What is a high deductible G Plan?

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is Plan G Aetna?

Jun 09, 2021 · In the year 2022, this amount is $233, once per year. Once this deductible is met, Medicare will pay 80% of your medical bills and Plan G will pay the remaining 20%. You’ll have no more medical bills for the rest of the calendar year.

What is a high deductible Medicare plan?

Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible. Prior to Medicare paying any doctor bills, someone is required to pay the Medicare Part B annual deductible. This deductible is $233 in 2022.

What is Medicare G Plan?

Dec 14, 2021 · Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other …

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the annual deductible for Plan G?

How much does Medicare Supplement Plan G cost?Atlanta, GASan Francisco, CAPlan G premium range$107– $2,768 per month$115–$960 per monthPlan G annual deductible$0$0Plan G (high-deductible) premium range$42–$710 per month$34–$157 per monthPlan G (high-deductible) annual deductible$2,370$2,370

Does Medicare Plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.Jan 24, 2022

What will 2022 Medicare deductible be?

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is the deductible for high deductible plan G?

$2,490The deductible for High Deductible Plan G is $2,490. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Alternatively, if you are more comfortable with higher monthly premiums and would rather not pay the higher deductible, standard Plan G would be the better choice for you.Mar 1, 2022

What is the monthly premium for Plan G?

The cost of Medicare Supplement Plan G varies depending on multiple factors, including where you live. However, the average cost of Medigap Plan G can range from $100-$300 per month. Medicare Supplement premium prices depend on ZIP Code, age, gender, and more.Feb 4, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

Medicare Plan G – Just One Small Deductible

With Plan G, you’ll pay a monthly premium for the plan and then only have one bill to pay each year. That bill is for the annual Part B deductible each year.

Medicare Plan G Companies

When it comes to Medicare supplement plans, each company offers identical coverage within each plan letter. This means a Plan G from one company, has exactly the same coverage as a Plan G from another.

Aetna Medicare Supplement Plan G

Aetna has been a leader in the Medigap insurance market for years, and 2022 will be no different. With highly competitive rates and a household discount, millions of people will be enrolling in Aetna Medicare Plan G this coming year.

Mutual of Omaha Medicare Plan G

With over 100 years in business, Mutual of Omaha once again will be one of the best companies for Medicare Plan G in 2022. They’ll have some of the lowest premiums in several states, as well as their typical household discount of up to 12%, often if you just live with someone even if they’re not applying.

Cigna Medicare Plan G for 2022

While it’s likely that Cigna won’t have the lowest premiums for 2022 in a large number of states, there will be areas where they are very competitive and worth looking at.

Accendo Medicare Plan G – 2022

Accendo came on the scene with a huge splash in 2020. Owned by CVS (just as Aetna is), Accedo offered people on Medicare yet another great option for Medigap insurance.

How to Enroll in Medicare Plan G in 2022

The easiest way to enroll in any Medigap Plan in 2022 is to just give us a call today at 1-888-891-0229.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

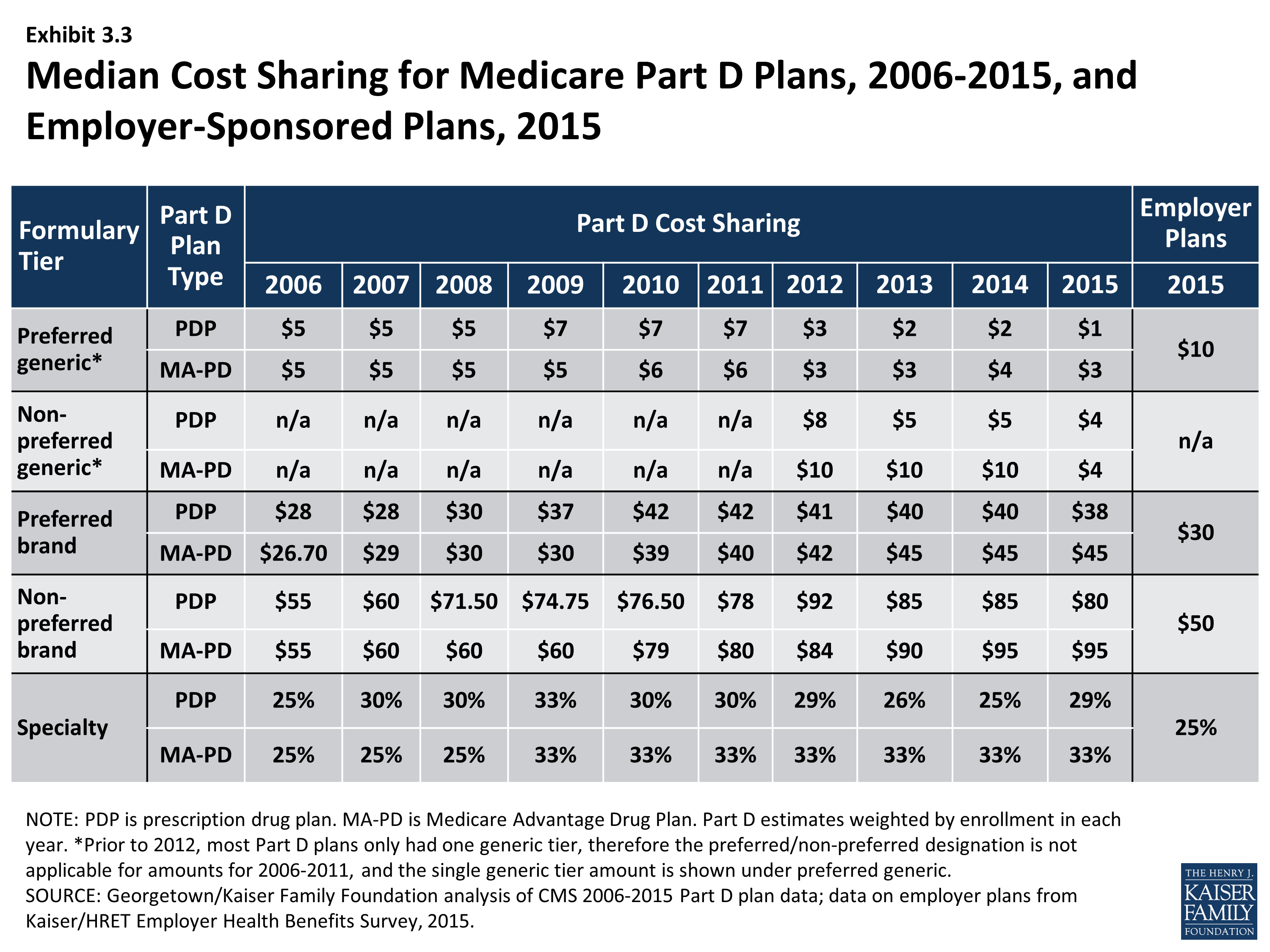

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.