Key Takeaways

- Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals.

- In 2022, the Medicare tax rate is 2.9%, which is split between an employee and their employer. ...

- Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings. ...

How much do I pay for Medicare tax?

Oct 06, 2021 · Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice. Generally, all U.S.-based workers must pay the tax on their wages.

How much do tax payers pay for Medicare?

Feb 24, 2022 · Medicare tax pays for Part A of the Medicare program, which includes hospital insurance for individuals age 65 or older and people who have certain disabilities or medical conditions. 2 Medicare...

What is the maximum income taxed for Medicare?

Mar 28, 2022 · The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older and people with disabilities or certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What income is subject to Medicare tax?

Jan 04, 2022 · The Medicare tax that is withheld from your paychecks helps fund health care costs for people enrolled in Medicare. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund Supplementary Insurance Trust Fund The funds in these trusts can only be used for Medicare.

What is Medicare tax money used for?

What is the Medicare tax used for? The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older and people with disabilities or certain medical issues.Mar 28, 2022

Do I get Medicare tax back?

You might overpay Social Security and Medicare taxes for a number of reasons. Some workers are exempt from paying these taxes. The government will give the money back to you if this happens, either as a refund or you can claim it as a tax credit in some cases.

Why is Medicare taken out of my paycheck?

Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities. Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs.

Can I remove Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.Apr 5, 2022

Can you opt out of Medicare tax?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

What happens if you don't pay Medicare tax?

He will face a late enrollment penalty that can increase the monthly premium by 10 percent. The penalty amount likely will go up every year as the premium increases. The penalty applies for twice the number of years the individual could have had Part A but didn't.May 15, 2019

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.Feb 18, 2022

What age do you stop paying Medicare tax?

Medicare Withholding after 65 If you have no earned income, you do not pay Social Security or Medicare taxes.

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

This is a standard deduction, and it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax prov...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

What is the Medicare tax rate for a person earning $225,000 a year?

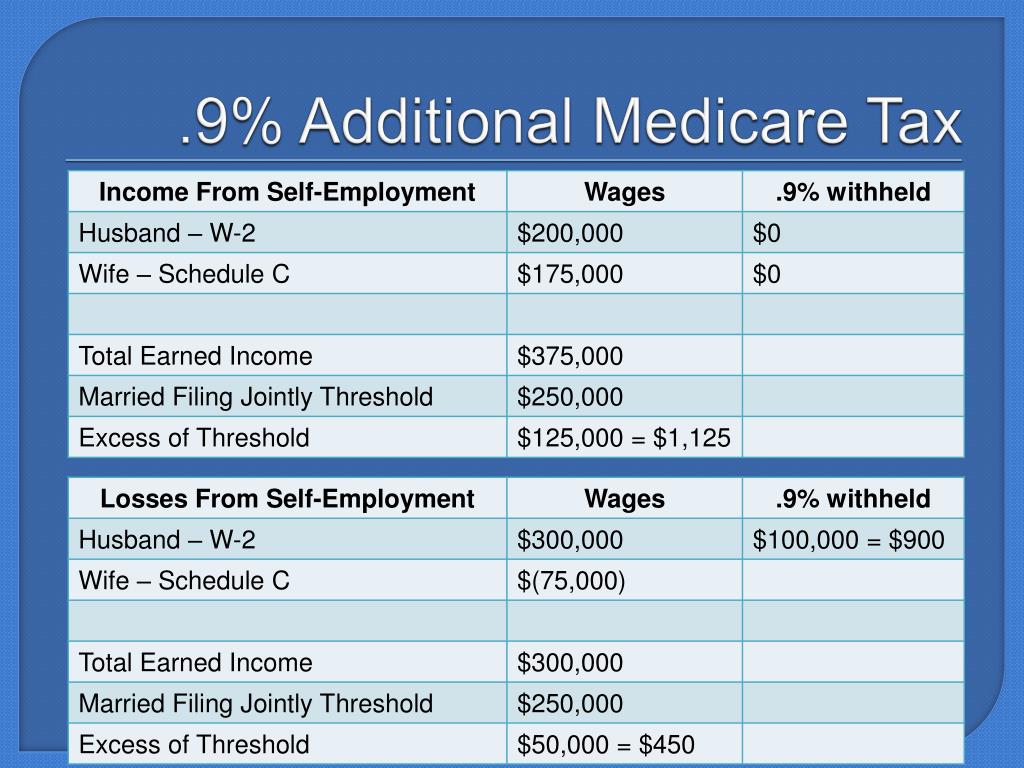

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

Can you opt out of paying Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you ‘ll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits. 6 дней назад

What is Medicare tax used for?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.

Why is Medicare tax taken out of my paycheck?

What is the Medicare tax? Your employer automatically withholds the Medicare tax from your paycheck in order to help cover the costs of the country’s Medicare program. The tax comprises one part of the Federal Insurance Contributions Act (FICA).

Who is exempt from paying Medicare tax?

The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

Do you get your Medicare tax back?

To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

At what point do you stop paying social security tax?

What Is the Social Security Tax Limit? You aren’t required to pay the Social Security tax on any income beyond the Social Security Wage Base. In 2021, this limit is $142,800, up from the 2020 limit of $137,700. As a result, in 2021 you’ll pay no more than $8,853.60 ($142,800 x 6.2%) in Social Security taxes.

Does everyone pay the same Medicare tax?

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How many years prior to income tax do you have to pay Social Security premium?

In most cases, this information is your income two years prior to the year for which you must pay an income-related premium. If information is not yet available for the two years prior, Social Security will temporarily use information from the tax year three years prior.

Can you request Social Security to use tax information from a more recent tax year?

You may request Social Security to use the tax information from a more recent tax year under certain circumstances.