How high will the Medicare Part B deductible get?

Oct 12, 2018 · The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and …

What is the maximum premium for Medicare Part B?

Oct 12, 2018 · CMS also announced that the annual deductible for Medicare Part B beneficiaries is $185 in 2019, an increase from $183 in 2018. Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing …

How to collect a part B deductible?

Nov 12, 2019 · The federal government sets the deductible, and it may change from year to year, similar to the premium. In 2020, the deductible is $198 (up from $185 in 2019). 4 After you meet the deductible, Part B pays 80% of the Medicare-approved amount for medically necessary services like doctor visits, outpatient therapy, and durable medical equipment.

Is Medicare Part B payments tax deductible?

Oct 16, 2018 · Part B On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019. Part A As for the Part A premium, CMS will raise it from $422 per month to $437 per month next year.

What is the 2021 deductible for Medicare for A and B?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the yearly Medicare Part B deductible?

$233The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the annual deductible for all Medicare Part B beneficiaries in 2020?

$198The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).Nov 6, 2020

What is the deductible for Part B 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.Nov 8, 2019

How does the Medicare Part B deductible work?

Typically, you'll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you'd be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital for 2021 will be $1,484, which is an increase of $76 from $1,408 in 2020.Nov 13, 2020

Can you deduct Medicare premiums from your taxes?

Medicare expenses that exceed 7.5% of your adjusted gross income may be deductible. Only expenses that are considered allowable by the IRS, such as Medicare premiums and annual physical exams, can be deducted. Keep your receipts and plan ahead to maximize your tax deductions.Sep 24, 2021

How much is Medicare deduction from Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Are Medicare premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

How much is Medicare Part A deductible?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

What is Medicare Part B 2020?

Part B, which helps millions of Americans pay for medical care, requires certain costs, two of which are premiums and deductibles. The prices are set by federal law, but the exact amount you’ll pay varies depending on certain factors like your income. Read on for details about Part B premiums and ...

How much is Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted ...

How much is the 2020 Medicare premium?

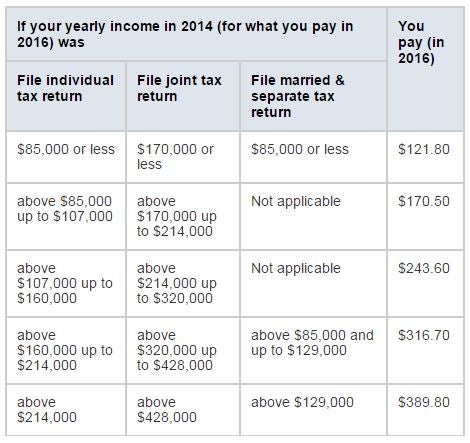

In 2020, that's $144.60 (up from $135.50 in 2019). 1. People who earn more than the standard premium threshold will pay higher premiums. This premium increase is called the Income-Related Monthly Adjusted Amount (IRMAA). 2. The table below outlines the 2020 premiums by income.

What is coinsurance in Medicare?

Coinsurance: This is a percentage that you pay for most services after you meet your deductible. For most services, your coinsurance is 20% of the Medicare-approved amount. Copayments: These are set dollar amounts you pay for certain services with some Advantage Plans.

What is the standard Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted from your monthly benefit payment. Social Security.

Does Part B have a deductible?

Part B includes a yearly deductible. This is the amount you must pay for most health care services before Part B starts to help. The federal government sets the deductible, and it may change from year to year, similar to the premium.

How much is Medicare Part B premium?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

How much will Social Security increase in 2019?

A day before CMS’ announcement about 2019 Medicare costs, the SSA announced their plans to raise the COLA 2.8 percent in 2019. As a result, retired workers collecting Social Security can expect to see their checks rise by an average of about $39 per month next year. Retired couples will receive an average of about $67 in additional Social Security benefits in 2019.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the Medicare deductible for 2019?

Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

How much does Medicare pay in 2019?

Answer: The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

How much is Social Security going up in 2019?

Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people. Premium increases are also minor for most higher-income beneficiaries—those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The “hold-harmless provision” prevents enrollees’ annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security ...

How much is Medicare Part B 2019?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

What is Medicare Part B?

Medicare Part B is the medical insurance component of the Medicare program. It pays for costs like doctor's office visits, medical equipment, and outpatient procedures.

Is Medicare Part A premium free?

Meanwhile, Medicare Part A, which mainly covers hospital stays, remains premium-free for most American seniors, although the Part A deductible is rising from $1,340 in 2018 to $1,364 in 2019.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .

What is the Medicare deductible for 2021?

For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

What is the difference between a deductible and a premium?

This is different from the deductible though; the premium is the amount you pay every month in order to have coverage, whereas the deductible is the amount you pay if and when you need medical care covered by Part B.)

Do you have to pay Part B deductible?

Enrollees who have Medicaid or retiree health benefits from an employer generally don’t have to pay the Part B deductible, as the other coverage picks up the tab. Some Medicare Advantage plans have no deductibles and low copays (Medicare Advantage enrollees pay the Part B premium plus the Medicare Advantage premium, ...

Will Medicare Part B increase in 2021?

Q: Did the Medicare Part B deductible increase for 2021? A: Yes. The Part B deductible increased by $5 for 2021, to $203. (Note that the monthly premium for Part B also increased for most enrollees for 2020, to $148.50/month.