How much is Medicare Part B annual deductible?

Nov 10, 2016 · CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part …

Does Medicare Part B have a deductible?

7 rows · Medicare Deductible 2017 for Part B In 2017, the annual Medicare Part B deductible is ...

What is the current deductible for Medicare Part B?

Nov 17, 2016 · In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017. Read the CMS announcement. Back to top.

How high will the Medicare Part B deductible get?

Apr 05, 2017 · Each year Medicare requires that beneficiaries meet their deductibles BEFORE Medicare will begin payment for charges submitted to them. Some services, such as lab work and certain preventive services, are not subject to the deductible. The Part B …

What was the 2017 Medicare Part B premium?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the Medicare rate in 2017?

The rate is 0.9 percent plus 1.45%, Total Additional Medicare Tax is 2.35%. Employers do not pay the additional 0.9% in matching contributions. ** The 2016 SDI tax rate was 0.9% ** The 2016 SDI maximum taxable wage base was $106,742.00. *** The 2016 SDI maximum tax was $960.68.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the annual Medicare Part B deductible?

$233The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What was Medicare Part B premium in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What is the Part B deductible for 2019?

$185 in 2019The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.Oct 12, 2018

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What are Medicare Part B premiums for 2019?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

What is the Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital for 2021 will be $1,484, which is an increase of $76 from $1,408 in 2020.Nov 13, 2020

Does Medigap cover Part A deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.Aug 6, 2021

Understanding the Factors that Will Impact Your Medicare Part B Deductible 2017

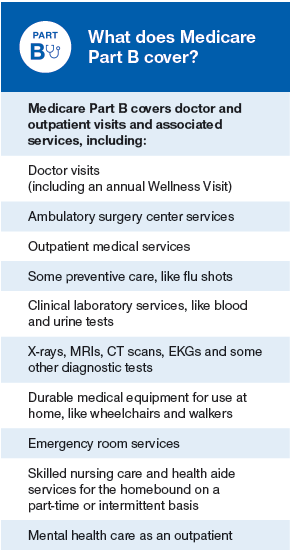

Original Medicare, the program funded by the Federal Government to help seniors and the disabled obtain affordable health covered California office near me, is comprised of two parts: Medicare Part and Part B. Medicare Part A covers the cost of inpatient care, such as treatments provided in a hospital or a skilled nursing facility.

Medicare Deductible 2017 for Part B

In 2017, the annual Medicare Part B deductible is $183. Once you have met your deductible, you will typically pay 20 percent of the Medicare-approved amount for covered services, such as non-routine physician exams, outpatient therapy, and DME.

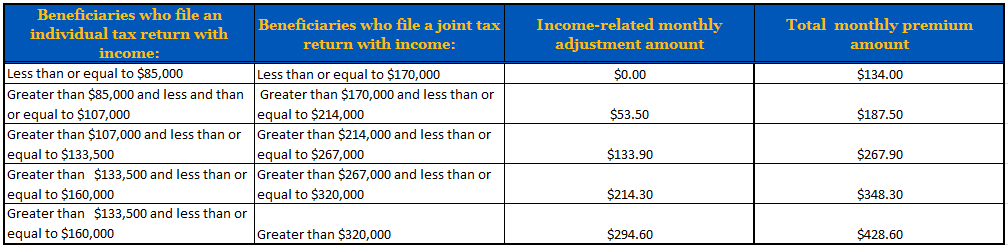

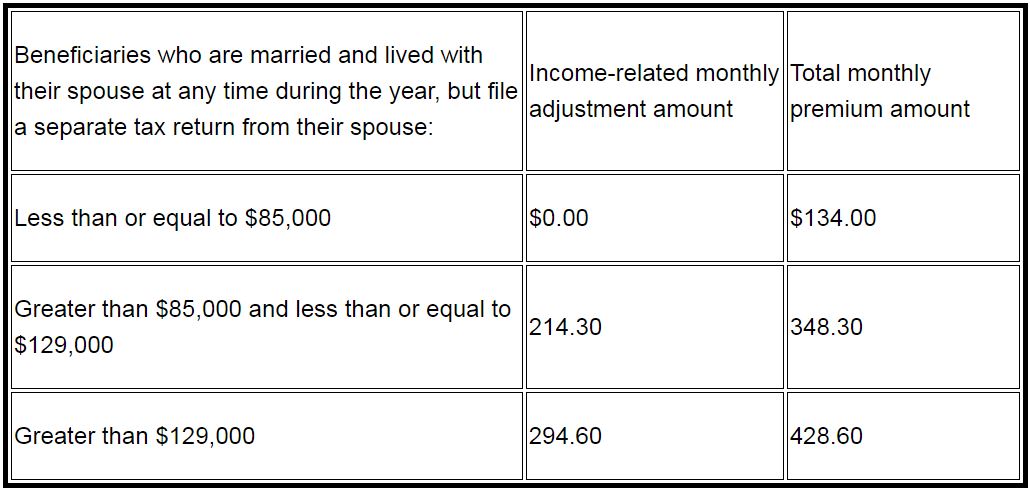

Medicare Premiums 2017 for Part B

Medicare Part B premiums are income-based. The standard Medicare Part B premium you’ll pay monthly, if eligible, in 2017 is $134, or up to $1,608 per year. Note, this premium cost may be higher depending on your income. Most Americans receiving Social Security benefits, however, will pay less.

Will I Qualify for Standard Part B Premiums in 2017?

The exact amount of annual premium payments you’ll pay for Part B will be determined by the Social Security Administration, if you are eligible. You may qualify to pay the standard premium amount, or a higher amount, if any of the following scenarios pertain to you:

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

How much does Medicare Part D cost?

The 2017 Part D plan premiums range from $12 to $179.

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

What happens if you don't get Part A?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up.

How long do you have to pay for Part A?

For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period.

Do you pay late enrollment penalty?

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a special enrollment period. Example: Mr. Smith’s initial enrollment period ended September 30, 2013. He waited to sign up for Part B until the General Enrollment Period in March 2016.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2017, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

Part B premium and deductible changes for 2017 to increase costs

Every year about this time The Centers for Medicare and Medicaid (CMS) announce the Medicare Part B premium and deductible for the coming year. They also address changes to the Part A premium although this affects very few people.

Medicare premium and deductible changes

The Medicare Part A premium which only affects people who did not work and contribute to payroll taxes for 40 quarter over their working life will increase $2 per month to $417. Determining your Part B premium involves taking your individual situation into consideration.

Medicare Part A premium and deductible changes in 2017

If you are hospitalized your Part A benefits will help pay your covered costs. The changes are as follows:

What this really means to you bottom line

If you are enrolled in a Medicare Advantage Plan or a Medicare supplement policy you may not initially feel the pinch as much as someone insured only by original Medicare. Everyone will see a small increase in Part B premiums and if you are becoming eligible for Medicare in 2017 you’ll pay a price for being a year younger.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .