What is covered by Medicare Part D?

Dec 14, 2021 · Some Part D plans have $0 deductibles, but average Part D deductibles hover around $367 per year in 2022. Medicare Supplement Deductibles by Plan There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option.

What is the cheapest Medicare Part D plan?

Nov 12, 2021 · The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Can Medicare Part D be deducted from Social Security?

Medicare Part D Defined Standard Benefit for 2022. MEDICARE PART D DEFINED STANDARD BENEFIT FOR CY2022. Beneficiary Plans Manufacturers Medicare. Initial Catastrophic Deductible Coverage Limit Coverage Gap Phase. $480 $4,430 $10,690*. 75% Plans.

What is Medicare Plan D deductible?

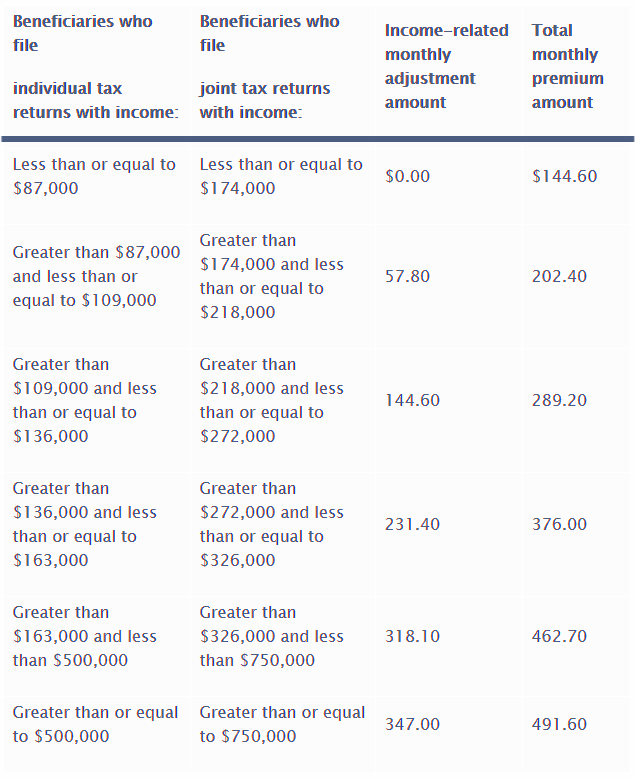

2022 Part D national base beneficiary premium— $33.37. This amount is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above. The national base beneficiary premium amount can change each year. If you pay a late enrollment penalty, these amounts may be higher.

What is the cost of Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is the 2022 Part D initial coverage limit?

$4,430CMS has released the following 2022 parameters for the defined standard Medicare Part D prescription drug benefit: Deductible: $480 (up from $445 in 2021); Initial coverage limit: $4,430 (up from $4,130 in 2021); Out-of-pocket threshold: $7,050 (up from $6,550 in 2021);Jan 28, 2021

What is the Part D donut hole for 2022?

For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.Oct 30, 2021

What is the Social Security deductible for 2022?

The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Will Medicare Part D go up in 2022?

The Medicare Part D total out-of-pocket threshold will bump up to $7,050 in 2022, a $500 increase from the previous year. The true (or total) out-of-pocket (TrOOP) marks the point at which Medicare Part D Catastrophic Coverage begins.

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

What is the maximum out-of-pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

Is the donut hole going away in 2022?

Q: Are there changes in the Medicare Part D prescription drug coverage for 2022? A: Yes. The maximum deductible will be slightly higher, and the upper and lower thresholds for the “donut hole” will change again.

What is the Medicare Part D deductible for 2021?

If you are on Medicare, you probably familiar with the Medicare Prescription Drug plan.

This plan has a Medicare Part D Deductible

It changes every year. Also, if you don't sign up for this “optional” plan, you could wind up with significant penalties later on.

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

Does Medicare cover prescription drugs?

Keep in mind, Medicare prescription drug policies and Medicare Advantage drug plans vary in terms of the particular medications they cover as well as the costs the beneficiary pays. This is despite the prescription drugs being the same.

What is Medicare Part D?

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area.

What is the maximum deductible for 2020?

The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

When do you enter the coverage gap?

In 2020, you enter the coverage gap once you and your insurance company spend ...

Does Medicare Supplement Insurance cover Part D?

Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage. Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan.

Does Medicare cover prescription drugs?

Medicare Part D coverage for prescription drugs is technically optional , but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.