The National Pay Rate= $24.89 Medicare Reimbursement= $22.26 And For a non-reporting hospital reduced rate (@0.981) the rate shall be

Full Answer

What do the CPT codes 86769 and 86328 mean?

2022 Workers' Compensation Part B Fee Schedule 84681-87400. View the PDF. CPT/HCPC Code Modifier Medicare Location Global Surgery Indicator Multiple Surgery Indicator Prevailing Charge Amount Fee Schedule Amount Site of Service Amount ; ... 86308 XXX: 9: X: 21.17: 21.95 ...

What is a Medicare reimbursement rate for CPT codes?

May 20, 2020 · On May 19, the federal agency updated guidance to include Medicare payment details for CPT codes 87635, 86769, and 86328, which can be used by healthcare providers and laboratories to bill payers for testing patients for SARS-CoV2. Medicare will pay $51.31, $42.13, and $45.23, respectively, for the codes.

Who develops the Medicare reimbursement rates?

Apr 07, 2022 · You can now check Medicare eligibility (PDF) for Cognitive Assessment & Care Plan Services (CPT 99483) data. If you need help, contact your eligibility service provider. To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable ...

What is an excess Medicare reimbursement charge?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

How do I find out my Medicare reimbursement rate?

How Much Does Medicare pay per RVU?

What is Medicare reimbursement fee schedule?

Is the 2021 Medicare fee schedule available?

How are Medicare RVUs calculated?

What is the RVU for 2021?

What percent of the allowable fee does Medicare pay the healthcare provider?

Do Medicare reimbursement rates vary by state?

Did Medicare reimbursement go up in 2022?

How Much Does Medicare pay for 99214 in 2021?

| 2021 Final Physician Fee Schedule (CMS-1734-F) | ||

|---|---|---|

| Payment Rates for Medicare Physician Services - Evaluation and Management | ||

| 99214 | Office/outpatient visit est | $110.43 |

| 99215 | Office/outpatient visit est | $148.33 |

| 99417 | Prolng off/op e/m ea 15 min | NEW CODE |

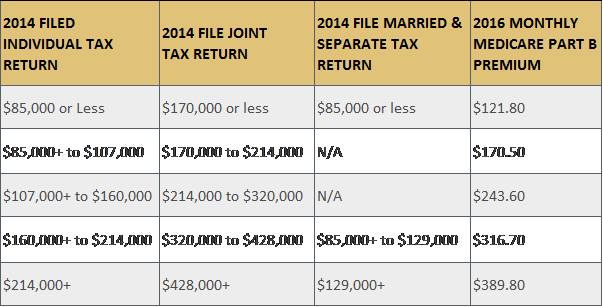

What is the Medicare premium for 2022?

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

What percentage of Medicare is reimbursed?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate.

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

Should Medicare beneficiaries review HCPCS codes?

It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

What is Medicare reimbursement rate?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare ...

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How many digits are in a CPT code?

CPT codes consist of 5 numeric digits, while HCPCS codes are an alphabetical number followed by 4 numeric digits.

What is the difference between CPT and HCPCS?

The CPT codes used to bill for medical services and items are part of a larger coding system called the Healthcare Common Procedure Coding System (HCPCS). CPT codes consist of 5 numeric digits, while HCPCS codes ...

What is CPT code 36415?

Physicians who satisfy the specimen collection fee criteria and choose to bill Medicare for the specimen collection must use Current Procedural Terminology (CPT) Code 36415, “Routine venipuncture – Collection of venous blood by venipuncture.

What is a vein phlebotomy?

Venipuncture or phlebotomy is the puncture of a vein with a needle to withdraw blood. Venipuncture is the most common method used to obtain blood samples for blood or serum lab procedures, and is sometimes referred to as a “blood draw.”.

What is venipuncture in medical terms?

Venipuncture is the process of withdrawing a sample of blood for the purpose of analysis or testing. There are several different methods for the collection of a blood sample. The most common method and site of venipuncture is the insertion of a needle into the cubital vein of the anterior forearm at the elbow fold.

What is venipuncture used for?

Venipuncture is the most common method used to obtain blood samples for blood or serum lab procedures. The work of obtaining the specimen sample is an essential part of performing the test. Reimbursement for the venipuncture is included in the reimbursement for the lab test procedure. code.

What is the most common method used to obtain blood samples for blood or serum lab procedures?

Venipuncture is the most common method used to obtain blood samples for blood or serum lab procedures. The work of obtaining the specimen sample is an essential part of performing the test. Reimbursement for the venipuncture is included in the reimbursement for the lab test procedure code.

What is a blood draw?

Venipuncture is the most common method used to obtain blood samples for blood or serum lab procedures, and is sometimes referred to as a “blood draw.”. Venipuncture is the process of withdrawing a sample of blood for the purpose of analysis or testing. There are several different methods for the collection of a blood sample.