What are the different prospective payment systems?

Medicare Prospective Payment Systems (PPS) A Summary Prospective payment systems are intended to motivate providers to deliver patient care effectively, efficiently and without over utilization of services.The concept has its roots in the 1960s with the birth of health maintenance organizations (HMOs).

What is an example of a prospective payment system?

The Medicare prospective payment system In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospita …

What does prospective payment system mean?

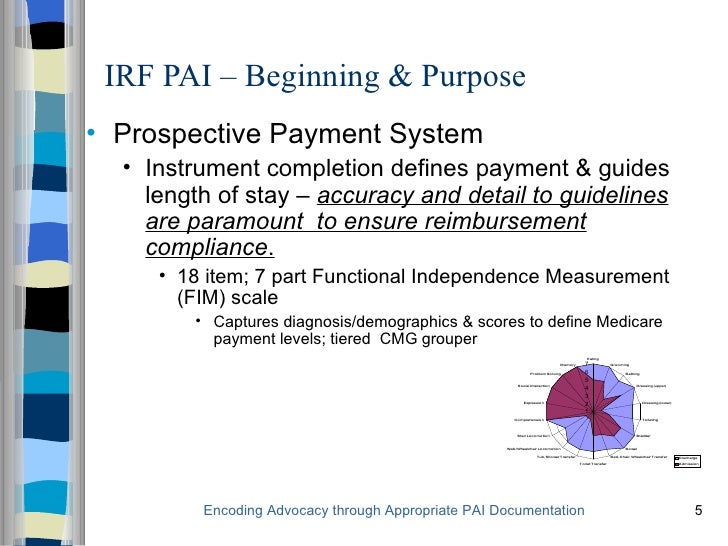

A Prospective Payment System (PPS) refers to several payment formulas when reimbursement depends on predetermined payment regardless of the intensity of services provided. Medicare bases payment on codes using the classification system for that service (such as diagnosis-related groups for hospital inpatient services and ambulatory payment classification for …

What is it the payment for the prospective payment system?

Implementation of the Medicare prospective payment system (PPS) for hospital payment has produced major changes in the hospital industry and in the way hospital services are used by physicians and their patients. The substantial published literature that examines these changes is reviewed in this article.

What is prospective payment system in Medicare?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).Dec 1, 2021

Why did Medicare move to a prospective payment system?

The idea was to encourage hospitals to lower their prices for expensive hospital care. In 2000, CMS changed the reimbursement system for outpatient care at Federally Qualified Health Centers (FQHCs) to include a prospective payment system for Medicaid and Medicare.

What is the purpose of prospective payment system?

PPS is intended to motivate healthcare providers to structure cost-effective, efficient patient care that avoids unnecessary services. The goal is to provide quality patient care that engages patients, and strives for faster diagnosis and treatment, shorter hospital stays, and lower costs.

When did Medicare switch to PPS?

1984The Medicare Case-Mix Index, which increased sharply with the implementation of PPS in fiscal year 1984, has continued to increase, at an annual rate of 3 percent for fiscal years 1984-86.

What are the disadvantages of a prospective payment system?

Prospective payment plans also come with drawbacks. Because providers only receive fixed rates, some might seek to employ cost-cutting measures to maximize profits while not necessarily keeping their patients' best interests in mind.Nov 25, 2016

Is prospective payment system good or bad?

An outpatient prospective payment system can make prepayment smoother and support a steady income that is less likely to be affected by times of uncertainty.Jul 22, 2020

What was the impact of the Medicare prospective payment system on healthcare and hospitals?

Under this system, hospitals were paid whatever they spent; there was little incentive to control costs, because higher costs brought about higher levels of reimbursement. Partly as a result of this system of incentives, hospital costs increased at a rate much higher than the overall rate of inflation.

What are the implications for the delivery of healthcare when providers are reimbursed on a prospective payment system?

What are the implications for the delivery of health care when providers are reimbursed based on a fee-for-service system? There are few incentives to save money or be efficient; more services mean more income.

What is the primary distinction between prospective payment and retrospective payment?

What is the primary distinction between prospective payment and retrospective payment? Prospective payment has the price set in advance. Retrospective payments have the billing completed after services.

What are the classification systems used with prospective payments?

The Ambulatory Patient Groups (APGs) are a patient classification system that was developed to be used as the basis of a prospective payment system (PPS) for the facility cost of outpatient care.

What's a prospective payment system for Medicare patients quizlet?

A method of determining reimbursement to health care providers based on predetermined factors, not on individual services. The Prospective Payment System established as mandated by the TEFRA of 1983 to provide reimbursement for acute hospital inpatient services.

What is retrospective payment?

Retrospective payment system means a system that sets payment rates for defined services according to historic costs. The payment rates reflect economic conditions experi- enced in the past.

When did Medicare become a prospective payment system?

The Medicare prospective payment system. In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospita …. ...

When did the Medicare program start?

The program will be phased in over a four-year period that began October 1, 1983. Several types of hospitals and distinct part units of general hospitals are excluded from the system until 1985, when Congress will receive a report on a method of paying them prospectively.

When did Medicare change?

In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospitals are paid a fixed sum per case according ...

When was the DRG rate published?

Information used to calculate the DRG rates was published September 1, 1983, as part of the interim final regulations. Other third party payers, such as state Medicaid systems and insurance companies, are considering converting to this method of payment, and several have adopted it.

How many days does Medicare cover?

Medicare allows 90 covered benefit days for an episode of care under the inpatient hospital benefit. Each patient has an additional 60 lifetime reserve days. The patient may use these lifetime reserve days to cover additional non-covered days of an episode of care exceeding 90 days. High Cost Outlier.

How long does Medicare cover inpatient hospital care?

The inpatient hospital benefit covers 90 days of care per episode of illness with an additional 60-day lifetime reserve.

When does home health care begin?

Home health care, when the patient gets clinically related care that begins within 3 days after a hospital stay. Rehabilitation distinct part units located in an acute care hospital or a CAH. Psychiatric distinct part units located in an acute care hospital or a CAH. Cancer hospitals.

What is a physician order?

The physician order meets 42 CFR Section 412.3 (b), which states: A qualified, licensed physician must order the patient’s admission and have admitting privileges at the hospital as permitted by state law. The physician is knowledgeable about the patient’s hospital course, medical plan of care, and current condition.

What is a prospective payment system?

Prospective Payment Systems (PPS) was established by the Centers for Medicare and Medicaid Services (CMS). PPS refers to a fixed healthcare payment system. This is based on the operating and capital-related costs of a medical diagnosis and determines reimbursement for care provided to Medicare and Medicaid participants.

What is PPS in Medicare?

Instead of a monthly payment amount for all services, like an HMO provides, PPS provides the healthcare facility with a single predetermined payment for each Medicare patient. This prepayment is based on the patient diagnosis and standardized assessments and covers a defined time such as an inpatient hospital stay, or a 60-day Home Health episode.

What is PPS in home health?

Home Health PPS classifications are based on Home Health Resource Groups (HHRG) determined by the Outcome and Assessment Information Set (OASIS). Medicare pays a predetermined base rate that is adjusted based on the patient’s health condition and service needs, which is considered the case-mix adjustment.

What was the primary motivation of Congress in enacting prospective payment for Medicare inpatient hospital services?

The principal motivation of Congress in enacting prospective payment for Medicare inpatient hospital services was to constrain the depletion of the Medicare Trust Funds, therefore, a primary indicator of the success or failure of PPS would be its effect on the volume and rate of growth in Medicare program expenditures.

What is the objective of Medicare?

The most important overall objective of the new Medicare prospective payment system is to stem the growth in hospital costs while continuing to ensure the access of beneficiaries to quality health care. To achieve this objective, the system is designed to pay a single flat rate per type of discharge, as determined by the classification of each case into a diagnosis-related group (DRG). These DRG's are used to classify patients into groups that are clinically coherent and homogeneous with respect to resource use. Such a classification scheme allows for equitable payment across hospitals in that comparable services can be comparably remunerated.

What is PPS in healthcare?

This article describes some of the available evidence on the impact of the Medicare prospective payment system (PPS) for hospitals during its first year, on hospitals, other payers for inpatient hospital services, other providers of health care, and Medicare beneficiaries. In addition, because the impetus for the enactment of the new system stemmed from concern over the financial status of the Medicare program, the first-year impact of PPS on Medicare program expenditures is also described.

When was PPS implemented?

Implementation of PPS began on October 1, 1983. Objectives.

What is a PPS?

Each hospital under PPS is required to have entered into an agreement with a utilization and quality control peer review organization (PRO). The function of the PRO program, which was established under the Peer Review Improvement Act of 1982 (Subtitle C of Public Law 97-248, the Tax Equity and Fiscal Responsibility Act of 1982), is to provide for the review of:

How many hospitals were under PPS in 1984?

By the end of September 1984, a total of 5,405 hospitals (81 percent of all Medicare-participating hospitals) were operating under PPS. This number represents virtually 100 percent of “PPS-eligible” hospitals (that is, short-stay acute care hospitals subject to the new payment system).

What percentage of hospital bills are covered by Medicare?

The Medicare program accounts for some 27 percent of all expenditures on hospital care in the United States, clearly establishing Medicare as the largest single consumer of hospital services ( Gibson, Waldo, and Levit, 1983 ). Given the dominant role played by Medicare, and the dramatic change in the way that Medicare pays for hospital services under PPS, it would not be unreasonable to expect that the entire hospital payment environment might be altered by the new system. Among those most likely to be directly affected by such a change are those who pay the bulk of the remaining portion of the Nation's hospital bill, the most prominent of these being the State Medicaid programs (on the public side) and the Blue Cross/Blue Shield plans (on the private side).

Overview

Section 10501 of the Patient Protection and Affordable Care Act of 2010 modified how payment is made for Medicare services furnished at Federally qualified health centers (FQHCs).

FQHC Center

For a one-stop resource web page focused on the informational needs and interests of Medicare Fee-for-Service (FFS) federally qualified health centers, go to FQHC Center.