What is covered by Medicare Part?

Medicare Part A Deductible Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, and deductibles that …

Does Medicare charge a deductible?

Dec 14, 2021 · In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

What is the premium for Medicare Part A?

Nov 12, 2021 · The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What are the four parts of Medicare?

If so, how much is the deductible? En español | The 2020 deductible for Medicare Part A is $1,408 for each benefit period. This period begins when you are admitted to a hospital or nursing home for up to 60 consecutive days, and ends 60 days after you’ve left. You must pay the hospital or nursing home deductible for each benefit period.

Is there a Medicare Part A deductible?

Medicare Part A Deductible Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care. For 2022, the Medicare Part A deductible is $1,556 for each benefit period.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the Medicare Part A deductible for 2022?

$1,556 per2022 Medicare Deductibles by Plan. In 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary.Dec 14, 2021

What is the standard deductible for Medicare Part A?

$1,556If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period.

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Does Medigap cover Part A deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.Aug 6, 2021

What is the annual deductible for Medicare Part B?

$233Alongside the premium, Medicare Part B includes an annual deductible and 20% coinsurance for which you are responsible to pay out-of-pocket. In 2022, the Medicare Part B deductible is $233. Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses.Feb 14, 2022

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

What is Medicare Part A?

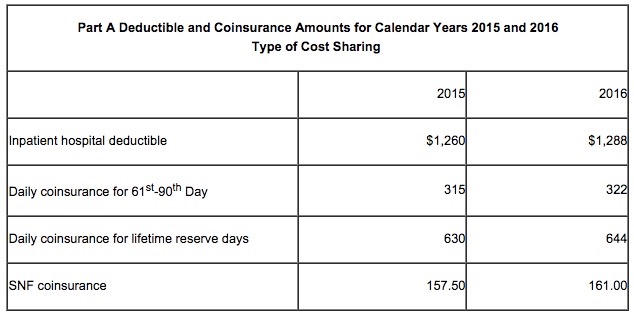

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

AARP Poll Reveals Strong Family Caregiver Tax Credit Support 1 Comments

Most older voters want to get their care at home for as long as possible

What to Watch on TV and Streaming This Week 27 Comments

Sandra Oh’s great new series on Netflix and a juicy documentary on Showtime

Museum Commemorates Baseball Great Roberto Clemente 2 Comments

Exhibit pays homage to Hall of Famer's legendary career and humanitarian efforts

Roberto Clemente: A Life in Baseball and Beyond 0 Comments

The famed outfielder was passionate about his family, helping others, and his Puerto Rican heritage

State-by-State Guide to Face Mask Requirements 122 Comments

Following federal guidance, many states dropping mask orders for fully vaccinated people

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible in 2021 is $203 per year, and the Part A deductible is $1,484 per benefit period. Learn more about these costs and what you can expect.

Does Medicare Supplement Insurance cover Part B?

If you enroll in one of these types of plans and pay a monthly premium to belong to the plan, you will not have to pay out of your own pocket for the Medicare Part B deduct ible.

How much is Medicare Part A 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period . Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period. A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, ...

Is Medicare Part C the same as Medigap?

It's important to note that Medicare Part C is a term only used for Medicare Advantage plans, and it's not the same as Medigap Plan C. Medicare Advantage plans provide the same benefits as Medicare Part A and Part B in one plan and serve as an alternative way to get Original Medicare coverage.

What is the coinsurance for Medicare Part B?

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent ...

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

What is the Medicare Part B?

Together with Medicare Part B, it makes up what is known as Original Medicare , the federally administered health-care program.

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How old do you have to be to get Medicare?

You are 65 or older and meet the citizenship or residency requirements. You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

How to contact the RRB?

If you worked for a railroad, contact the RRB to apply at 1-877-772-5772. (TTY users, call 1-312-751-4701). You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.