Where can I find information about Medicare Part D drug coverage?

Official Medicare site. Learn about the types of costs you’ll pay in a Medicare drug plan. Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When does Medicare Part D coverage start?

The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enroll in a Part D drug plan in 2018, your coverage will start January 1, 2019.

How do I enroll in Medicare Part D drug plans?

If you want to get coverage for your medications, you can enroll in a Medicare Part D drug plan during the annual Medicare Part D Open Enrollment. If you already have Part D benefits, the open enrollment period is also a time when you can explore other plan options.

When should I sign up for Medicare Part A?

Generally, you’re first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

How long do I have to enroll in Medicare Part D?

7 monthsFor people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

Can you add Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What is initial enrollment for Part C and D How long should we wait after Medicare active?

Your first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

What is the window sign up for Medicare?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you sign up for Medicare, stop your Marketplace coverage so it ends when your Medicare coverage starts. See how to change from Marketplace to Medicare.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

Is there a cap on Medicare Part D Penalty?

The Part D penalty has no cap. For example: The national average premium is $33.37 a month in 2022. If you went 29 months without creditable coverage, your penalty would be $9.70.

What happens if you don't sign up for Medicare at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

When Does Medicare Part D Open Enrollment Start?

Medicare Part D Open Enrollment 2018 started October 15. This date began the fall Open Enrollment for Medicare, also known as the Annual Election P...

When Does Medicare Part D Open Enrollment End?

The 2018 AEP for Medicare Part D ends December 7. From the AEP start date (October 15), this gives you about eight weeks to enroll in Medicare Part...

Options For Ending Your Part D Benefits

The Medicare Part D Enrollment Period also allows you to opt out of Part D drug benefits. You can: 1. Drop your PDP or MAPD coverage completely. 2....

When Am I Eligible For Medicare Part D?

The first time you’re eligible for Part D benefits is during your Medicare Part D Initial Enrollment Period (IEP). Your IEP for Part D is the same...

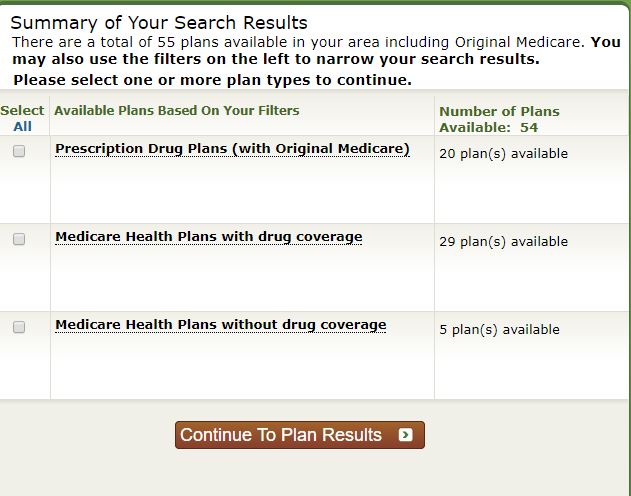

Requirements to Join A Medicare Part D Plan

To enroll in Part D during the fall Open Enrollment or other election period, you must live in a service area where plans are available. If you wan...

Switching to A Medicare Advantage Prescription Drug Plan (MAPD)

Whether you’re switching from Original Medicare or from a standalone drug plan to an MAPD, making the switch not only allows you to get drug benefi...

Switching from An Mapd to A PDP

If you’re currently enrolled in an MAPD and you switch to a standalone PDP during Medicare Part D Open Enrollment 2018, you will be disenrolled fro...

Get Help Choosing A Medicare Part D Plan

Because Medicare Part D plans are only available through private insurance companies, the cost, pharmacy network, and drug formulary can vary from...

How long does Medicare Part D last?

Your IEP lasts for seven months and:¹. Begins three months before , and ends three months after, you turn 65, or.

When is it important to review Medicare Part D?

It’s important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

What happens if you don't get Medicare Part D?

If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty (an extra amount added to your Part D premium) if:². You went more than 63 days past your IEP without having other credible drug coverage.

How long do you have to enroll in Medicare Part D?

From the AEP start date (October 15), you have about eight weeks to enroll in Medicare Part D coverage before the AEP deadline. The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2020, ...

When does Medicare open enrollment end?

Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board (RRB) disability benefits. If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment.

Do I have to have Medicare Part A or Part B to enroll in Medicare?

To be eligible for enrollment in a Part D Medicare plan during the fall Medicare Open Enrollment Period or other election period, you must live in an area where plans are available; if you want to join a standalone prescription drug plan (PDP), you must have Medicare Part A and/or Part B. However, if you want to get drug benefits ...

Can you switch from Medicare to MAPD?

Whether you’re switching from Original Medicare or from a standalone drug plan to an MAPD, making the switch not only allows you to get drug benefits but access to other health benefits such as dental, vision, hearing, and wellness coverage.

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How long does an open enrollment period last?

Typically a SEP lasts for 63 days.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

When do you get Medicare Part A and B?

If you’re already receiving Social Security or Railroad Retirement Board benefits and you’re a U.S. resident , the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. You’ll receive your Medicare card in the mail about three months before you turn 65, and your coverage will take effect the first of the month you turn 65.

How much will Medicare cost in 2021?

The standard Part B premium for 2021 is $148.50 per month. The increase in the Part B premiums was limited by the short-term government spending bill that was signed into law on October 1, 2020. The Part B premium for most enrollees was $144.60/month in 2020, and the spending bill capped the increase for 2021 at a quarter of what it would otherwise have been. Earlier in 2020, the Medicare Trustees Report had projected a Part B premiums of $153.30 per month for most enrollees in 2021. The actual price that people pay can also also be limited by the Social Security cost of living adjustment (COLA) that beneficiaries receive, but the 1.3% COLA for 2021 was adequate to allow the full standard Part B premium to be deducted from most beneficiaries’ Social Security checks.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

How much is Part A coinsurance for 2021?

2021 Part A coinsurance: $371 per inpatient day (days 61-90 in the benefit period for which the deductible applied; up from $352 per day in 2020) $742 per inpatient day for day 91 and beyond during the benefit period (up from $704 per day in 2020).

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.

What is Medicare Part D?

Part D is Medicare’s prescription drug benefit. Unlike Medicare Parts A and B that are run by the government, Medicare pays private companies to run Part D plans to cover medications.

What is the Part D late enrollment penalty?

When you’re about to turn 65, you have a 7-month Initial Enrollment Period around the time of your birthday to sign up for Medicare Parts A and B through Social Security. At that time, you’ll need to figure out how you will meet Medicare’s Part D drug coverage requirement.

How is the late enrollment penalty calculated?

The late enrollment penalty is based on two factors. The first is the number of months you went without proper drug coverage before enrolling in Part D. The second factor is the amount of Medicare’s current “national base beneficiary premium.”

How can I avoid the Medicare Part D late enrollment penalty?

There are three main ways to avoid the Medicare Part D late enrollment penalty. Here are your potential options.

The bottom line

To avoid the Medicare Part D late enrollment penalty, when you’re turning 65, you must decide promptly how you will get prescription drug coverage. If you have the correct level of coverage through your existing health plan, you can keep that plan without penalty.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?