What is the Medicare tax rate for 2018?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.

What are the Social Security and Medicare withholding rates?

Mar 15, 2022 · Different rates apply for these taxes. Social Security and Medicare Withholding Rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What are the new tax withholding tables for 2018?

Jan 11, 2018 · The IRS today released Notice 1036, which updates income tax withholding tables for 2018 to reflect changes from the tax reform legislation enacted last month. IR-2018-05, Jan. 11, 2018 ... The new tables reflect the increase in the standard deduction, repeal of personal exemptions and changes in tax rates and brackets.

How much extra tax do I have to withhold for Medicare?

Jan 24, 2018 · The Medicare tax rate also remains at 1.45% for the employer and employee in 2018. The Medicare tax has no wage base limit. In addition to withholding Medicare tax at 1.45%, employers must withhold a 0.9% Additional Medicare Tax from wages more than $200,000 that are paid to an employee in a calendar year.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

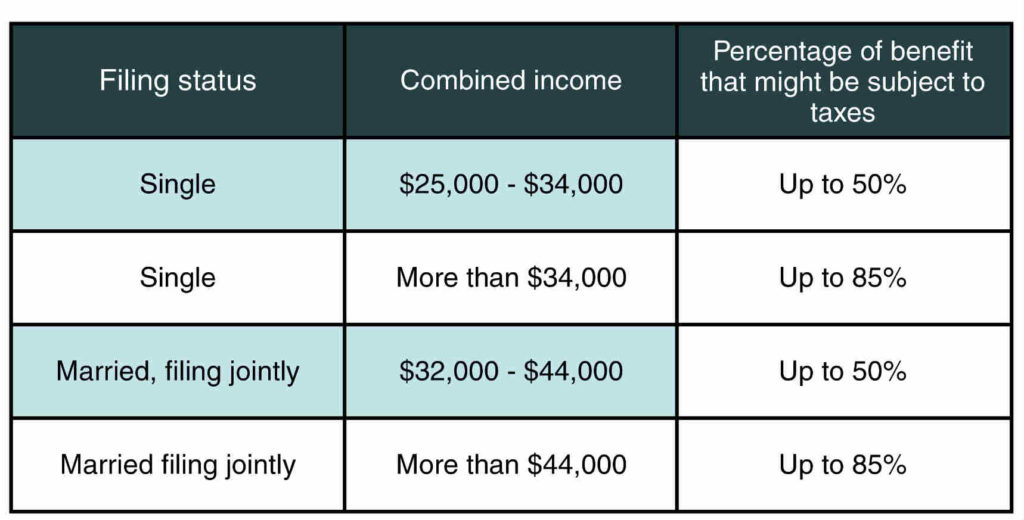

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

When should employers use 2018 withholdings?

Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018. They should continue to use the 2017 withholding tables until implementing the 2018 withholding tables.

What are the new tax tables?

The new law makes a number of changes for 2018 that affect individual taxpayers. The new tables reflect the increase in the standard deduction, repe al of personal exemptions and changes in tax rates and brackets. For people with simpler tax situations, the new tables are designed to produce the correct amount of tax withholding.

Is the W-4 revised?

The IRS is also working on revising the Form W-4. Form W-4 and the revised calculator will reflect additional changes in the new law, such as changes in available itemized deductions, increases in the child tax credit, the new dependent credit and repeal of dependent exemptions.

Will the IRS change withholdings in 2019?

For 2019, the IRS anticipates making further changes involving withholding. The IRS will work with the business and payroll community to encourage workers to file new Forms W-4 next year and share information on changes in the new tax law that impact withholding.

What is the tax rate for Medicare?

(Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

What is the effective tax rate for 2018?

The effective tax rate for 2018 is 0.6%.

How much is withheld from a full retirement?

In the year an employee reaches full retirement age, $1 in benefits will be withheld for each $3 they earn above $45,360 until the month the employee reaches full retirement age . Once an employee reaches full retirement age or older, their benefits are not reduced regardless of how much they earn.

What is the maximum pretax contribution for 2018?

The maximum employee pretax contribution increases to $18,500 in 2018. The “catch-up” contribution limit remains at $6,000 in 2018 for individuals who are age 50 or older.

Who needs a W-9?

Be sure to request and keep on file a completed Form W-9 from all non-corporate taxpayers to whom your company pays commissions, interest, rents, etc., totaling $600 or more, and also payments made to certain incorporated entities such as attorneys for legal services and providers of medical and health care services.

What is the Medicare premium for 2018?

For 2018, the standard monthly premium for Medicare Part B enrollees will stay at $134. "Some beneficiaries who were held harmless against Part B premium increases in prior years will have a Part B premium increase in 2018, but the premium increase will be offset by the increase in their Social Security benefits next year," the U.S. Centers for Medicare & Medicaid Services (CMS) said.

What is the Medicare payroll tax rate?

For employers and employees, the Medicare payroll tax rate is a matching 1.45 percent on all earnings, bringing the total Social Security and Medicare payroll withholding rate for employers and employees to 7.65 percent each—with only the Social Security portion (6.2 percent) limited to the $128,700 taxable-maximum amount.

How much does the SSA deduct for retirement?

Until an individual reaches full retirement age, the SSA deducts $1 dollar in Social Security benefits for every $2 earned over the retirement earnings exemption limit. A separate earnings test applies in the year an individual reaches full retirement age. During that year, in the months prior to attaining full retirement age, the SSA deducts $1 dollar in benefits for every $3 earned over the limit until the month the worker turns age 66. The SSA announced that:

What is the maximum amount of Social Security earnings?

Starting Jan. 1, 2019, the maximum earnings that will be subject to the Social Security payroll tax will increase by $4,500 to $132,900—up from the $128,400 maximum for 2018, the Social Security Administration announced Oct. 11, 2018.

How much is Medicare Part B?

Premiums for Medicare Part B, which primarily covers doctors' visits and other outpatient care, can also change annually. For 2017 the base premium was $134, with higher earners paying more. For 2018, the standard monthly premium for Medicare Part B enrollees will stay at $134.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings. Additional Medicare Tax.

What is the maximum Social Security benefit for a full time employee?

According to a new SSA fact sheet, the maximum Social Security benefit for workers retiring at full retirement age in 2018 will be $2,778 per month, up from $2,687 per month in 2017.

When will the 2018 withholding tables be updated?

Employers are instructed to use the 2018 withholding tables as soon as possible, but not later than February 15, 2018.

When will the IRS release the 2018 tax tables?

However, the IRS has not yet released the official 2018 tax tables (expect those at the end of January 2018 ). If you're looking for the rates that you'll use to file your tax returns in 2018, those are the 2017 rates found here. The 2018 filing season will open on January 29, 2018.

What is the new withholding table?

The new withholding tables are designed to work with the forms W-4 that employees already have on file with their employers. That means that you don't have to do anything else at this time - but keep reading.

When will the IRS withhold tax calculator be available?

The IRS is also revising the withholding tax calculator on IRS.gov. It should be available by the end of February. Remember that in addition to income tax withholding, your pay is also subject to withholding for FICA (Social Security and Medicare) taxes.

What is the taxable wage base for Social Security?

For 2018, the employee portion of Social Security tax is 6.2% with a taxable wage base of $128,400 (wages over that amount are not subject to Social Security tax) while the employee portion of Medicare tax is 1.45% with no wage base limit (all wages are subject to Medicare tax).

How often do you get paid as a tax payer?

Most taxpayers are paid weekly, bi-weekly, or semimonthly. Here's what those tables look like: