Which is the best Medicare supplement?

Medicare Supplement Plan G is identical to Plan F except you pay the Part B deductible once per year on Plan G. It’s definitely one of the best Medicare supplement Plans. Whereas Plan F pays that amount for you (with the extra money you give them in the higher monthly premium for Plan F).

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

Which Medicare supplement plan should I Choose?

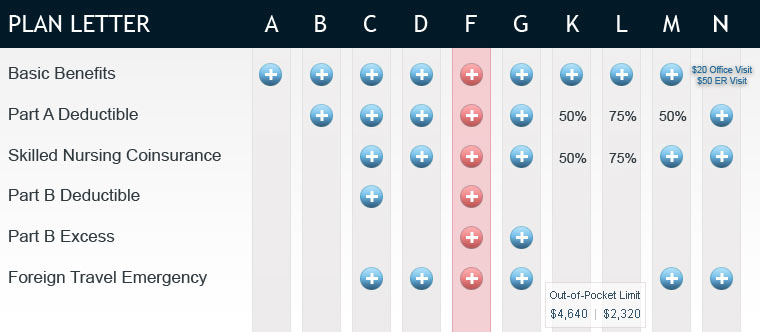

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

How to pick the best Medicare supplement plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Which Medicare Supplement plan is the most comprehensive?

Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Who is Aflac's largest competitor?

Aflac's top competitors include Old Mutual, Manulife, Prudential, MetLife, Allstate and Colonial Life.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

What is the difference between Part F and Part G Medicare Supplement?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the deductible for plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement Insurance plan is during your Medigap Open Enrollment Period. This six-month period begins as soon as you are 65 years old and enrolled in Medicare Part A and Part B.

How to compare Medigap plans?

One way to compare Medigap plans is to get in touch with a licensed insurance agent who can help you review the selection of plans available in your area. To get help finding the right plan for your needs, you can visit MedicareSupplement.com.

What is the spending limit for Medicare in 2021?

Two types of plans provide an annual out-of-pocket spending limit. Medigap Plan L ($3,110 in 2021) and Plan K ($6,220 in 2021) cover 100% of Original Medicare expenses for the rest of the calendar year once a beneficiary reaches these spending limits.

How much is Medicare Part A coinsurance in 2021?

Part A coinsurance and hospital costs. In 2021, Medicare Part A coinsurance is $371 per day for days 61-90 of an inpatient hospital stay, and $742 per day thereafter.

What are the benefits of Medigap?

5 important things to note about Medigap plans 1 The coverage provided by each type of Medicare Supplement Insurance plan is standardized, which means the benefits of each type of plan will be the same, no matter where the plan is sold. 2 Not every plan type is sold in all locations. People in some states may have access to more types of Medigap plans than people in other states. 3 The cost of plans can vary based on location, provider and coverage offered. Plans with more benefits typically cost more than plans with less coverage. 4 High-Deductible Medigap Plan F and high-deductible Medigap Plan G are two plan options beneficiaries can consider. These two plans require the plan holder to meet a $2,370 annual deductible in 2021 before the plan covers any benefits. 5 Two types of plans provide an annual out-of-pocket spending limit. Medigap Plan L ($3,110 in 2021) and Plan K ($6,220 in 2021) cover 100% of Original Medicare expenses for the rest of the calendar year once a beneficiary reaches these spending limits.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is the most popular Medigap plan?

The most popular Medigap plan is Plan F , which is the only plan to provide maximum coverage in each benefit area. Because Plan F is not available for new beneficiaries who became eligible for Medicare after January 1, 2020, Plan G will likely become the most popular Medigap plan for new Medicare beneficiaries.

What is Medicare Supplement Plan A?

Medicare Supplement Plan A: Medigap plan A is one of the lowest-cost plans with the least amount of coverage. Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days. Learn more about Medigap Plan A.

Why are Medicare plans G and N so popular?

Plans G and N are popular because they are also quite comprehensive but demand lower annual premiums. Both Plan G and Plan N still leave a little of the gap we talked about earlier, so there will be some out-of-pocket expenses involved if Medicare Part A or Part B do not cover all your medical costs.

What is a Medigap Plan F?

As discussed above, Medigap Plan F is popular because it leaves no gap – or, covers 100 percent of the costs – after the benefits from Medicare Parts A and B have reached their limit. For example, Medicare Plan F helps with Part B excess charges, hospital costs, Part B coinsurance, skilled nursing facility costs, nursing facility care, hospice care coinsurance and more. It also covers the Medicare Part B deductible, which sets it apart from the other most popular plans. Like Plans C, D, G, M, and N, Plan F covers some of the expenses incurred if you have a foreign travel emergency. Learn more about Medicare Plan F and the high-deductible version, high deductible Plan F; you may like that this plan covers more than any of the other plan on the comparison Medigap plan comparison chart.

How many Medigap plans are there?

There are 10 Medigap plans commonly offered in the United States, and it’s essential to check out a Medigap plan comparison chart to assess the various benefits and drawbacks of each plan.

Does Medicare Supplement Plan N require a deductible?

Medicare Supplement Plan N: Although Medicare Supplement Plan N offers lower premium rates than Plans G and F, it does require you to cover the Part B deductible, as well as your co-pays for your doctor and emergency room visits. Learn more about Medicare Plan N.

Is Medigap Plan G the same as Plan F?

Medigap plan G is a very comprehensive plan that covers almost all the same bases as Plan F, except any excess costs that arise after the Medicare Part B deductible. In other words, your deductible is covered, but anything above that you must pay out of pocket.

Does Medicare Supplement have a comparison chart?

Every year, Medicare releases a very helpful Medicare Supplement plan comparison chart that allows people shopping for Medigap insurance to quickly view the 10 plans side by side and compare their features, or lack thereof.

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

Which Medicare supplement plan requires copays?

When you are learning how to compare Medicare Supplement plans, just remember that Plan N is the one that requires copays from you for doctor and E.R. visits. That’s why the premiums are lower. People interested in the Medigap policies which offer the most affordable rates are usually interested in Plan N.

What is a Medigap Plan B?

Medigap Plan B. Medigap Plan B covers everything that Plan A covers but it also picks up the Medicare Part A hospital deductible. Plan B is a Medigap plan that pays after Medicare pays. Don’t confuse it with Part B, which is part of your Original Medicare benefits that pays for outpatient medical.

What is the difference between Plan F and Plan G?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. Plan G is only slightly different, so it is also a popular seller. When you compare Plans F and G side by side, you’ll immediately notice that Plan G has only one difference: the Part B deductible.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

Is Plan G available for Medicare?

Plan G has also gained popularity over Plan F since Plan F is no longer available to new Medicare enrollees. Because Plan C and Plan F cover the Part B deductible, they are no longer available to those who become eligible for Medicare in 2020 or later.

What is Medicare Part A?

Original Medicare is made up of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Medigap plans are specifically designed to cover the costs of original Medicare that normally fall to you. Some costs that Medigap plans often cover include: coinsurance. copayments.

What is a Medigap plan?

Medigap plans, sometimes also called Medicare supplement plans, are optional plans you can add to your Medicare coverage to help pay for some of the out-of-pocket costs of Medicare. The plans work alongside original Medicare. Original Medicare is made up of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

What is the difference between Plan B and Plan C?

Plan B. Plan B includes the same coverage as Plan A , as well as the Medicare Part A deductible. Plan C. Plan C covers the deductibles , copays , and coinsurance associated with Medicare parts A and B , as well as foreign travel emergency care.

How does Medigap evaluate your coverage?

Medigap companies evaluate your coverage application by looking at your health, gender, and age.

How many Medigap plans are there in 2020?

If you’re new to Medicare as of 2020, you actually have only 8 Medigap plan choices. Due to recent changes to Medicare regulations, Plan C and Plan F are no longer available to new Medicare enrollees. This change applies only if you became eligible for Medicare starting on January 1, 2020, or later.

How does Medigap evaluate your application?

Medigap companies evaluate your coverage application by looking at your health, gender, and age. You could be charged a higher rate or even denied coverage if your health has declined. However, if you purchase a Medigap plan during your initial enrollment, you’re guaranteed to get a plan at the company’s best rates.

Can you choose a Medigap plan?

Takeaway. Medigap plans can help you cover the out-of-pocket costs of Medicare. You can often choose from among 10 different Medigap plans. Medigap plans are standardized, which means they’re the same nationwide. Purchasing a Medigap plan when you first become eligible can save you money in the long run.