pay after you've paid your plan deductibles. For Medicare Part A (inpatient coverage), there's no coinsurance until you've been hospitalized for more than 60 days in a benefit period.

What is the Medicare coinsurance rate for 2021?

$371 per dayIn 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).Nov 6, 2020

What will Irmaa be in 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $222,000 but less than or equal to $276,000$297.00More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.9012 more rows•Dec 6, 2021

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What is a Medicare coinsurance?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

How is Medicare coinsurance calculated?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.Nov 29, 2021

What is the Medicare coinsurance amount for 2022?

Daily Coinsurance Costs for Medicare Part A in 2022 You pay $0 coinsurance for first 20 days and $194.50 for days 21 to 100. You are responsible for all costs from day 101 and beyond.

What is the Part D Irmaa for 2022?

The average premium for a standalone Part D prescription drug plan in 2022 is $47.59 per month.Feb 15, 2022

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

What is Medicare Part B Irmaa?

Register. The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA.

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

Medicare Part A eligibility

If you’re age 65 or older or have certain disabilities, you’re likely eligible for Medicare, a form of government-sponsored medical insurance. Part A is paid via Medicare payroll taxes withheld from your paychecks over your working life.

How much is Medicare Part A?

The good news is that you typically don’t have to pay a monthly premium for Part A. That’s true so long as you or your spouse paid sufficient Medicare taxes over your lifetime.

Medicare Part A deductible

Aside from premiums, Medicare Part A recipients may also pay out-of-pocket costs, including a deductible and coinsurance .

How to sign up for Medicare Part A

Most people eligible for Medicare Part A and B are enrolled automatically.

Medicare Part A vs. Part B

Part A and Part B are both components of Original Medicare, but they cover different health care services.

Frequently Asked Questions

If you already have Medicare Part A but need Medicare Part B, there are forms you and your employer (if applicable) need to complete to enroll in Part B without having to pay penalties, according to Reese. If you missed your qualifying window, there’s a general enrollment period between Oct. 15 and Dec. 7.

What is coinsurance in Medicare?

Medicare coinsurance is the amount of money you have to pay out of your own pocket for medical services you receive after you’ve paid your deductible. It’s a percentage of the Medicare-approved price of the services you receive.

What percentage of Medicare coinsurance is paid?

After meeting the deductible, your coinsurance will usually be 20 percent of the Medicare-approved price for certain services. Medicare Part B services for which you pay coinsurance include: Most doctor services including hospital inpatient doctor services. Outpatient therapy or treatments.

What is a Medigap insurance?

Medigap, also called Medicare supplemental insurance, can offer some help in paying Medicare coinsurance and other out-of-pocket costs associated with your Medicare coverage.

How much is Medicare Part D coinsurance for 2021?

Medicare Part D Prescription Drug Coinsurance. Your Medicare Part D plan’s design will determine your 2021 coinsurance. There is a standard deductible of $445 for all Part D prescription drug plans, but after that, the amount of your coinsurance is set by the insurer through which you purchased your Part D coverage.

How long do you have to pay coinsurance for Medicare 2021?

But you still don’t have to pay coinsurance for the first 60 days of hospitalization even after you’ve paid your deductible.

How long does Medigap cover?

All Medigap plans cover certain basic benefits. 365 days of additional hospital coverage. Full or partial coverage for Medicare Part B coinsurance. Hospice coinsurance for drugs and up to five days of inpatient care. Medicare Plan A hospital coinsurance. You may also choose plans that cover differing amounts of coinsurance ...

When does coinsurance kick in?

Medicare coinsurance kicks in after you’ve paid your Medicare deductible for the year. The amount for Medicare Part A hospital insurance is a set dollar amount while coinsurance for other Medicare parts are a percentage of the cost of the medical or hospital service you receive. When Medicare Coinsurance Begins.

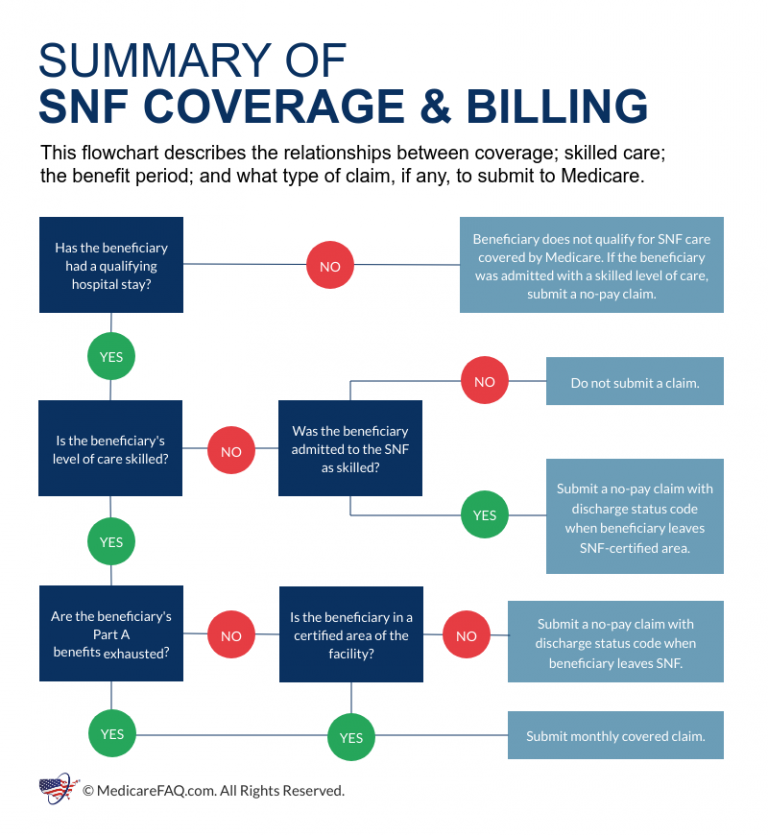

How long does Medicare cover coinsurance?

You typically need to pay coinsurance for days 21-100. If your stay in a skilled nursing facility longer than 100 days in a benefit period, Medicare generally doesn’t cover these costs.

How long does Medicare pay for skilled nursing?

Generally Medicare will pay 100% of the Medicare-approved cost for the first 20 days and part of the cost for another 80 days of medically necessary care in a Medicare-certified skilled nursing facility each benefit period. You typically need to pay coinsurance for days 21-100. If your stay in a skilled nursing facility longer than 100 days in ...

How long does Medicare benefit last?

You haven’t used up all the days in your Medicare benefit period. A benefit period starts the day you’re admitted to a hospital as an inpatient. It ends when you haven’t been an inpatient in a hospital or skilled nursing facility for 60 days in a row. If you meet these requirements, Medicare may cover skilled nursing facility care ...

What does Medicare pay for?

Typically Medicare will pay for the following items and services delivered by trained health professionals: 1 Semi-private room 2 Meals 3 Care by registered nurses 4 Therapy care (including physical, speech and occupational therapy) 5 Medical social services 6 Nutrition counseling 7 Prescription medications 8 Certain medical equipment and supplies 9 Ambulance transportation (when other transportation would be dangerous to your health) if you need care that’s not available at the skilled nursing facility

What is Medicare Supplement Plan?

Medicare Supplement (Medigap) plans help pay for some of your out-of-pocket costs under Medicare Part A and Part B, including certain cost-sharing expenses.

What are the services of a skilled nursing facility?

Some skilled nursing facilities might have laboratory, radiology and pharmacy services, social and educational programs, and limited transportation to needed health services that are not available at the facility. At a skilled nursing facility, you normally get health services according the care plan that your doctor created based on your specific ...

Why do you need skilled nursing?

You may need skilled nursing care if you have an illness or injury that requires treatment or monitoring. Skilled nursing facilities provide 24-hour care for people who need rehabilitation services or who suffer from serious health issues that are too complicated to be tended at home. Some skilled nursing facilities might have laboratory, ...