What is covered by Medicare Part D?

QUINCY (WGEM) - For those of you with a Medicare D plan, a list of vaccines is now covered for you in Adams County. Starting on Monday, the Adams County Health Department will begin offering vaccines for Shingles, Tetanus, Hepatitis A and B, and more.

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

Can Medicare Part D be deducted from Social Security?

recognize that they can offer that only because the government pays them a fixed amount for your care from the Medicare Part B premium taken from your Social Security. The Part B premium you are paying from your Social Security benefit is why your Medicare ...

What is Medicare Plan D deductible?

What is the Medicare Part D coverage gap (“donut hole”)?

- Brand-name drugs. Once you hit the coverage gap, you will owe no more than 25 percent of the cost of the brand-name prescription drugs covered by your plan.

- Generic drugs. Once you hit the coverage gap, you will owe 25 percent of the cost of the generic drugs covered by your plan.

- Catastrophic coverage. ...

What is the deductible for Part D?

How much does Medicare pay for prescriptions in 2020?

What factors determine how much the monthly premium will be?

What is a Part D plan?

How long does Medicare have to enroll in a Part D plan?

What is the IRMAA for 2020?

Does Medicare limit copayments?

See more

What is my Medicare Part D deductible?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is the 2021 Medicare Part D deductible?

Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the Part D deductible for 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

What is the average deductible for Part D?

Among the 16 national PDPs, average monthly premiums are increasing for 12 PDPs, including 5 PDPs with increases exceeding $10. Most Part D PDP enrollees who remain in the same plan in 2022 will be in a plan with the standard (maximum) $480 deductible.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the cost of Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do all Medicare Part D plans have the same deductible?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022.

What is the average cost of Part D Medicare?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Average Cost of Medicare Part D | 2022 Medicare Prescription Drug Plans

Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2022 is $47.59 per month. 1 Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

Monthly premium for drug plans | Medicare

Note You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You’re required to pay the Part D IRMAA, even if your employer or a third party (like a teacher’s union or a retirement system) pays for your Part D plan premiums.

2020 Medicare IRMAA: Part B and Part D Premium Brackets

For updated information about 2021 Medicare IRMAA costs for Part B and Part D, read our updated What Is IRMAA? 2021 guide. The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums.. This IRMAA surcharge is in addition to the standard Part B premium and any premium associated ...

CMS Releases 2022 Premiums and Cost-Sharing Information for Medicare ...

The Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles and other key information for Medicare Advantage and Part D prescription drug plans in advance of the annual Medicare Open Enrollment to help Medicare enrollees decide on coverage that fits their needs.

How much is the maximum deductible for 2020?

Deductibles vary between plans, but CMS sets a maximum deductible each year ($435 in 2020). 7 That means you might have a lower deductible or even no deductible, but you won’t have one higher than the maximum CMS sets.

What happens when you meet your Part D deductible?

Once you meet your Part D deductible, you begin the Initial Coverage Phase of your plan, during which you'll pay coinsurance or copayment for prescriptions.

What is Part D insurance?

Part D prescription drug coverage helps millions of Original Medicare beneficiaries pay for their medication costs. Those benefits, however, come at a price.

What is Medicare premium based on?

The Medicare portion based on your income. The insurer’s portion, which varies from plan to plan. The Medicare portion of your premium depends on your Modified Adjusted Gross Income (MAGI) from your most recent tax return.

Why is Medicare late enrollment penalty?

Late enrollment penalties encourage more people to sign up and help fund benefits for those who sign up late.

How much does the federal government pay for generic drugs?

With some Part D plans, you may pay even less. Of the remaining 75% (if it's a brand-name drug), the drug manufacturer pays 70% of the cost, and the federal government pays the remaining 5%. If it's generic, the government covers the remaining 75%.

When does the coverage gap start?

The coverage gap, or “donut hole,” phase begins once you reach your Initial Coverage Limit.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is the maximum deductible for Medicare Part D 2021?

In 2021, the maximum deductible for Medicare Plan D is $445. Medicare Part D helps pay for brand name and generic drugs that have been prescribed by a doctor. A person must have original Medicare, parts A and B, to be eligible for a PDP. Private insurance companies approved by Medicare administer Part D plans, and they must provide ...

How much is a deductible for Medicare 2021?

Some Medicare plans, such as Medicare Part D, are administered by private insurance companies. In 2021, private insurance companies may not charge more than $445 for the Part D deductible. In this article, we discuss what is covered by Medicare Part D, ...

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How often does a deductible change?

The deductible can change every year, but many policies have lower deductible options. However, plans with low deductibles often have higher monthly premiums.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is deductible insurance?

Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments.

How much income do you need to file for Medicare?

Medicare may use an Income-Related Monthly Adjustment Amount (IRMAA) to decide the premium cost relative to a person’s income. An individual must earn above $88,000 filing individually, or above $176,000 filing jointly before paying an IRMAA charge.

What is the maximum deductible for Medicare Part D 2021?

When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

How much is the deductible for Part D in 2021?

The highest deductible amount that any Part D plan can charge in 2021 is $445.

What is Medicare Part D copayment?

The Medicare Part D copayment and coinsurance amounts are the costs you pay after your Part D deductible has been met. Depending on the plan you choose, you will either owe copayments or coinsurance fees.

How much is the coinsurance for 2021?

After that, you’ll only be responsible for a minimal copayment or coinsurance. In 2021, the coinsurance amount is 5 percent and the copayment amount is $3.70 for generic drugs and $9.20 for brand-name drugs.

What is a prescription drug plan?

Prescription drug plan formularies cover both brand-name and generic drugs from the commonly prescribed drug categories. Before you enroll in a Part D plan, check that your medications are covered under the plan’s formulary. When you enroll in Part D, there are plan fees in addition to your original Medicare costs.

What is the Medicare Part D limit for 2021?

Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

What is a donut hole in Medicare?

Most Medicare Part D plans have a coverage gap , also called a “ donut hole .”. This coverage gap happens when you’ve reached the limit of what your Part D plan will pay for your prescription drugs. This limit is lower than your catastrophic coverage amount, however, which means that you will have a gap in your coverage.

What is the Medicare premium for 2020?

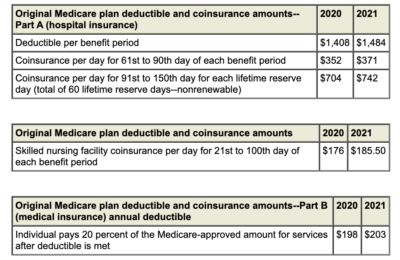

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much does Medicare cost in 2020?

Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $252 in 2020, a $12 increase from 2019. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $458 a month in 2020, a $21 increase from 2019.

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

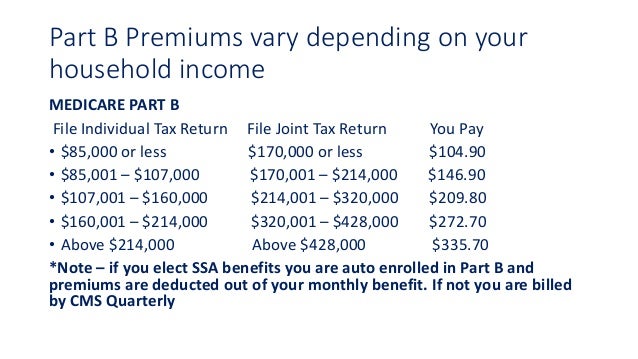

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Why is the Part B premium going up?

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one, President Trump has made it a top priority to lower drug prices.

How often do Medicare Part D deductibles change?

You probably already know that the deductibles for your drug plan change every year. Below is a list of Medicare Part D deductible amounts from 2015 through 2021. The insurance company can have a deductible less than the amount listed, but it cannot be more.

How much is the 2018 Part D deduction?

2018 the Part D Deductible saw a $5 increase to $405

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

What is the IRMAA for 2020?

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan; this is called the Part D income-related monthly adjust amount (IRMAA). For 2020, this amount is based on the recipient’s tax filing status for 2018.

Does Medicare limit copayments?

Medicare does not limit the amount plans can require for copayments and coinsurance amounts. Medicare also does not standardize how drugs are categorized into different tiers, which impacts how much the copayment or coinsurance amount for that medication may be in each tier.