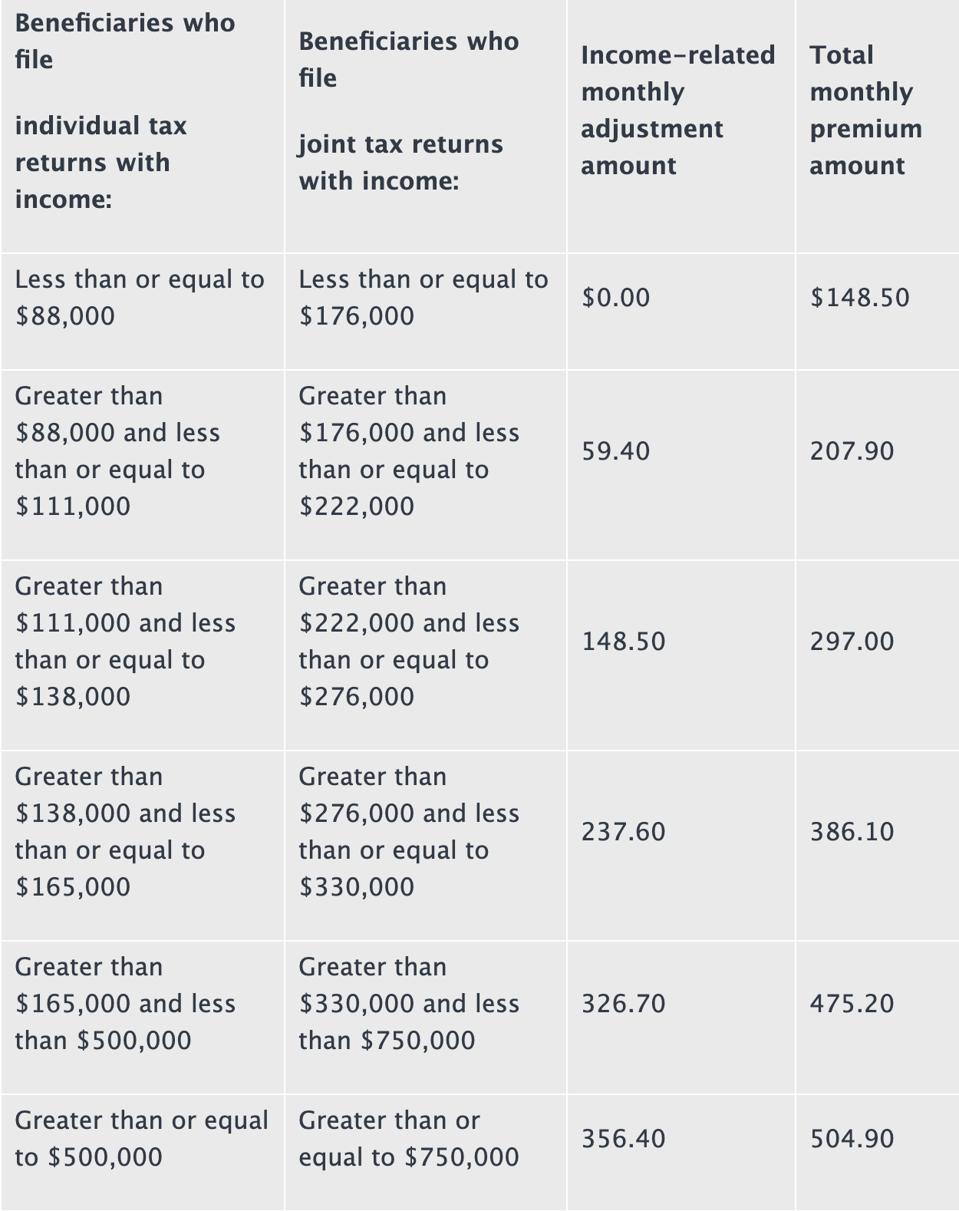

In 2021, individuals with modified adjusted gross income of $88,000 or more and married couples with MAGIs of $176,000 or more will pay additional surcharges ranging from $59.40 per month to $356.40 per month on top of the standard Part B premium. Married couples where both spouses are enrolled in Medicare will pay twice as much.

What is the monthly premium for Medicare Part B?

Feb 16, 2021 · 2020 – $202.40 (surcharge of $57.80) 2021 – $207.90 (surcharge of $59.40) For married couples earning more than $750,000 and individuals above $500,000, premiums alone could reach nearly $12,120 per year.

What are Medicare income limits?

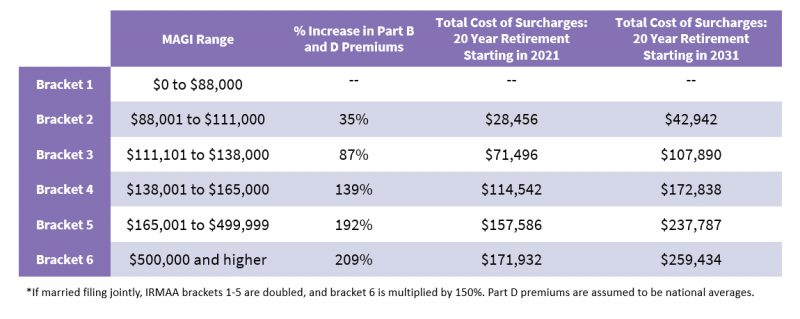

Mar 03, 2021 · Medicare Part B Premiums — Surcharges Can Cost You Thousands in 2021 If you have a higher income, your costs for Medicare Part B premiums can be very high. People in the highest brackets will pay $4,276 more each year than those in the lowest brackets.

How does Medicare calculate my premium?

Nov 10, 2020 · (See chart below.) In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000....

Is Medicare Part B premium?

2 days ago · Decisions made on your 2021 Form 1040 can affect your 2021 MAGI and, in turn, your 2023 Medicare health insurance premiums. If you're self-employed or an owner of a pass-through business entity ...

What are the Irmaa surcharges for 2021?

How much are Part D IRMAA surcharges?Table 2. Part D – 2021 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or lessYour Premium> $91,000 – $114,000> $182,000 – $228,000$12.40 + Plan Premium> $114,000 – $142,000> $228,000 -$284,000$32.10 + Plan Premium3 more rows

What is the Medicare premium for 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Is Medicare cost increasing in 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

What is the amount for a Medicare surcharge?

What's the Medicare surtax? The Affordable Care Act of 2010 included a provision for a 3.8% "net investment income tax," also known as the Medicare surtax, to fund Medicare expansion.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

How much is Medicare going up next year?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

Do Medicare premiums increase every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

How do I avoid Medicare surcharges?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

How much will Medicare premiums increase in 2021?

Medicare Part B premiums will increase by about $4 per month next year and high-income surcharges will also rise modestly in 2021, the Centers for Medicare and Medicaid Services announced late Friday.

How much will Medicare Part B cost in 2021?

The standard Medicare Part B premium, which covers doctor’s visits and other outpatient services, will increase to $148.50 per month in 2021, up $3.90 from this year’s monthly premium of $144.60. Higher-income Medicare beneficiaries will pay more.

How much will Social Security increase in 2021?

SSA said the average Social Security benefit for a retired worker will rise by $20 a month to $1,543 in 2021, while the average benefit for a retired couple will grow $33 a month to $2,596. The higher Medicare Part B premium will reduce retirees’ net monthly Social Security payments.

What is Medicare surcharge?

Not everyone knows this, but there are Medicare surcharges (officially called Income Related Monthly Adjustment Amount , or IRMAA) that correspond to income brackets. These additional costs can really add up. It is the highest-earning 5% of Medicare recipients who pay more for their health coverage.

How much does Medicare cost in 2021?

The monthly premiums for Medicare Part A range from $0–$471. Most people don’t pay a monthly premium for Part A. If you buy Part A, you’ll pay $471 each month in 2021 if you paid Medicare taxes for less than 30 quarters and $259 each month if you paid Medicare taxes for 30–39 quarters.

Do you pay monthly premiums for Medicare?

You may pay monthly premiums, IRMAA (see below), coinsurance, as well as co-pays and deductibles. Your total out-of-pocket costs for Medicare will vary tremendously depending on the types of coverage you select, your income, where you live, your health status, and healthcare usage.

What is Medicare Part D?

However, there is a standardized surcharge over and above your premium for higher income earners. This surcharge is usually added to your Part B premium and paid to Medicare. The highest earners will pay $925.00 more than the lowest earners as a premium surcharge.

How to avoid IRMAA?

With some planning, there are steps you can take to avoid or reduce IRMAA. Here are 5 ideas: 1. Find Out if You Will Pay a Medicare Surcharge, IRMAA . You can use the NewRetirement Planner to see your projected annual income and assess when you might be assessed for IRMAA. Free members can review the Cash Flow Forecast.

What is IRMAA based on?

Your IRMAA is based on your income from two years ago. If your circumstances have changed since that time, you can file an appeal with Medicare to let them know about a reduction in income.

How much of your paycheck never reached your pocket?

During your working years, you paid into Medicare, albeit reluctantly. You watched as somewhere around 15% of your paycheck never reached your pocket, because the federal government took it for Social Security and Medicare payments. 1

Does Medicare cover all of your medical expenses?

Once you reach retirement, you’re a little more accepting of those decades of deductions, because you'll receive full health insurance at next to no cost—especially compared to what you may have paid while you were working. To be fair, Original Medicare alone likely isn’t enough to cover all of your healthcare needs.

How much does Medicare cost for retirees?

That drives monthly healthcare costs higher, but for most people, standard Medicare costs just $148.50 per month. For your Part B premiums, the federal government—thanks in part to your decades of deductions—pays 75% of the cost.

Is MAGI the same as AGI?

Most poeple's MAGI and adjusted gross income (AGI) will be the same, but if you’re paying student loan interest, alimony payments, moving expenses, or some other types of payments, your MAGI may be different.

How much will Medicare pay in 2021?

Here’s how much higher-income Medicare beneficiaries will pay for coverage in 2021 1 Next year, the income-related monthly adjustments will kick in for individuals with modified adjusted gross income above $88,000. 2 For married couples who file a joint tax return, that threshold is $176,000.

Who is Elizabeth Gavino?

As long as you meet one of the qualifying reasons, most of the time it gets adjusted, said Elizabeth Gavino, founder of Lewin & Gavino and an independent broker and general agent for Medicare plans. You’ll also need to provide supporting documents to justify your appeal.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

Can seniors sign up for Medicare?

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.