What is better than Medicare Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers. Find out who to call about Medicare options, claims and more. Talk to Someone

How much will you pay for Medicare Part B?

Sep 08, 2021 · What is the Penalty for Not Taking Medicare Part B? The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you were eligible to enroll but didn’t. The penalty is based on the standard Part B premium, regardless of the premium amount you actually pay. Here Are some examples of how the penalty works:

How do you calculate Medicare penalty?

Your monthly premium would be 70% higher for as long as you have Medicare (7 years x 10%). Since the base Part B premium in 2022 is $170.10, your monthly premium with the penalty will be $289.17 ($170.10 x 0.7 + $170.10). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then …

How much is the premium for Medicare Part B?

May 17, 2020 · This results in a 20% penalty, to reflect 10% for each 12-month cycle. The result is a monthly premium 20% higher than you would have paid had you signed up during initial enrollment. If you would have paid the standard Part B premium of $144.60 per month, the premium with the penalty included amounts to $173.52.

Is there a cap on Medicare Part B penalty?

Is There a Cap on the Medicare Part B Penalty? As of now, there is no cap on the Part B late enrollment penalty. However, if passed, the Medicare Part B Fairness Act or H.R. 1788 would cap the penalty amount at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

How is the Part B penalty calculated?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn't. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

What is the Medicare penalty payment?

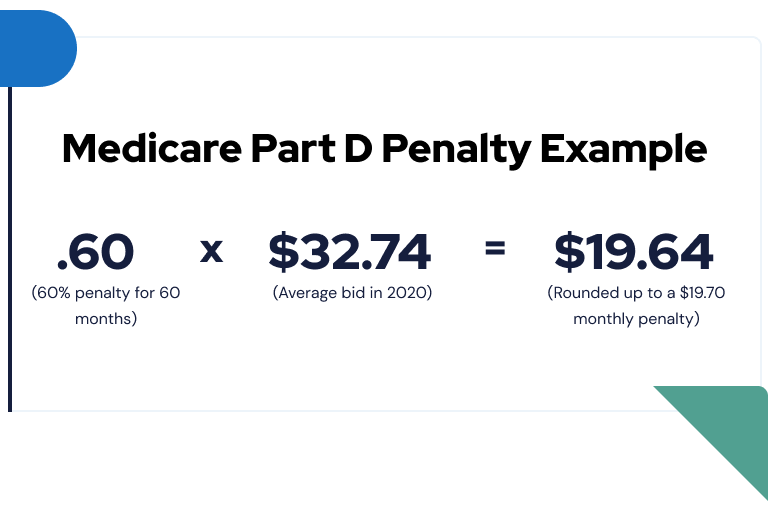

The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Why is there a late enrollment penalty for Medicare?

Part A late enrollment penalty However, you have to pay a monthly premium. If you're not automatically enrolled and don't sign up for Medicare Part A during your initial enrollment period, you'll incur a late enrollment penalty when you do sign up.

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

How long is a member responsible for a late enrollment penalty?

For most people, you have to pay the LEP as long as you are enrolled in the Medicare prescription drug benefit. There are some exceptions: If you receive Extra Help, your penalty will be permanently erased. If you are under 65 and have Medicare, your LEP will end when you turn 65.

How do I defer Medicare Part B?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How do I appeal a Medicare Part B premium?

First, you must request a reconsideration of the initial determination from the Social Security Administration. A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772. 1213) as well as by writing to SSA.

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the late enrollment penalty for Medicare Part B?

This can be when you turn 65, or under the age of 65 if you’ve been receiving disability payments from Social Security or the Railroad Retirement Board for 24 months.

What happens if you sign up for Part B?

If you sign up for Part B after the initial enrollment period and you’re not eligible for a Special Enrollment Period, you may be subject to a late enrollment penalty. The penalty may be imposed for the duration of Part B coverage. The amount may be as much as 10% more than the monthly premium you would normally pay, ...

How much is the 2020 Part B premium?

Part B, on the other hand, will require you to pay a monthly premium. The 2020 Part B premium begins at $144.60 per month and may increase based on an individual’s modified adjusted gross income and tax filing status. Types of enrollment periods. Enrollment periods fall into three categories:

What age do you have to be to enroll in Medicare?

Sign-up requirements. Anyone approaching age 65 who is not collecting Social Security or Railroad Retirement Board benefits must enroll in Parts A and/or B when they are first eligible for Medicare or risk incurring Part B late enrollment fees. For some Medicare recipients, a Special Enrollment Period may apply.

What Is Medicare Part B?

Medicare Part A provides coverage for inpatient care that you receive in a hospital or skilled nursing facility (SNF).

When Can You Sign Up for Medicare Part B?

In most cases, Medicare eligibility begins when you turn 65. Around 15 percent of Medicare beneficiaries qualified before turning 65 due to one of the following:

Who Is Automatically Enrolled in Medicare?

Medicare enrollment no longer occurs automatically when you turn 65 UNLESS you began collecting Railroad Retirement Board (RRB) or Social Security retirement benefits at least 4 months before your 65th birthday. Everyone else must choose to sign up for Medicare. You do this through the Social Security Administration (SSA) here.

How Much Is the Medicare Part B Late Enrollment Penalty?

The Medicare Part B late enrollment penalty is levied against Medicare beneficiaries who delayed Part B enrollment for at least 12 months AND who do not qualify for an SEP. It is calculated as a percentage of the Part B monthly premium.

A Quick Note About Medicare Part A

The vast majority of Medicare beneficiaries don't pay a monthly premium for Medicare Part A. That's because they or their spouse worked and paid Medicare taxes for the required 10 years/40 quarters to qualify for premium-free Part A.

When Is it Okay to Delay Medicare Part B Enrollment?

First, if you have coverage through a group health plan, it is always a good idea to talk to the benefits administrator at your employer or union to see how your current coverage works with Medicare. The following guidelines are provided by CMS, but your employer plan may have unique requirements.

What Happens If You Don't Qualify for a Special Enrollment Period?

If you don't sign up for Medicare during your Initial Enrollment Period AND do not qualify for a Special Enrollment Period, you have to wait until General Enrollment.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.