What is the IRS Part D irmma for 2020?

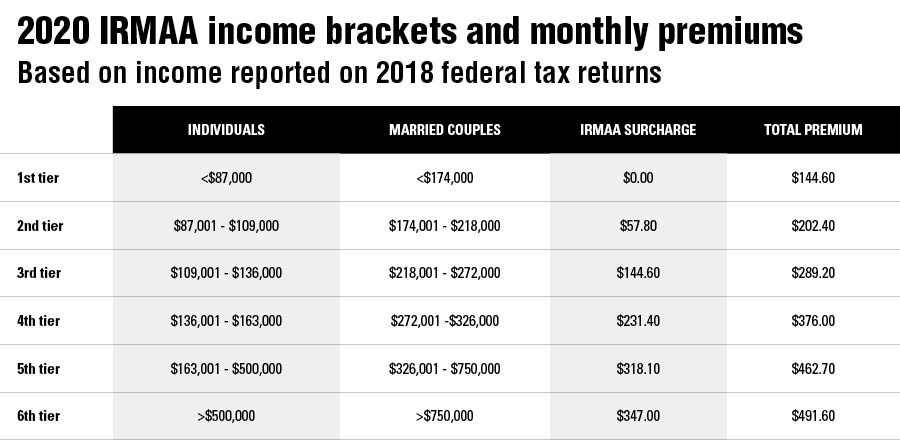

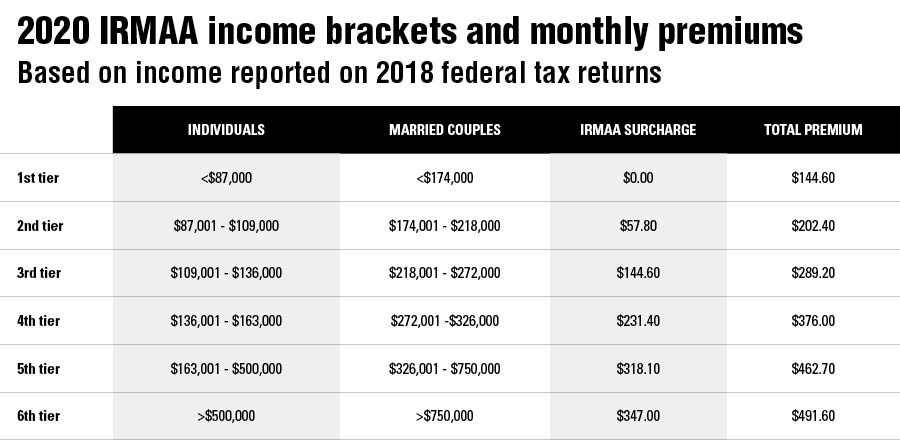

Apr 22, 2021 · The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums. This IRMAA surcharge is in addition to the standard Part B premium and any premium associated with their Part D plan . 2020 IRMAA amounts were based on a beneficiary’s …

Will irmaa costs impact your Medicare premiums in 2020?

Nov 13, 2021 · IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an …

What is the Medicare irmaa for Part B and Part D?

Nov 01, 2019 · As background, Medicare Part D IRMAA payments can change every year and are calculated using the annually-released standard base Medicare Part D premium. The 2020 standard base premium is $32.74, a decrease of $0.45 (-1.4%) or roughly 1.5% lower than the 2019 standard base premium.

What are the changes to Medicare Part D plans in 2020?

Changes to the Part D Coverage Gap in 2020. Part D plans are not required to impose an initial coverage limit, but for those that do, the max limit for 2020 is $4,020. Once the costs you and your Part D plan pay have reached this limit, you will pay a fixed 25% of Medicare’s costs for prescription medication until the catastrophic coverage threshold is reached.

What is the Part D Irmaa for 2020?

| IRMAA Table | 2020 |

|---|---|

| More than $326,000 but less than o $750,000 | $70.00 + Plan premium |

| More than or equal to $750,000 | $76.40 + Plan premium |

| Married filing separately | |

| More than $87,000 but less than $413,000 | $70.00 + Plan premium |

What are the Part D Irmaa brackets for 2021?

| Table 2. Part D – 2021 IRMAA | ||

|---|---|---|

| Individual | Joint | Monthly Premium |

| $91,000 or less | $182,000 or less | Your Premium |

| > $91,000 – $114,000 | > $182,000 – $228,000 | $12.40 + Plan Premium |

| > $114,000 – $142,000 | > $228,000 -$284,000 | $32.10 + Plan Premium |

What is the income limit for Part D Irmaa?

Is there an Irmaa for Medicare Part D?

WHAT IS THE MAGI for 2021?

What are the Part D Irmaa rates for 2022?

Does Social Security income count towards Irmaa?

Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

What is Medicare D Irmaa?

How do you pay Part D Irmaa?

...

How to pay your Part B and Part D IRMAA

- Online through your secure Medicare account.

- From your bank's online bill payment service.

- Signing up for Medicare Easy Pay.

- Mailing your payment to Medicare.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

What is modified adjusted gross income?

The Modified Adjusted Gross Income is different from your Adjusted Gross Income, because some people have additional income sources that have to be added to their AGI in order to determine their IRMAA-specific MAGI.

Do mutual funds distribute dividends?

At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What is the maximum deductible for Medicare?

The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit. In 2020, plans cannot set their deductible higher than $435.

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

What is IRMAA in Medicare?

One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

Higher-income people will pay slightly less in 2020 than in the previous two years. The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2020:

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.