Full Answer

What is the Medicare tax rate?

The Medicare Tax Rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare Tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note). The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent,...

What is the additional Medicare tax?

In addition to the standard Medicare tax rate, certain high-income individuals also have to pay what has become known as the Additional Medicare Tax. This tax is imposed on single filers who have wages, compensation, or self-employment income of more than $200,000.

What is the withholding for Medicare tax?

For most individuals, withholding for Medicare tax is simple. The complications that sometimes arise with Social Security withholding when someone has two or more jobs don't come up with Medicare, because there's no income limit on when Medicare tax is imposed.

What is the maximum amount of earnings subject to Medicare tax?

There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax. The Medicare Tax Rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare Tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the maximum Social Security tax for 2016?

What is the FICA tax rate for 2016?

When did Medicare withholding change?

Is Medicare taxed on self employment?

About this website

What is the tax rate for the Medicare tax?

1.45%Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions.

How do you calculate your Medicare tax?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

Was there a Medicare tax increase?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax (0.9%) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.

When did Medicare tax go up?

Since 2013, you'll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government's General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

Are Medicare premiums based on adjusted gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Why did Medicare premiums go up?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

How are Medicare wages calculated?

Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

What is the Medicare tax rate?

What your Medicare tax rate is. Medicare taxes get taken directly out of the paychecks of most workers. The tax rate for employees is 1.45%, which is withheld under the provisions of FICA, or the Federal Insurance Contributions Act. Your employer also has to pay an additional 1.45% of your earnings to Medicare.

What is the Medicare tax rate for single filers?

The rate of the Additional Medicare Tax is 0.9% , and so the total tax rate that employees pay is 2.35%.

How does Medicare withholding work?

How Medicare withholding works. For most individuals, withholding for Medicare tax is simple. The complications that sometimes arise with Social Security withholding when someone has two or more jobs don't come up with Medicare, because there's no income limit on when Medicare tax is imposed.

Why do people feel entitled to Medicare?

Medicare provides basic medical coverage for Americans over the age of 65, and most people rely on the promise of Medicare being there when they retire. Part of the reason why people feel entitled to Medicare is that they pay taxes over the course of their careers.

Does demographic shift affect Medicare?

The problem, though, is that demographic shifts will reduce the number of younger workers per retired Medicare beneficiary, and that could pose difficulties for Medicare in providing the necessary funding from payroll taxes.

Do you pay Medicare taxes backwards?

Many people feel that they've earned their Medicare benefit because of the taxes that they've paid into the system. However, in reality, the tax revenue that you pay in Medicare taxes doesn't go toward covering your own benefit.

Can I withhold my spouse's wages if I file jointly?

However, your employer generally won't know what your spouse has received in compensation if you're married and file jointly, and so the right amount of withholding based on the total amount of the couple's compensation above $250,000 usually won't happen unless the family has a single earner.

What is the Medicare payroll tax rate?

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

What is the tax rate for Medicare and Social Security?

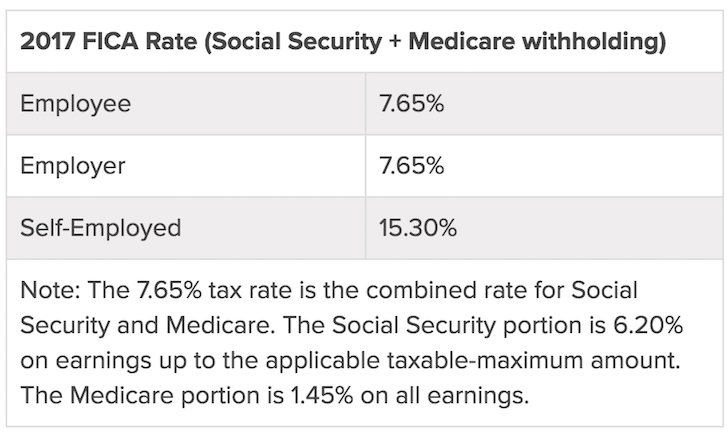

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings. Source: Social Security Administration.

What is the Social Security earnings limit for 2016?

Earnings Limit Unchanged. The annual earnings limit for those who both work and claim Social Security benefits will stay at $15,720 in 2016 for individuals who opt to receive benefits early (ages 62 through 65). For those who turn 66 in 2016, the earning limit remains at $41,880.

When do employers have to adjust payroll?

Typically, by Jan. 1 each year , U.S. employers must adjust their payroll systems to account for the higher taxable wage base under the Social Security payroll tax, and notify highly compensated employees affected by the change that more of their paychecks will be subject to the tax.

When was Revenue Procedure 2015-53 issued?

The IRS issued Revenue Procedure 2015-53 at the end of October 2015, with annual inflation adjustments for income tax provisions including 2016 taxable income ranges for singles, married (filing jointly), married (filing separately), and heads of households. While there was no statutory increase in tax rates for 2016, ...

Will HR adjust payroll taxes in 2016?

HR professionals won’t have to adjust their payroll tax systems in 2016 for a Social Security FICA increase, as the amount of earned income subject to Social Security taxes won’t change, given the absence of inflation and tepid wage increases over the past year. But the modest amount of inflation this year was enough to cause small upward ...

Is there a Social Security increase for 2016?

On Oct. 15, 2015, the Social Security Administration (SSA) announced that there will be no increase in monthly Social Security benefits in 2016, and that the maximum amount of wages subject to Social Security taxes will also remain unchanged at $118,500. Earnings above this amount are not subject to the Social Security portion ...

What is the maximum Social Security tax for 2016?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2016 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare Tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of ...

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.