A medical write-off is simply an agreement by a medical provider to accept less than the full amount billed in full satisfaction of the provider’s bill. Medical write-offs can be voluntary, forced, or statutory. For example, a hospital may bill an injured party $100,000.00 for treatment resulting from a motor vehicle accident.

Why do health insurance companies write off so much?

As part of the network, they bill the policyholders in a different way than those who aren't. For every health service, there is an allowable payment. Their accounting system them writes off any amount in excess of that allowable payment.

What are the different types of write offs in insurance?

There are two types of write off: One is contractual write off and the other one is adjustments. Contractual write off are those wherein the excess of billed amount over the carrier’s allowed amount is written off.

What is the difference between a write-off and a deduction?

A write-off is a type of deduction, and in some cases, the words may be used interchangeably. For example, when a self-employed person or small business owner files his income tax return, he often refers to his business write-offs as deductions.

Can a physician write off a coinsurance amount after Medicare payment?

Can a physician write off a coinsurance amount required after Medicare and Medicaid has made payment. Not categorically. Make sure you do your research first. You should have a solid financial aid policy in place before you write off any patient responsibility for which you are contractually obligated to collect.

What does insurance write-off mean medical billing?

A provider write-off is the amount eliminated from the fees for a service provided by a facility that serves as a healthcare provider for an insurance company. The write-off could be in the form of not billing the insured for certain services that exceed the allowable costs set in place by the insurance company.

What is the difference between a write-off and an adjustment in healthcare?

A contractual adjustment is the amount that the carrier agrees to accept as a participating provider with the insurance carrier. A write off is the amount that cannot be collected from patient due to several issues.

What does provider write-off mean?

The difference between the actual charge and the allowable charge, which a network provider cannot charge to a patient who belongs to a health insurance plan that utilizes the provider network.

What is write-off in billing?

Write Off - Write Off is one way of dealing with bad debts. Bad debts usually means any specific invoice that becomes uncollectible. You can Write Off an invoice when you're sure that the invoice amount is uncollectible. When you Write Off an invoice it will be marked as Paid.

Can a physician write-off a patient balance?

There is no rule of thumb for writing off balances; it is per the practice's discretion. Many practices make the determination based on the patient's ability to pay. A more practical solution may be to set a policy for indigent charity write-offs.

What is the difference between billed amount allowed amount and write-off?

The difference between the billed amount and the system allowed amount will be the write off, if the EOB allowed amount is less than the system allowed amount. Otherwise the difference between the billed amount and the EOB allowed amount would be the write off.

What is write of in health insurance?

A write-off refers to an amount deducted by the provider from a medical bill and does not expect to collect payment owned by patients or payers. Write-offs are a common practice in the billing system.

Does a tax write-off mean you get the money back?

Instead, a tax write-off is an expense you can partially or fully deduct from your taxable income, reducing how much you owe the government. If you're due a tax refund, the government is giving you back the amount of tax you overpaid based on your tax liability.

How are write-offs calculated?

Divide the amount of bad debt by the total accounts receivable for a period, and multiply by 100. There are two main methods companies can use to calculate their bad debts. The first method is known as the direct write-off method, which uses the actual uncollectable amount of debt.

Do write-offs affect net income?

Under the direct write-off method, bad debt expense serves as a direct loss from uncollectibles, which ultimately goes against revenues, lowering your net income.

What is a provider write off?

A health insurance company has a network of health facilities, such as hospitals and clinics, that provide services for its policyholders. As part of the network, they bill the policyholders in a different way than those who aren't. For every health service, there is an allowable payment.

Is there an allowable payment for health care?

For every health service, there is an allowable payment. Their accounting system them writes off any amount in excess of that allowable payment. For instance, if a procedure is normally be billed for $100, but as part of the network, the facility is only allowed to charge policyholders $95, then the excess $5 is written off.

What is an expense write off?

An expense write-off will usually increase expenses on an income statement which leads to a lower profit and lower taxable income.

What is a write off in accounting?

What Is a Write-Off? A write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account. It is primarily used in its most literal sense by businesses seeking to account for unpaid loan obligations, unpaid receivables, or losses on stored inventory.

What is a write off on a business statement?

A write-off primarily refers to a business accounting expense reported to account for unreceived payments or losses on assets. Three common scenarios requiring a business write-off include unpaid bank loans, unpaid receivables, and losses on stored inventory. Write-offs are a business expense that reduces taxable income on the income statement.

What is itemized deduction?

Individuals can also itemize deductions if they exceed the standard deduction level. Deductions reduce the adjusted gross income applied to a corresponding tax rate. 1 . Tax credits may also be referred to as a type of write-off. Tax credits are applied to taxes owed, lowering the overall tax bill directly. 2 .

What is write off on balance sheet?

As such, on the balance sheet, write-offs usually involve a debit to an expense account and a credit to the associated asset account.

Why do companies write off inventory?

On the balance sheet, writing off inventory generally involves an expense debit for the value of inventory unusable and a credit to inventory.

When do banks use write off accounts?

Banks. Financial institutions use write-off accounts when they have exhausted all methods of collection action. Write-offs may be tracked closely with an institution’s loan loss reserves, which is another type of non-cash account that manages expectations for losses on unpaid debts.

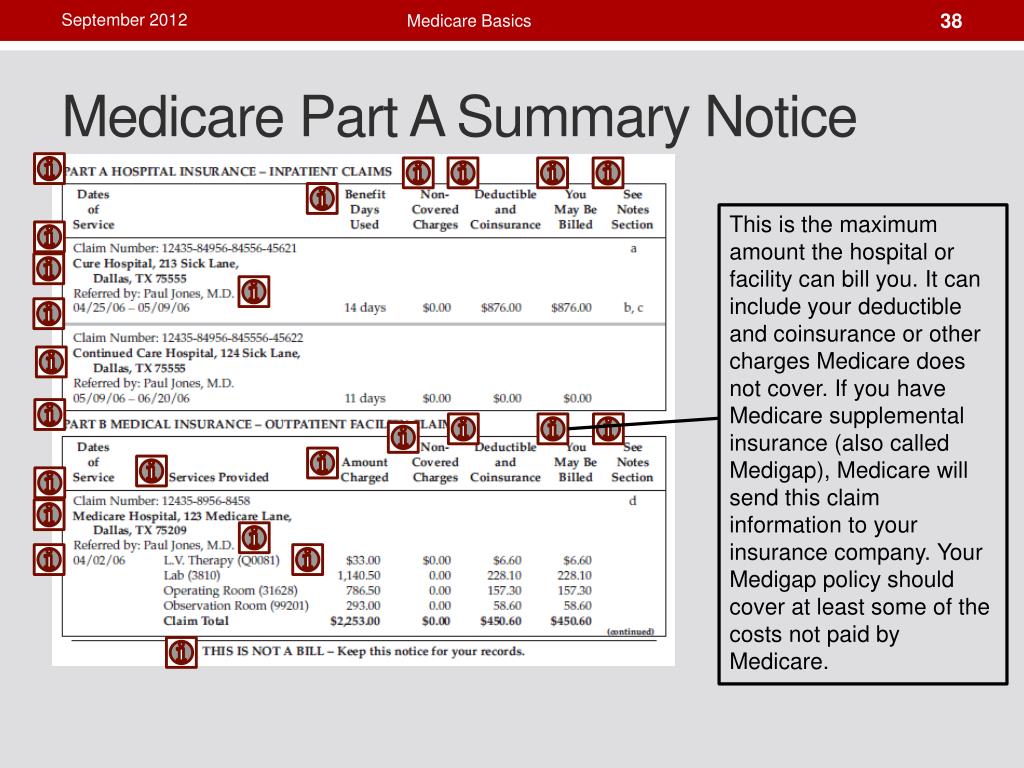

How long will Medicare be cut?

Per the Budget Control Act, $1.2 trillion in federal spending cuts must be achieved over the period of nine years. Unless changes are made by Congress, Medicare Sequestration will limit federal spending until 2022. Only time will tell if the cuts made to Medicare reimbursement will continue until 2022.

Why did Medicare fail to meet the deadline?

Some believe Medicare failed to meet the deadline because economists and financial analysts predicted Congress would step in and squash the Budget Control Act of 2011. When Congress didn’t step in, it gave little time for entities such as Medicare to outline a plan before the deadline.

What is Medicare sequestration?

Medicare sequestration is a penalty created during The Budget Control Act of 2011. Medicare sequestration was made to create savings and prevent further debt, but it had some negative repercussions on hospitals, physicians, and health care. Beneficiaries are not responsible for the price difference caused by the sequestration.

What was the Medicare cut in 2013?

Under these budget cuts, any claim received by Medicare after April 1, 2013 was subject to a 2 percent payment cut. Any drugs that were administered as part of the claim were also reimbursed with a 2 percent cut implemented.

Is chemo covered by Medicare?

Chemo is administered in a clinical setting by a physician, so it is a covered charge under Medicare Part B. Part B drugs are subject to a 2 percent reduction, which made it impossible for some expensive chemotherapy sessions to be canceled or moved to facilities that could absorb the loss in payment.

Is Medicare 2 percent cut?

The 2 percent cut to Medicare payments is also not cumulative. This means is payments will not continually be reduced by 2 percent year after year. Instead, they will only be subject to the initial 2-percent reduction until 2022. The only way this reduction could be removed or changed is if Congress voted to change it.

How much does Medicare pay for a doctor?

Medicare pays the 80 percent of the cost that it has decided is appropriate for the service, and you are responsible for the remaining 20 percent. A doctor who doesn’t accept assignment can charge up to 15 percent above the Medicare-approved amount for a service.

Does Medicare cover copays?

The doctor is supposed to submit your claim to Medicare, but you may have to pay the doctor at the time of service and then claim reimbursement from Medicare. If you have Medigap insurance, all policies cover Part B’s 20 percent copays in full or in part. Two policies (F and G) cover excess charges from doctors who don’t accept assignment.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

How long does interest accrue?

Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pursuing an appeal or a beneficiary is requesting a waiver of recovery; the only way to avoid the interest assessment is to repay the demanded amount within the specified time frame. If the waiver of recovery or appeal is granted, the debtor will receive a refund.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

What is Contractual Adjustment?

A contractual adjustment, or contractual allowance, is a portion of a patient’s bill that a doctor or hospital must cancel. They don’t charge for this part of the bill because of their agreements with health insurance companies. It is a write-off.

Contractrual Adjustment and Insurance

If you don’t have health insurance, you will be responsible for the total amount of the bill. In the above example, that would mean paying $100 out of pocket each time you want to visit that specific doctor.

What Services Get a Contractual Adjustment?

Having health insurance, meeting your deductible, and seeing an in-network healthcare provider doesn’t mean you automatically will receive a contractual adjustment on your medical bill.

More Medical Billing Terms to Know

As you can see, the health insurance industry has many terms that can confuse someone who doesn’t specialize in healthcare. The good news is, you’ve learned these terms so far:

Understanding Your Healthcare

After all this article talked about, now you are better prepared to know how much you will need to pay for different medical services. Understanding a contractual adjustment is just the first step to knowing your health insurance coverage and payment responsibilities.

What Is A write-off?

- A write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account. It is primarily used in its most literal sense by businesses seeking to account for unpaid loan obligations, unpaid receivables, or losses on stored inventory. Generally, it can also be referred to broadly as something that he...

Understanding Write-Offs

- Businesses regularly use accounting write-offs to account for losses on assets related to various circumstances. As such, on the balance sheet, write-offs usually involve a debit to an expense account and a credit to the associated asset account. Each write-off scenario will differ, but usually, expenses will also be reported on the income statement, deducting from any revenues a…

Tax Write-Offs

- The term write-off may also be used loosely to explain something that reduces taxable income. As such, deductions, credits, and expenses overall may be referred to as write-offs. Businesses and individuals have the opportunity to claim certain deductions that reduce their taxable income. The Internal Revenue Service allows individuals to claim a standard deduction on their income tax re…

Write-Offs vs. Write Downs

- A write-off is an extreme version of a write-down, where the book value of an asset is reduced below its fair market value. For example, damaged equipment may be written down to a lower value if it is still partially usable, and debt may be written down if the borrower is only able to repay a portion of the loan value. The difference between a write-off and a write-downis a matter of de…