A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium. How does a Part B give back plan work?

Full Answer

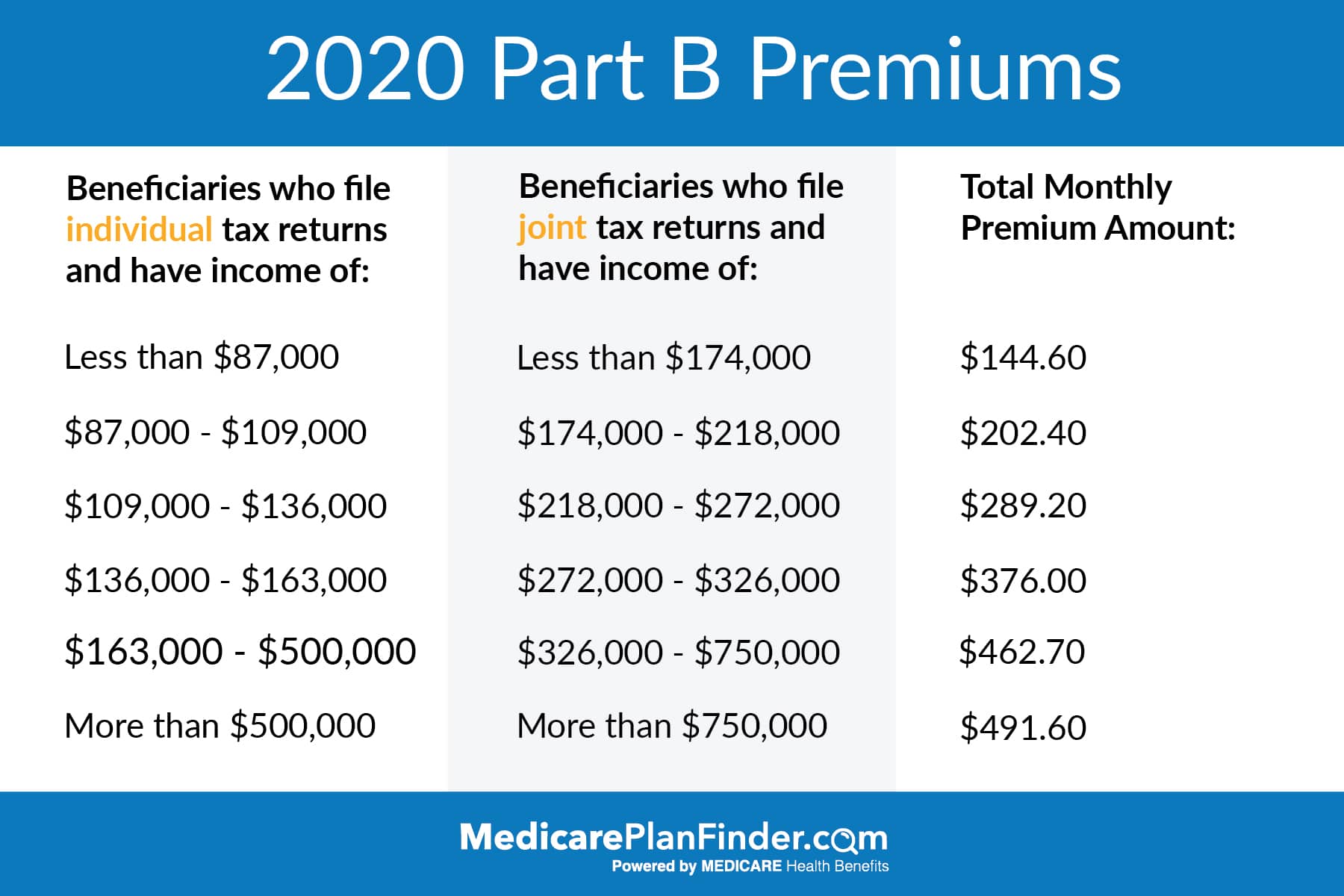

What is the monthly premium for Medicare Part B?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Is it mandatory to have Medicare Part B?

Dec 13, 2021 · A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit …

What is the difference between Medicare an and B?

Sep 20, 2021 · The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

What is the Medicare Part B premium Giveback?

Sep 16, 2021 · The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost ($148.50 in 2021).

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

What does Part B give back mean?

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

Who is eligible for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is Medicare Part B give back benefit?

If you're looking to maximize your savings while on Medicare, you may be wondering, what is the Medicare give back benefit? This benefit is not an official Medicare program, but rather a colloquial name for a Medicare Part B premium reduction included in some Medicare Advantage plans.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much is the Medicare Part B reimbursement?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Do some Medicare Advantage plans pay for a portion of the Part B premium?

premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a "Medicare Part B premium reduction." The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay.

How can I reduce my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What is a Medicare give back benefit?

A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium.

How does a Part B give back plan work?

Medicare Advantage plans with the premium reduction benefit work exactly the same as other Medicare Advantage plans. The only difference is that your monthly Part B premium will be reduced by the giveback amount in your plan.

How much will I save with a give back plan?

The premium reduction amount varies widely depending on the plan you choose and where you live. Some giveback plans give back as little as $0.10 each month while others pay the full Part B premium.

Is there an income requirement for the give back benefit?

No, there is no income test for the giveback benefit. Anyone eligible to enroll in Medicare Advantage can buy any Medicare giveback plan sold in their area. However, you must pay your own Part B premium. If you get premium assistance from Medicaid or another source, you aren’t eligible for the giveback benefit.

What should I watch for with the Part B give back benefit?

It’s always a good idea to compare all the costs and benefits of any Medicare plan you are considering. Think of premium reduction as just another extra benefit available with Medicare Advantage.

How can I find a Medicare Advantage giveback plan in my area?

The Boomer Benefits team uses a comprehensive comparison tool to see if a buyback plan is available in your area. We represent the top carriers in the country to be able to present our clients with many options. Talk to a Medicare expert on our team today to see what plan is right for you.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Is Part B reduction worth it?

Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing . Beneficiaries on a budget should consider High Deductible Plan G or High Deductible Plan F. The premiums are more affordable than the standard versions.

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

What is the Medicare Part B Giveback Benefit?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans.

How do I receive the Medicare Giveback Benefit?

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

Is the Medicare Giveback Benefit a type of Medicare Savings Program?

No. The Medicare Giveback Benefit is only available to people enrolled in certain Medicare Advantage plans. Medicare Savings Programs (MSPs) are available to people enrolled in Original Medicare who have limited income and resources.

Learn more about Medicare

For more helpful information on Medicare, check out these 10 frequently asked questions about Medicare plans.

What Does Medicare Pay For?

Medicare provides healthcare coverage to those 65 and older, as well as people with disabilities and some chronic diseases, through five major options:

Medicare Give Back – What Is It?

If you are on Medicare and looking forward to maximizing your savings, you might wonder what the Medicare give back benefit is. This is a term for a Medicare Part B premium decrease featured in some Medicare Advantage plans rather than an official Medicare program. The Part B premium reduction is the give back benefit.

How Does Medicare Part B Give Back Plans Work?

Instead of Medicare, Part B Give Back plans are health plans offered by commercial insurance firms.

How Can I Qualify for the Give Back Benefit?

Well, that depends on where you reside and whether or not you have access to a Medicare Advantage Plan that provides this benefit. To enroll in this plan, you must live in the plan’s service area.

With a Part B Give-Back Plan, How Much Do I Get Back?

The amount you get back ranges between $0.10 to $148.50 in various jurisdictions. In addition, the amount you receive will be determined by the options available in your location. Furthermore, multiple give back counties may have varying premium buy-downs for the same plan name.

Where Can I Look For Plans That Include This Benefit?

The Medicare Plan Finder is undoubtedly the best place to start. On the details page, you will notice if a plan offers the Part B premium reduction. Finding the exact amount of the reduction will almost certainly necessitate a search through plan paperwork or a phone call to the plan.

Bottom Line

We think that now you must have answers to the question “what is the Medicare give back benefit ?” The monthly Give Back may not be worth it if the prices are significantly greater than other plans. You might be able to find another plan that is more cost-effective in the end.

How long after you sign up for Part B will you get your money back?

You’ll have to continue paying your A and B premiums, even if you do get some of that money back. Additionally, it may be a few months after you sign up for your premium give back plan before you receive your first Part B reimbursement.

How to contact Part B buy back?

If you’re interested, call us at 800-691-1832. Let us know that you’re interested in Part B buy back plans, and we’ll do all we can to help!

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium will be $148.50. Your premium may be a bit higher if you have a higher income. . The reason you have to keep paying this premium is because Medicare Part B is a paid program, unlike Medicare Part A which you earned during your working years by paying social security taxes.

Does Medicare Advantage have a low premium?

They can vary greatly in coverage amounts and premium prices. Some Medicare Advantage plans can come with a $0 premium or a low premium in addition to a Part B buy back (or give back, as some plans call it). If you pay your Part B premium automatically out of your Social Security check, this could feel like a bonus added to your monthly checks!

Do you have to pay for Medicare Part B?

By default, everyone has to pay for Medicare Part B unless they get some kind of financial assistance. While Medicare Part B is a part of original Medicare, Medicare Advantage plans are privately owned and offer additional benefits beyond original Medicare. In particular, Part B buy back is an additional benefit offered by some plans.

Is there a catch with Medicare Advantage?

What’s the Catch? You’re probably skeptical about the idea of an insurance company wanting to give YOU money. However, there’s not really a catch. According to Quality Health Plans of New York, Medicare Advantage plans “may choose to use some of the funding it receives” to “reduce its members Medicare Part B premium.”.

Can Medicare put money back into Social Security?

Can they really put money back into your social security check? Yes, it’s offered through some Medicare Advantage plans. Here is how it works. Some Medicare Advantage plans out there that can “buy back” your Part B premiums, ultimately putting money back into your pocket (just like it says on the TV commercials we all see).

What is the Medicare Part B giveback?

If you choose to enroll in a Medicare Advantage plan, you pay the premium for Part B plus the premium for the Advantage plan. Well over half of all Advantage plans have $0 premiums, which means their enrollees just pay the Part B premium.

How does a Part B giveback rebate work?

The specifics of the giveback rebate rules are outlined in federal regulations that have been applicable since Medicare+Choice plans were rebranded as Medicare Advantage. Medicare Advantage plans receive payments from the federal government (which cost the government more per-person than it spends on Original Medicare).

How large are the Part B givebacks?

For plans that take this option, the Part B premium reduction can be as little as 10 cents, or as much as the full Part B premium. The Part B premium reduction has to be provided uniformly to a plan’s enrollees, so everyone in the plan gets the same Part B premium reduction.

How do you receive the Part B giveback?

For most Medicare beneficiaries, the cost of Part B is deducted from their Social Security checks. Beneficiaries who don’t receive Social Security retirement benefits are invoiced directly for their Part B premiums.

Where is the Part B giveback offered?

The commercials for Medicare Advantage giveback rebates are aired nationwide, but plans that offer this benefit are not available in all areas. And even if you’re in an area where this benefit is offered by at least one Advantage plan, it’s likely that the majority of the available plans will not offer it.

How can I find Medicare Advantage plans with a Part B giveback

When you’re comparing plans on the Medicare Plan Finder tool, you can click on “plan details” to see more information about each plan. An overview page will appear, and the section at the top is all about premiums.

What factors – other than premium – should I consider when choosing a Medicare Advantage plan?

The total monthly premium is just one aspect of your coverage, and there are numerous other features that you’re going to want to take into consideration when you’re making a plan selection. For example:

What is Medicare Part B premium giveback?

As we mentioned, the Medicare Part B Premium Giveback is a program in place to help you receive some money back on your Part B premium. The program is for Medicare Part C plans, also called Medicare Advantage plans, which are offered by private insurance companies but still approved and regulated by the Centers for Medicare & Medicaid Services ...

How much is Medicare giveback?

In some cases, the giveback may be as low as $10, while in others it may be the entire premium. Generally, it falls somewhere between $20 and $100. You will occasionally see above $100.

How much is Social Security giveback 2021?

Let’s say your monthly Social Security benefit is $1,543 (roughly the expected average for 2021) and your giveback is $80. Once the giveback kicks in, your check would begin to be $1,623, since that $80 would be added in.

How much is Medicare Part B 2021?

In 2021, the standard monthly Part B premium cost is $148.50. Most people have this premium taken directly out of their Social Security check each month. The carrier that offers ...

How long does it take for Social Security to kick in?

It can take a few months for the benefit to kick in once you’ve enrolled in a plan with the giveback, but this will be credited to you. If it takes two months for the benefit to begin, you’ll receive two months of giveback on your first Social Security check with the benefit.

Does Medicare Advantage give back premiums?

So, not only can some Medicare Advantage plans help you afford your health care, they can also reduce the monthly premium that covers the care, too. This makes the Medicare Part B Premium Giveback yet another way that Medicare can help make your health care available and affordable! Just like you, your health is one of a kind.

Does Medicare Advantage take out Social Security?

Most people have this premium taken directly out of their Social Security check each month. The carrier that offers the Medicare Advantage plan has notified CM S and the SSA that they’ll be covering all or a portion of the Part B premium.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.