How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How to collect a part B deductible?

- The beneficiary was later determined to have been entitled to Medicare benefits;

- The beneficiary’s entitlement period fell within the time the provider’s agreement with CMS was in effect; and

- Such amounts exceed the beneficiary’s deductible, coinsurance or non covered services liability. ...

Is Medicare Part B payments tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

How much is deductible on Part B Medicare?

$233Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What is the deductible for Medicare Part B 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

What is the current Part B deductible?

The Part B deductible increased by $30 for 2022, to $233. (Note that the monthly premium for Part B also increased for 2022, to $170.10/month for most enrollees.

What is the deductible for Medicare Part B 2021?

$203.00 per yearPart B: (Medical Insurance) Premium You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How do I find out what my Medicare deductible is?

Deductibles for Original Medicare You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

Is there a copay on Medicare Part B?

Medicare Part B does not usually have a copayment. A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the monthly cost of Medicare Part B in 2019?

$135.502019 Medicare Part B premium The standard monthly Medicare Part B premium is $135.50 in 2019.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

How much does Medicare pay for inpatient hospital admission?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

Is Medicare deductible finalized?

Premiums and de ductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Last month, CMS released the benefit, premium, and cost sharing information for Medicare Advantage plans in 2019.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

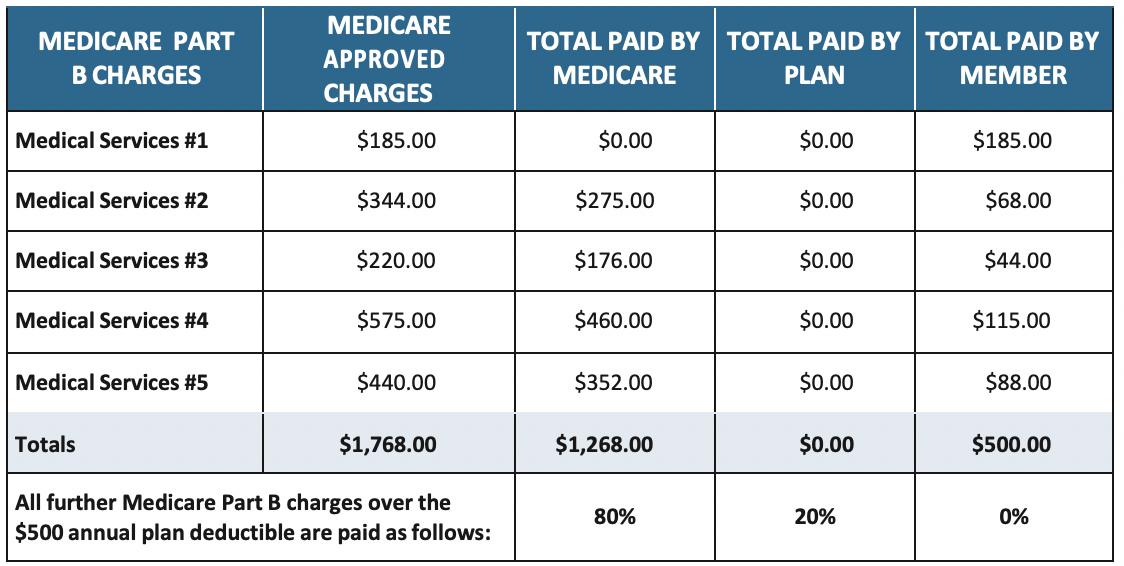

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the deductible for Part B?

Part B includes a yearly deductible. This is the amount you must pay for most health care services before Part B starts to help. The federal government sets the deductible, and it may change from year to year, similar to the premium. In 2020, the deductible is $198 (up from $185 in 2019). 4 After you meet the deductible, ...

What is Medicare Part B 2020?

Part B, which helps millions of Americans pay for medical care, requires certain costs, two of which are premiums and deductibles. The prices are set by federal law, but the exact amount you’ll pay varies depending on certain factors like your income. Read on for details about Part B premiums and ...

What percentage of Medicare deductible is coinsurance?

Coinsurance: This is a percentage that you pay for most services after you meet your deductible. For most services, your coinsurance is 20% of the Medicare-approved amount.

How much is the 2020 Medicare premium?

In 2020, that's $144.60 (up from $135.50 in 2019). 1. People who earn more than the standard premium threshold will pay higher premiums. This premium increase is called the Income-Related Monthly Adjusted Amount (IRMAA). 2. The table below outlines the 2020 premiums by income.

How much is Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted ...

What is the standard Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted from your monthly benefit payment. Social Security.

What does it mean to pay higher Social Security premium?

In general, this means that the higher your income is, the higher premium you’ll pay. Social Security uses the modified adjusted gross income (MAGI) that you reported on your taxes the year before. For example, to determine your 2020 premium, Social Security uses the income you earned in 2018 and reported when you filed your taxes in 2019.

How much is Medicare Part B premium?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

How much will Social Security increase in 2019?

A day before CMS’ announcement about 2019 Medicare costs, the SSA announced their plans to raise the COLA 2.8 percent in 2019. As a result, retired workers collecting Social Security can expect to see their checks rise by an average of about $39 per month next year. Retired couples will receive an average of about $67 in additional Social Security benefits in 2019.

Will Medicare be released in 2021?

The Centers for Medicare & Medicaid Services have released the Medicare costs for 2021. Please see our most recent article, 2021 Medicare Part A and Part B Premiums and Deductibles, for current facts and figures

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

How much is a knee injury deductible in July?

In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $150 for the appointment. You will be responsible for paying the first $65 of the $150 for the appointment out of your own pocket, because that is how much is left on your deductible. After the $65 is paid, ...

How much is the Part B tax deductible?

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203.

What is the Medicare deductible for 2021?

For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

What is the difference between a deductible and a premium?

This is different from the deductible though; the premium is the amount you pay every month in order to have coverage, whereas the deductible is the amount you pay if and when you need medical care covered by Part B.)

How much is the Affordable Care Act 2021?

2021: $203. Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Will Medicare Part B increase in 2021?

Q: Did the Medicare Part B deductible increase for 2021? A: Yes. The Part B deductible increased by $5 for 2021, to $203. (Note that the monthly premium for Part B also increased for most enrollees for 2020, to $148.50/month.

Is Part B deductible indexed annually?

Part B deductible by year. These amounts are indexed annually, after being set by the Medicare Modernization Act in 2005: Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.

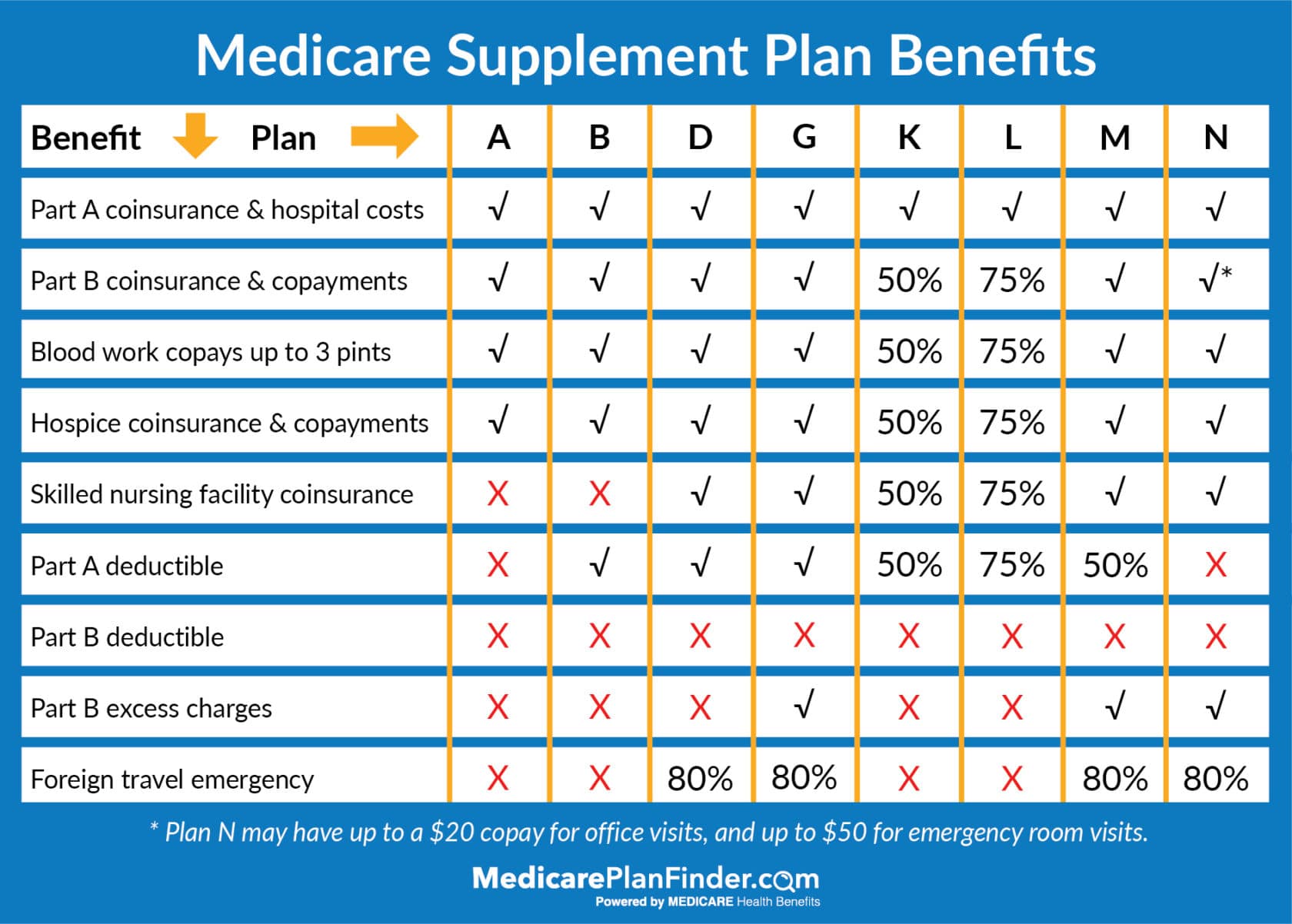

Do you have to pay Part B deductible?

Enrollees who have Medicaid or retiree health benefits from an employer generally don’t have to pay the Part B deductible, as the other coverage picks up the tab. Some Medicare Advantage plans have no deductibles and low copays (Medicare Advantage enrollees pay the Part B premium plus the Medicare Advantage premium, ...