What is Medicare Part D catastrophic coverage?

Medicare Part D Catastrophic Coverage is the fourth and final part of your Medicare Part D prescription drug plan coverage and is designed to help reduce the out-of-pocket spending for people with high drug costs. In short, once you spend over a certain amount of money each year, your formulary drug costs will be limited to no more than 5% of ...

What is Medicare Part D?

What tiers are called and what they include can differ between plans, but here’s an example:

- Tier 1: The most generic drugs with the lowest copayments

- Tier 2: Preferred brand-name drugs with medium copayments

- Tier 3: Non-preferred brand name drugs with higher copayments

- Specialty: Drugs that cost more than $670 per month, the highest copayments 4

What is Medicare Part D coverage gap?

The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part D prescription-drug program administered by the United States federal government.

What is the Medicare Part D Donut Hole?

What is the Donut Hole?

- Deductible Stage: A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. ...

- Initial Coverage Stage: Most members with a Part D prescription drug plan will start in the Initial Coverage stage. ...

- Coverage Gap Stage (the Donut Hole): Tufts Health Plan pays the remaining 75% of the cost. ...

What is the current Medicare Part D donut hole?

Donut Hole: Who Pays What in Part D Medicare beneficiaries will see a Part D deductible up to $480 in 2022, followed by an Initial Coverage Period in which they will be responsible for 25% of costs up until they reach the threshold of $4,130 spent on prescription medications.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Is the Medicare Part D donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Do all Medicare D plans have a donut hole?

Can I find Medicare Part D plans without the donut hole? No, all Medicare prescription drug plans include the donut hole. If you anticipate reaching the donut hole and have trouble with costs, you can apply for Extra Help with Medicare Part D.

Will there be a Medicare donut hole in 2022?

Q: Are there changes in the Medicare Part D prescription drug coverage for 2022? A: Yes. The maximum deductible will be slightly higher, and the upper and lower thresholds for the “donut hole” will change again.

What happens when the donut hole ends in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Does the donut hole reset each year?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.95 for generic drugs and $9.85 for brand-name drugs. You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

How do you get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

What is the maximum out-of-pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

Does SilverScript have a donut hole?

With SilverScript, you have access to more than 65,000 pharmacies, as well as many preferred pharmacies. The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

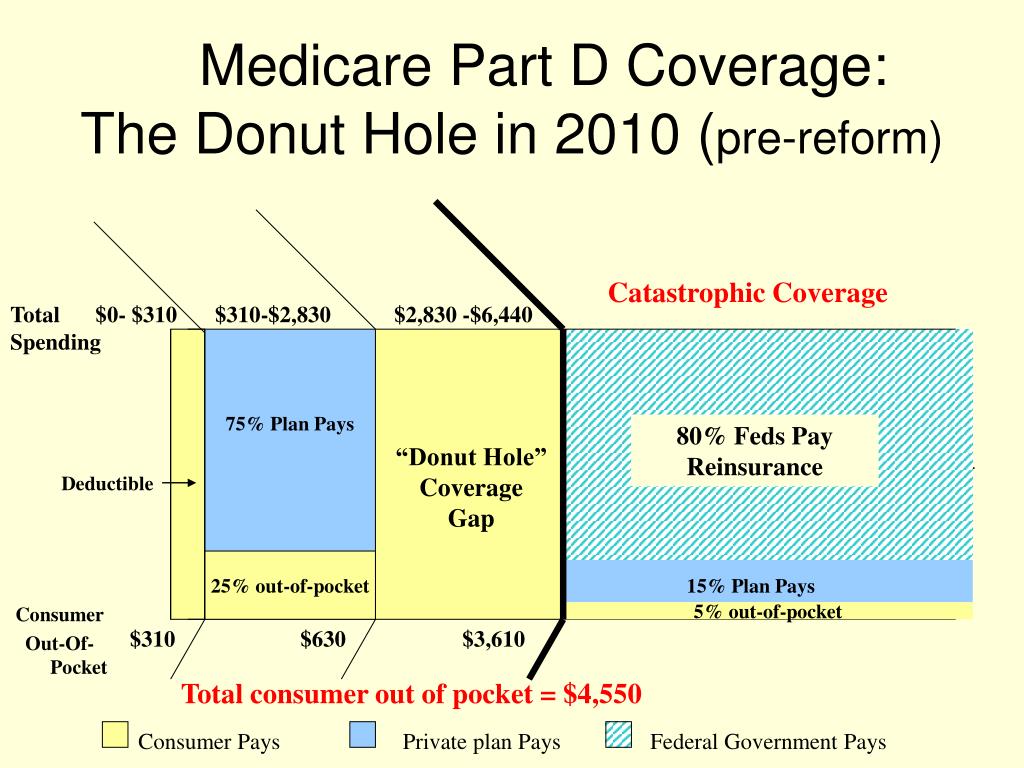

What happened before the ACA closed the donut hole?

Before the ACA closed the donut hole, it caused some seniors to pay significantly higher costs for their medications after they had reached a certain level of spending on drugs during the year. Those higher costs would continue until the person reached another threshold, after which the costs would decrease again.

How does the Donut Hole work?

Each year, the federal government sets a maximum deductible for Part D plans, and establishes the dollar amounts for the thresholds where the donut hole starts and ends.

How much does Mary pay for her prescriptions?

This is what her prescription medications will cost in the plan she has selected: Mary will pay a deductible of $435.

How much does Medicare pay for drugs?

If you're enrolled in a Medicare Part D plan, you now pay a maximum of 25% of the cost of your drugs once you meet your plan's deductible (if you have one). Some plans are designed with copays that amount to less than 25% of the cost of the medication, but after the deductible is met, Part D plans cannot impose cost-sharing that exceeds 25% ...

How much is deductible for Medicare?

Deductible: If you're enrolled in a Medicare prescription drug plan, you may have to pay up to the first $435 of your drug costs, depending on your plan. 5 This is known as the deductible. Some plans don't have a deductible, or have a smaller deductible, but no Part D plan can have a deductible in excess of this amount.

How much does Mary's medication cost in 2020?

Because the total cost of Mary's medications is only about $5,500 in 2020, she won't reach the catastrophic coverage level. Instead, she'll remain in the donut hole for the rest of the year, paying 25% of her drug costs.

What is catastrophic coverage?

This level, when you're only paying a very small portion of your drug costs, is known as catastrophic coverage (this term is specific to Medicare Part D, and isn't the same thing as catastrophic health insurance ). The expenses outlined above only include the cost of prescription medications.

What is the donut hole in Medicare Part D?

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

What percentage of Medicare Part D patients are covered by generic drugs?

After Part D began, about 60 to 70 percent of eligible people without prescription drug coverage enrolled. Both brand-name and generic drugs are covered in Medicare Part D plans. At least two drugs in commonly prescribed drug categories are included on the list of covered medications, which is called a formulary.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What percentage of medication is considered OOP?

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

Is the Donut hole going away?

The “donut hole” isn’t really going away, because Medicare Part D still has four payment stages. The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is the minimum copay for 2021?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: 5 percent of a drug’s cost or a small copay. The minimum copay for 2021 has increased a little from 2020: Generic drugs: minimum copay is $3.70, which is up from $3.60 in 2020.

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

How much money do you have to spend to get out of the donut hole?

This is the amount of OOP money that you have to spend before you exit the donut hole. For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole.

What to consider before choosing a Medicare plan?

Below are some things to consider before choosing a plan. Use the Medicare website to search for a plan that’s right for you. Compare a Medicare Part D with a Medicare Advantage (Part C) plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

Key Takeaways

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold.

Let's keep in touch

Subscribe to receive important updates from NCOA about programs, benefits, and services for people like you.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

When did Medicare Part D start?

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.