How much does Medicare cost at age 65?

4 rows · Nov 10, 2015 · Because of slow growth in medical costs and inflation, Medicare Part B premiums were unchanged ...

How much does Medicare cost per month?

Aug 25, 2016 · If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90. Your 2016 monthly premium is typically $121.80 if any of the following is true for you: You enrolled in Medicare Part B in 2016 for the first time. You don’t receive Social Security benefits. You get a bill for the Part B premium.

What is the monthly premium for Medicare Part B?

Average is $34.10 per month No more than $360 per year Each Part D plan charges a different premium and deductible. Note: The premium is $121.80 if you are new to Medicare in 2016 or if you are not collecting Social Security

Who is eligible for Medicare Part B reimbursement?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

What was the monthly cost of Medicare in 2017?

What was the cost of Medicare Part B in 2015?

What is the Medicare premium for 2018?

...

What You'll Pay for Medicare in 2018.

| Income (adjusted gross income plus tax-exempt interest income): | ||

|---|---|---|

| $133,501 to $160,000 | $267,001 to $320,000 | $348.30 |

What is the average monthly cost for Medicare?

| Medicare plan | Typical monthly cost |

|---|---|

| Part B (medical) | $170.10 |

| Part C (bundle) | $33 |

| Part D (prescriptions) | $42 |

| Medicare Supplement | $163 |

How much did Medicare go up in 2016?

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

What was the Medicare deductible in 2014?

What is the Medicare Part B deductible for 2016?

What is the Medicare Part B deductible for 2021?

What is Medicare Part B premium 2019?

How much does Medicare take out of Social Security?

Is Medicare Part A free at age 65?

Does Medicare coverage start the month you turn 65?

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

Do you have to pay for Medicare Part A?

Most people don’t have to pay a premium for Medicare Part A. They do, however, have to factor in the following Medicare Part A costs for inpatient hospital stays for each benefit period. Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

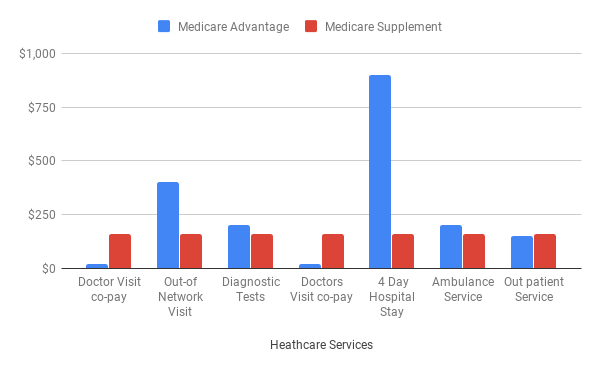

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

Is Medicare dual eligible?

You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount. Your premium could be higher than the amount listed above, as there are different premiums for different income levels.

How much did Medicare pay in 2015?

But because of a law that ties Medicare increases to cost-of-living adjustments for Social Security, the majority of existing participants will pay the $104.90 monthly premium they paid in 2015. Image source: Getty Images.

What is Medicare Part B?

Medicare Part B covers services and supplies considered medically necessary to treat a disease or condition.

Why do retirees need Medicare?

Retirees rely on Medicare to help them with their healthcare expenses, but getting a better understanding of how the program's different components can be challenging. Medicare Part B plays a key role in the everyday aspects of healthcare, and below, you'll learn more of the specifics of how much Part B costs and what it covers. ...

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is the Medicare budget for 2016?

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored off the President’s Budget adjusted baseline, which assumes a zero percent update to Medicare physician payments. These reforms will strengthen Medicare by more closely aligning payments with the costs of providing care, encouraging health care providers to deliver better care and better outcomes for their patients, and improving access to care for beneficiaries. The Budget includes investments to reform Medicare physician payments and accelerate physician participation in high-quality and efficient healthcare delivery systems. Finally, it makes structural changes in program financing that will reduce Federal subsidies to high income beneficiaries and create incentives for beneficiaries to seek high value services. Together, these measures will extend the Hospital Insurance Trust Fund solvency by approximately five years.

How much money did Medicare spend in 2016?

In FY 2016, the Office of the Actuary has estimated that gross current law spending on Medicare benefits will total $672.6 billion. Medicare will provide health insurance to 57 million individuals who are 65 or older, disabled, or have end-stage renal disease.

What is Medicare Part C?

Part C ($198.0 billion gross spending in 2016): Medicare Part C, the Medicare Advantage program, pays plans a capitated monthly payment to provide all Part A and B services, and Part D services, if offered by the plan.

Does the hold harmless provision apply to Medicare Part B?

Clarify Calculation of the Late Enrollment Penalty for Medicare Part B Premiums: This proposal would clarify that the cap on increases to the Part B premium, commonly referred to as the hold harmless provision, does not apply to the calculation of the Part B late enrollment penalty, but applies only to the annual increase to the basic Part B premium. The hold harmless provision imposes a cap on increases to the basic Part B premium based on the amount of the cost-of-living adjustment increase in a beneficiary’s Social Security benefits. This clarification is consistent with current CMS practice. [No budget impact]

What are the goals of CMS for FY 2016?

Clinical Quality Improvement: The key goals for FY 2016 are improving the health status of communities; delivering patient-centered, reliable, accessible, and safe care; and better care at lower costs. Through improving cardiac health, reducing disparities in diabetic care, using immunization information systems and meaningful use of health IT to improve prevention coordination, CMS aims to improve the health status ofbeneficiaries. These goals will also be achieved by efforts to reduce healthcare‑associated infections, healthcare‑associated conditions in nursing homes, and hospital readmissions and adverse drug events.

What is the 190 day limit for psychiatric services?

Eliminate the 190-day Lifetime Limit on Inpatient Psychiatric Facility Services: The 190-day lifetime limit on inpatient services delivered in specialized psychiatric hospitals is one of the last obstacles to behavioral health parity in the Medicare benefit. Beginning in FY 2016, this proposal would eliminate the 190-day limit and more closely align the Medicare mental health care benefit with the current inpatient physical health care benefit. Many beneficiaries who utilize psychiatric services are eligible for Medicare due to a disability, which means they are often younger beneficiaries who can easily reach the 190-day limit over their lifetimes. Therefore, this proposal would expand the psychiatric benefit and bring parity to the sites of service, while also containing the additional costs of removing the 190-day limit.

5.0 billion in costs over 10 years]

Medicare Part B Costs

Medicare Part B covers day to day care. These are your costs for 2016:

How to Lower Your Medicare Out of Pocket Costs

There are a few options to lower the above costs. If you do not have retiree, job-based, or other creditable insurance, you will want to consider enrolling in one of the following:

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.