During the “free look period” you can generally have both your old and new Medicare Supplement insurance plans for a 30-day decision period. You will pay the premiums for both plans for one month so the “free” look is not free in terms of costs. It just gives you the opportunity to try out a new plan without canceling your old plan.

Full Answer

What is a Medicare supplement insurance plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits.

When is the best time to enroll in Medicare supplement insurance?

Medicare Supplement Open Enrollment Period. As I said earlier, timing your enrollment is important, it can affect your coverage options and expenses. The best time to purchase a Medicare Supplement insurance policy is when you’re in the Medigap Open Enrollment Period. This enrollment period is generally the best time to enroll in a Medigap policy.

What is the best Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How long does the Medicare supplement window last for?

This window lasts for six months and is a once-in-a-lifetime opportunity to enroll in any Medicare Supplement plan without the need to answer health questions and undergo the medical underwriting process. How long is Open Enrollment for Medicare Supplement policies?

How long does an insured have to examine a Medicare Supplement policy?

a 30 dayHow long do I have to decide whether or not I want to keep my Medicare supplement policy? A. You have a 30 day "free look" period from the date the policy is delivered to you.

How long is the free look period for a Medicare Supplement plan?

30 daysMedigap free-look period You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period." The 30-day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

What is the grace period on a Medicare Supplement?

A grace period is a specified number of days where a person can pay a premium beyond its due date and coverage will stay in force. Medicare Supplement policies require a grace period of at least 7 days and not more than 31 days, depending on the payment mode.

How long does it take for Medicare Supplement to go into effect?

Your Medicare Supplement Open Enrollment Period starts the first day of the month your Medicare Part B is in effect. For many beneficiaries, this is the first day of the month they turn 65.

What is a 30 day free look period?

The free look period is the first 10 to 30 days of your life insurance policy, when you can cancel your coverage without penalty and get a refund of premiums you've paid.

What provision allows a person to return a Medicare Supplement policy within 30 days for a full premium refund?

The free-look provision starts from the day the policy is delivered. A Medicare Supplement policy issued or delivered in Florida must contain a provision which allows the insured to return the policy or certificate within 30 days and receive a full refund.

Can you change your Medicare Supplement anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

What is the minimum number of days for the grace period?

During a grace period, you may not be charged interest on your balance — as long as you pay it off by the due date. Grace periods vary by card issuer, but must be a minimum of 21 days from the end of a billing cycle.

What does 90 day grace period mean?

A short period — usually 90 days — after your monthly health insurance payment is due. If you haven't made your payment, you may do so during the grace period and avoid losing your health coverage.

Can you change Medicare Supplement plans with pre-existing conditions?

You can change your Medicare Supplement plan at any time. However, if you're outside of your Medigap Open Enrollment Period or don't have guaranteed issue rights at the time, you'll have to answer underwriting questions and could face denial or increased monthly premiums due to pre-existing conditions.

Can Medicare Supplement plans deny for pre-existing conditions?

A Medicare Supplement insurance plan may not deny coverage because of a pre-existing condition. However, a Medicare Supplement plan may deny you coverage for being under 65. A health problem you had diagnosed or treated before enrolling in a Medicare Supplement plan is a pre-existing condition.

What enrollment periods will a client not have to go through underwriting when purchasing a supplement?

Each beneficiary has a Medigap Open Enrollment Period when turning 65 and first activate their Part B. After Medigap research, you'll learn the 6-month enrollment window allows you to apply for a supplement without underwriting.

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

When will Plan C be available?

Important: Plan C is not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is not included in Medigap Plan C?

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesn’t accept assignment — meaning they won’t accept the Medicare-approved amount as full payment for covered services.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

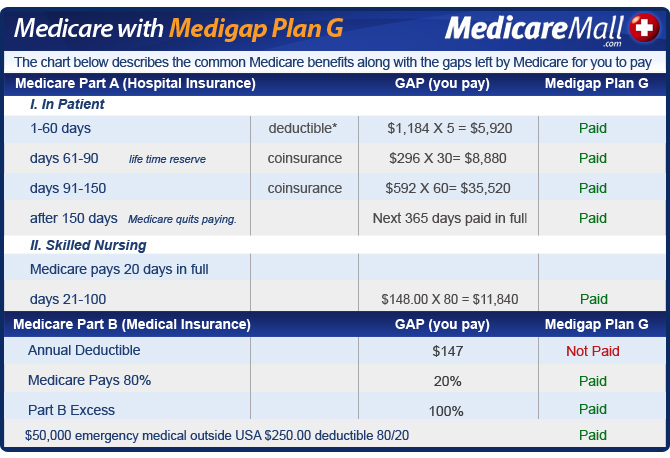

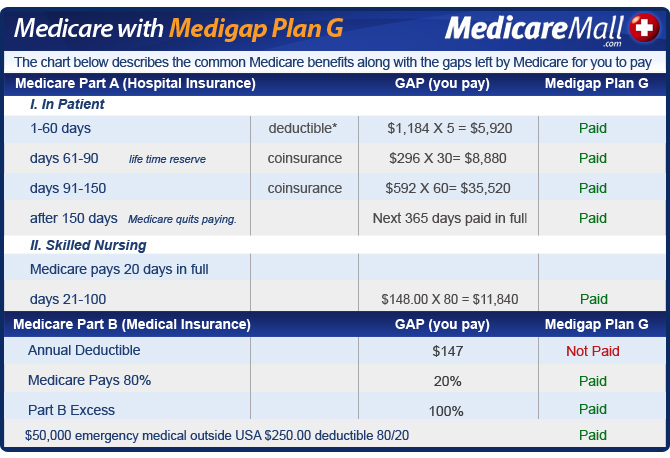

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement?

Medicare Supplement insurance plans are private insurance plans that are offered to help bridge the gap between the coverage you need and what is offered through Medicare. While Medicare pays for a large percentage of the healthcare services and supplies you may need, it does not offer complete coverage, so Medicare Supplement insurance plans can ...

How does Medicare Supplement insurance work?

A Medicare Supplement insurance plan will have a monthly premium cost that you pay to the private insurance company that you purchased the plan through. You’ll pay your monthly Medigap policy premium separately of any Medicare premiums. Costs can vary widely for Medicare Supplement plans because they are offered through private insurance companies, ...

What happens when you buy a Medicare Supplement?

When you purchase a Medicare Supplement insurance plan, your Medigap policy will serve as a secondary source of insurance. That means that Medicare will be used first to pay for any Medicare-approved costs for any healthcare supplies and services. After Medicare has been applied, then your Medigap policy will be charged.

Why is Medicare Supplement Insurance called Medigap?

Medicare Supplement insurance plans are often referred to as Medigap policies, because they can help fill the gap between Medicare and healthcare needs. Many people use Medigap policies to help cover the costs of associated healthcare expenses, such as coinsurance payments, copays and deductibles.

How much does Medigap pay for emergency care?

Additionally, the Medigap policy will only pay 80% of the billed charges for eligible medically-necessary emergency care providing you pay your $250 year ly deductible. Additionally, the $250 deductible for foreign travel coverage is a separate deductible from any regular deductible that your plan stipulates.

How long after Medicare benefits are used up can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance or copayment. The first three pints of blood. Part A hospice care coinsurance or copayment. Skilled nursing facility care coinsurance. Part A deductible.

Does Medicare Supplement cover travel?

Unlike Original Medicare, Medicare Supplement insurance plans offer the advantage of additional coverage for emergency health care when you are outside of the U.S. For instance, Medigap Plans C, D, F, G, M, and N offer foreign travel emergency health care coverage if you are traveling outside of the U.S. There are also additional Medigap policies that are no longer for sale, but if you are already enrolled in them, they cover you for emergency care while traveling as well.

What is Medicare Supplement Special Enrollment Period?

A Medicare Supplement Special Enrollment Period restores your ability to enroll in Medicare Supplement (“Medigap”) at fair prices, even if your Medigap Open Enrollment Period is over. There are many ways to qualify for special enrollment. In certain situations such as when you move, see significant changes in coverage, ...

How long does Medicare Advantage last?

Your Special Enrollment Period starts 60 days before and lasts for 63 days after your previous coverage ends.

How long does Medigap last?

You can purchase a new plan within a reasonable amount of time after learning about the rule violation. Your Special Enrollment Period lasts for 63 days after your previous coverage ends.

What is a select Medicare plan?

A Medicare SELECT policy is a Medigap plan with provider networks that is combined with Original Medicare. 1 If you experience issues with your Medicare SELECT policy, then you may qualify for a Medigap Special Enrollment Period.

How long do you have to have Medicare Supplement in Washington?

At certain times during the year, these five states allow you to transfer to any Medicare Supplement plan that has equal or lesser benefits to your current policy with a few caveats: In Washington, you must have Medigap for 90-plus days and people with Plan A are limited to picking another Plan A.

What is special enrollment in Medicare?

During special enrollment and open enrollment, you’ll be applying with guaranteed issue rights. These rights (also called “Medigap protections”) entitle you to the most favorable Medicare Supplement prices, without the risk of being denied care.

Is Medicare Supplement out of business?

Your Medicare Supplement provider goes out of business. If you qualify for special enrollment under this condition, then you’re allowed to purchase any Medigap Plan A, B, C, F, K, or L (Plans C and F are only available to enrollees who were eligible for Medicare prior to 2020).

What is Medicare Supplement Open Enrollment Period?

What is Medicare Supplement Open Enrollment? Medicare Supplement Open Enrollment Period is a once in a lifetime window that allows you to enroll in any Medigap plan without answering health questions.

Why do people delay enrolling in Medicare Supplement?

For some; they choose to delay enrolling in Part B due to still working and having creditable coverage with their employer. When they do retire and enroll in Part B, they will initiate their Medicare Supplement Open Enrollment Period.

What happens if you miss your Medigap open enrollment period?

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

How long does Medicare open enrollment last?

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary, unless you delay enrollment into Part B due to having other creditable coverage.

Does timing affect Medigap coverage?

Timing can affect how much you pay for coverage; how easy coverage is to obtain, and it can significantly determine the options available to you. The Megiap OEP is the only time you’ll ever get that allows you to enroll in any Medigap letter plan. You’ll be able to avoid having to answer any health questions.

Do you have to be 65 to get a Medigap plan?

Many states are not required to offer all supplement plans to those under 65. Most states only offer Plan A to those under 65. If they wait to enroll in a Medigap plan when they turn 65 during their second Medigap OEP, they’ll be able to choose from all the programs available to them in their state.