How does income affect monthly Medicare premiums?

Nov 08, 2019 · Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is the average cost of Medicare coverage?

$170.10 each month (or higher depending on your income). The amount can change each year. The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

What is the monthly premium for Medicare Part B?

Jan 26, 2020 · Changes to the 2020 Monthly Premium The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How does Medicare calculate my premium?

Feb 19, 2018 · The standard Part B premium in 2020 is $144.60 per month. However, if your Medicare premiums are paid directly from your Social Security benefits, Medicare cannot cause you to receive less Social Security than you did in the previous year. Accordingly, some people who receive Social Security benefits pay less than $144.60.

How much does Medicare cost per month in 2020?

$144.60 forThe standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year.Nov 11, 2019

What will Medicare cost me in 2021?

In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.Dec 16, 2020

What is the average monthly cost for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

What is the monthly cost for Medicare in 2022?

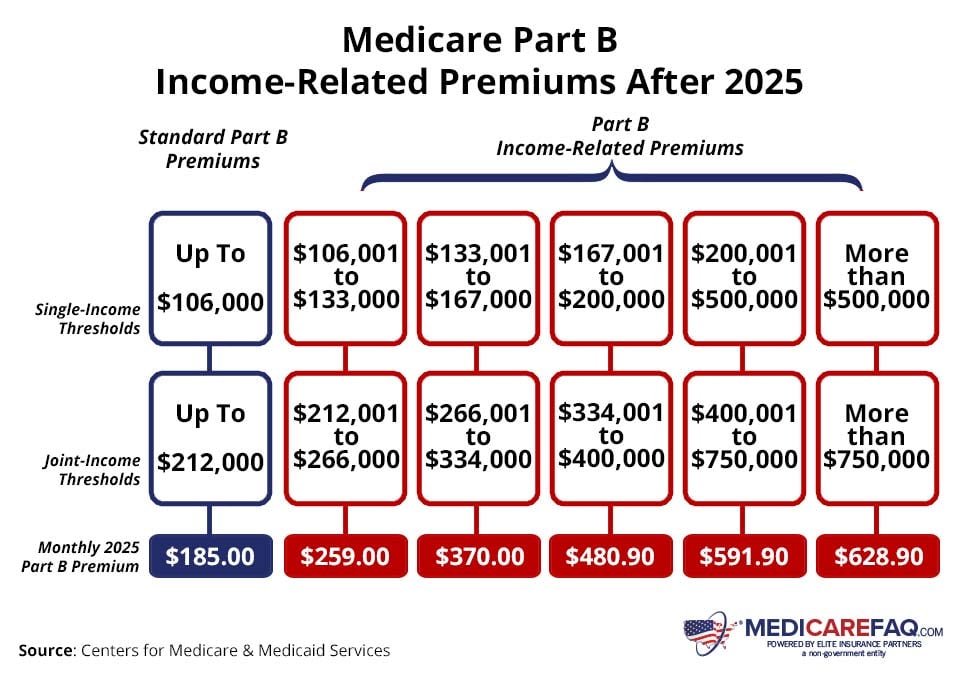

$170.102022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

How much does Part C Medicare cost?

An HMO plan is generally cheaper than a PPO plan. A Medicare Part C HMO plan costs about $23 per month, while local PPO plans average $43 per month. The most expensive plans are Regional PPO plans, which average $80 per month, and Private Fee-for-Service (PFFS) plans, which average $77 per month.Jan 24, 2022

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Does Medicare cost the same for everyone?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly).

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What is the COLA for 2020?

For 2020, the COLA is 1.6%; if this change in a beneficiary’s Social Security payment does not cover the rise in their premium cost, their premium will only increase by 1.6% of the prior year’s premium. If you qualify as a dual eligible enrollee with Medicare and Medicaid, your Medicare premium will be $144.60 a month and is paid by Medicaid.

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

How much is Part B premium for 2020?

more than $413,000, you pay $491.60 a month in 2020. The Part B premium can be scaled to the Social Security cost-of-living adjustment (COLA) if the rise in a premium is more than the change in a retiree’s Social Security benefit.

How much do you pay for unemployment?

In 2020, you pay: 1 $0 for the first 20 days of each benefit period 2 $176 per day for days 21–100 of each benefit period 3 All costs for each day after day 100 of the benefit period

What is Medicare Part A?

Medicare Part A covers inpatient stays in hospitals and skilled nursing facilities, as well as home health care and hospice. You need to keep Part A and B to get additional coverage such as a Medicare supplement plan or Medicare Advantage plan.

How much is Medicare deductible for 2020?

In 2020, you’ll pay: $1,408 deductible per benefit period (this was $1,364 in 2019) $352 per day for days 61–90 of each benefit period (this was $341 in 2019) $704 per “lifetime reserve day” after day 90 of each benefit period, up to a maximum of 60 days over your lifetime (this was $682 in 2019) Some Medicare Supplement plans pay ...

What is the average Medicare premium for 2020?

Average Medicare Advantage premiums are projected to drop to $23.00 in 2020. 1 Although each Medicare Advantage plan is different, the government believes that monthly Medicare Advantage premiums have decreased since 2017 when they were $31.91. 2

What is the maximum out of pocket cost for Medicare Advantage 2020?

In 2020, the maximum out-of-pocket cost for those with Medicare Advantage is $6,700. You won’t have to pay a penny more than this amount for services that would have been covered under Original Medicare (Parts A & B). However, this only applies to services that would have been covered under Original Medicare.

What is an AEP for Medicare?

Every year, the Annual Enrollment Period (AEP) gives Medicare-eligible citizens a chance to rethink their coverage. If your options include Original Medicare, a Medicare Part C (Medicare Advantage) plan, or a Medicare Part D plan, it helps to know the facts and figures you’ll be expecting. While the costs and coverage for Medicare Advantage ...

How long do you have to pay Medicare premiums?

All it takes to qualify is to pay your Medicare taxes for 40 quarters, or 10 years. Last year, CMS reported that nearly 99 percent of Part A beneficiaries receive Part A premium-free. Once again, CMS confirmed this in their release for 2020, with about 99 percent of beneficiaries receiving Medicare Part A premium-free. That said, if you’re among the one percent of people who don’t receive it premium-free, you will owe a monthly premium. For 2020, this monthly premium is $458, a $21 increase from 2019. If you have paid 30 quarters or more of Medicare tax or are married to someone who’s paid 30 or more quarters, you’ll pay a monthly premium of $252, an increase of $12 from 2019.

How much is Medicare premium for 2020?

For 2020, this monthly premium is $458, a $21 increase from 2019. If you have paid 30 quarters or more of Medicare tax or are married to someone who’s paid 30 or more quarters, you’ll pay a monthly premium of $252, an increase of $12 from 2019. There are a few other costs with Part A that were announced as well.

How much is Medicare Part B premium?

Beneficiaries of Medicare Part B will be seeing a moderate increase over the costs in 2019. For 2020, the standard monthly premium will increase $9.10, from $135.50 in 2019 to $144.60, unless you’re considered held harmless. Many people subtract their Part B premiums from their monthly Social Security check.

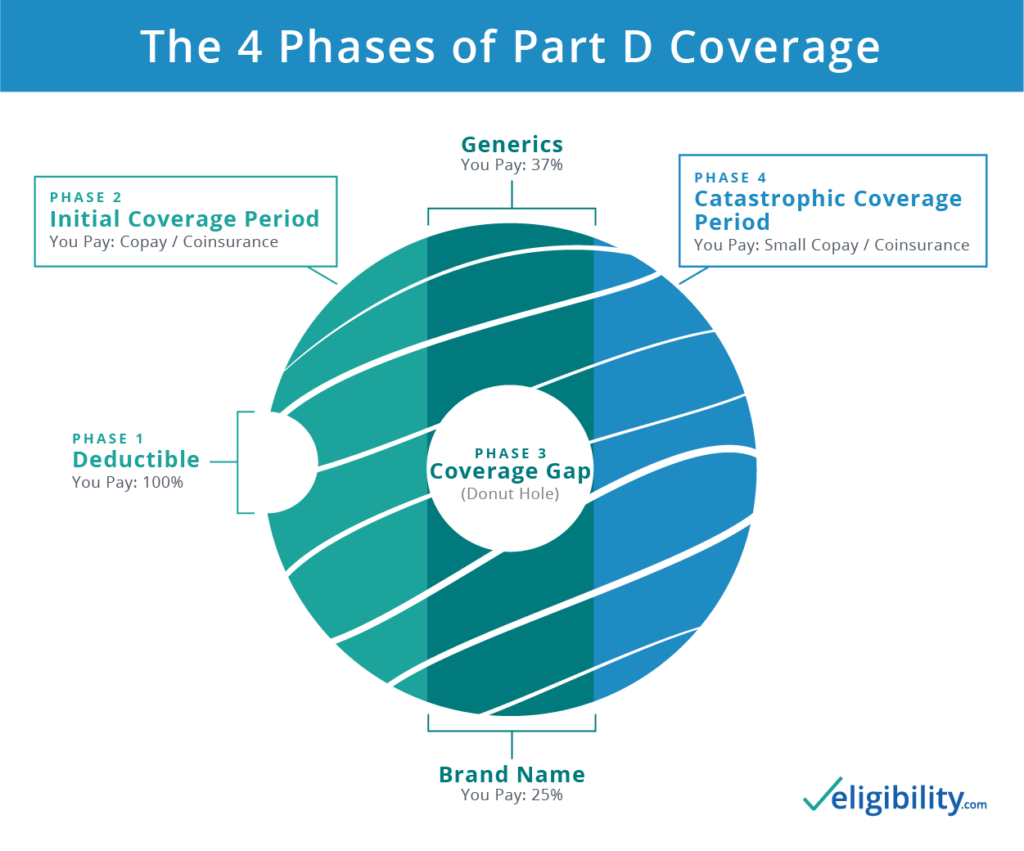

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.