Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What you should know about Medicare Part D?

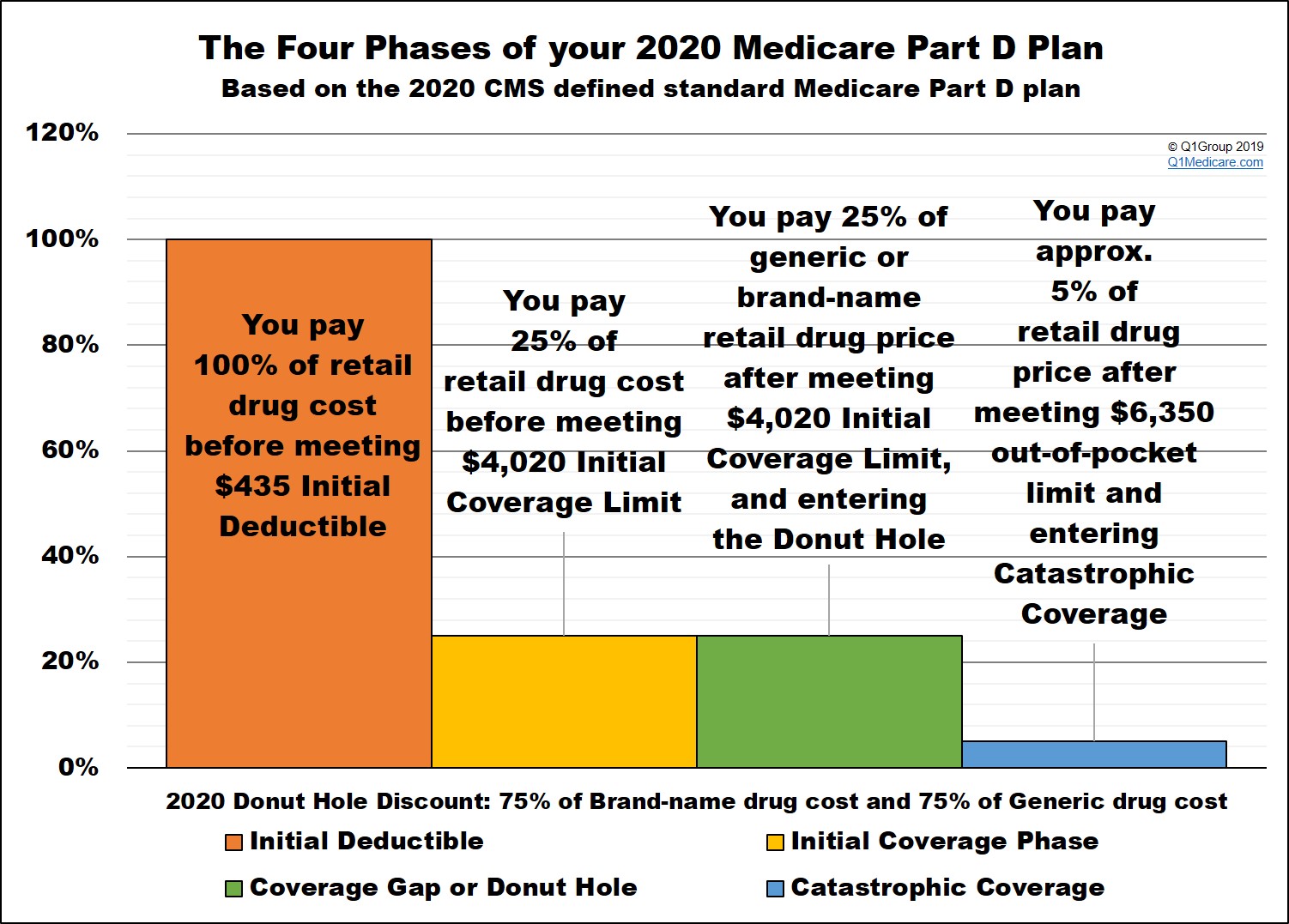

Feb 12, 2020 · The donut hole is a stage in Part D’s coverage plan that can temporarily limit what medications the plan will and won’t cover. When you reach this stage, you might find yourself paying more for the covered prescriptions than you had to pay earlier. Every year, you’ll enter this donut hole at a different dollar amount.

What are the rules of Medicare Part D?

Feb 10, 2022 · The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

What is the exact Medicare Part D Donut Hole amount?

The idea behind the “donut hole,” or the time when you enter a total coverage gap in your Part D drug plan, is that you’ll be incentivized to look for cheaper drugs. Medicare thinks that by introducing this coverage gap, seniors will look for cheaper, …

How to understand Medicare Part D?

The Medicare “donut hole” refers to the coverage gap in Plan D prescription coverage. You will enter it after you have reached an initial coverage limit. In 2022, you will be required to pay 25% out-of-pocket from the time you fall into the donut hole until you meet the out-of-pocket threshold.

How does the donut hole work in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

How does a Medicare recipient get out of the donut hole?

You'll get out of the gap when your costs for prescriptions during the gap period reach $7,050. You're fully responsible for reaching this amount, but your drugs are also discounted while in the donut hole. Once you reach the limit, catastrophic drug coverage kicks in automatically.Feb 14, 2022

What happens when you reach the donut hole?

You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year. Once you fall into the donut hole, you'll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit.

How long do you stay in the donut hole with Medicare?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will the donut hole go away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Has the donut hole been eliminated?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

Does Medigap cover the donut hole?

There is not a Medicare plan that covers the donut hole. You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare.Dec 2, 2021

Is there insurance to cover the donut hole?

There is no Donut Hole Insurance but there are ways to reduce your overall Part D spending. Insurance to cover the Donut Hole in Medicare Part D does not exist. There is no Donut Hole insurance policy that you can buy just to cover the higher expenses during the coverage gap.Aug 8, 2014

Are there any ways to avoid the Medicare Part D donut hole?

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Purchase your brand name drugs at another pharmacy and pay the insurance copay. This strategy will reduce your out-of-pocket costs in Stage 2, and often keep you from falling in the Stage 3 donut hole.

What is the donut hole amount for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What is the donut hole gap in coverage for prescription drugs?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

How much do you pay for a drug deductible?

You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your drugs reaches $2,800.

What is Medicare for people over 65?

If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have the option of paying a monthly premium for outpatient prescription drug coverage.

Does Medicare Part D cover prescriptions?

Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan. If you would like more information on the one-time rebate check, feel free to call 1-800-MEDICARE.

Does Medicare have a donut hole?

For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs. Needless to say, for most people with Medicare Part D, the donut hole presents serious financial challenges.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

How to calculate out of pocket expenses?

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: 1 Your prescription drug plan’s yearly deductible 2 The amount you pay for your prescription medications 3 The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

Do manufacturer discounts count towards catastrophic coverage?

Additionally, manufacturer discounts for brand-name drugs count towards reaching the spending limit that begins catastrophic coverage. If your plan requires you to get your prescription drugs from a participating pharmacy, make sure you do so, or else the costs may not apply towards getting out of the coverage gap.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.