- The most popular type of Medicare Advantage plan: HMO plans. Of the more than 26 million Americans) currently enrolled in Medicare Advantage, about 16 million have an HMO plan ).

- PPO plans. Around one-third of people enrolled in Medicare Advantage have a PPO plan. ...

- Private fee-for-service plans. These are far less common than HMO or PPO Advantage plans. ...

- Special needs plans. Nearly 4 million people are enrolled in these Advantage plans, according to Kaiser. ...

- Less common types of Advantage plans. Additional options for Advantage plans may also be available to some people. ...

What are top rated Medicare Advantage plans?

Dec 21, 2021 · Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 stars from CMS in 2021. 4 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national...

What companies offer Medicare Advantage plans?

Aug 27, 2021 · Standout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of...

Which is the best Medicare Advantage plan?

Oct 14, 2021 · The companies with a gold badge are the U.S. News & World Report's Best Medicare Advantage Plan Companies 2022. A Best Insurance Company for Medicare Advantage Plans is defined as a company whose ...

What are the best Medicare Advantage programs?

Below are the most common types of Medicare Advantage Plans. Health Maintenance Organization (HMO) Plans Preferred Provider Organization (PPO) Plans Private Fee-for-Service (PFFS) Plans Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include Hmo Point Of Service (Hmopos) Plans and a

How do I choose the best Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Is Medicare Advantage the same as Blue Advantage?

In Summary … Blue Cross Blue Shield's Medicare Advantage options cover the same benefits offered by Original Medicare (Medicare Part A hospital insurance and Medicare Part B medical insurance). They also offer coverage for dental, vision, and hearing services, as well as prescription drug benefits.Oct 29, 2020

What are the two types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

What is the difference between a Medicare supplement plan and a Medicare Advantage plan?

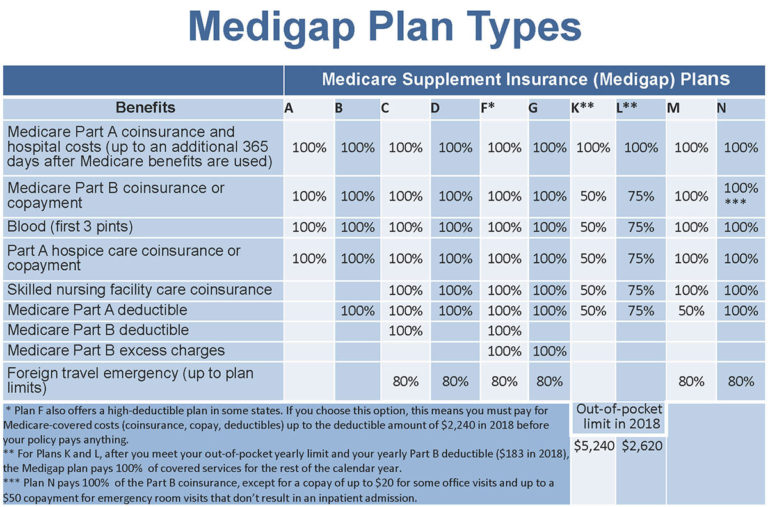

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medicare Part B required for Medicare Advantage plans?

You must have Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) to join a Medicare Advantage Plan.

What is Medicare Part C called?

Medicare Advantage PlansMedicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

How can Medicare Advantage plans charge no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Plan G Medicare?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What are the different types of Medicare Advantage plans?

Understanding the Types of Medicare Advantage Plans 1 HMO plans only cover you when you go to doctors, providers, or hospitals in your plan’s network except in urgent or emergencies. Referrals from primary care doctors to see other doctors or specialists may be required. 2 PPO plans will generally cover you outside the network with a higher out of pocket cost to you. 3 PFFS plans are most like Medicare; you can go to any doctor, provider, or hospital if they accept the plan’s payment terms. 4 Special Needs Plans provide specialized health care for specific groups of people, like those with Medicare and Medicaid, people living in a nursing home, or those with certain chronic medical conditions. 5 HMO-POS plans may allow you to get some services out-of-network for a higher cost.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Does Medicare Advantage have a special enrollment period?

Also, two Medicare Advantage contracts in Florida and Tennessee have a 5-star rating on CMS. 5-star plans have a Special Enrollment Period option; so, if you don’t have a 5-star plan, you can enroll in the high-quality plan anytime during the year.

Do you need prior authorization for Medicare Advantage?

Check with the plan before you get a service to find out if the service is covered and what your costs might be. Many times, Medicare Advantage plans require prior authorization. Following plan guidelines, like getting a referral when needed, can keep your costs lower. Check with your plan.

Is Aetna a PPO?

Aetna is one of the largest health insurance carriers in the world . They have earned the title of an AM Best A Rated Company. These plans have options- HMO or PPO, zero or low premiums, and added benefits. You can choose the plan that is right for you and your needs.

Does HMO cover PPO?

HMO plans only cover you when you go to doctors, providers, or hospitals in your plan’s network except in urgent or emergencies. Referrals from primary care doctors to see other doctors or specialists may be required. PPO plans will generally cover you outside the network with a higher out of pocket cost to you.

Is Medicare Advantage free?

But, since Medicare isn’t free, it’s a good idea to have other options for coverage. One option is a Medicare Advantage plan. These plans will take the place of Medicare. When you go to the doctor, your Medicare Advantage Plan ID card is your main card for Medicare. These plans have Part D, which can make keeping track of your healthcare easier.

What is the rating of Medical Associates Clinic Health Plan?

The Wisconsin-based Medical Associates Clinic Health Plan achieved a five star-rating for customer service performance in its four-count y market. The plan achieved a four-star rating for chronic disease management, but scored a three star rating for preventive care.

How many stars does BCBS have?

BCBS of Minnesota’s Medicare Advantage plan secured a five-star overall rating for medical and prescription drug plan customer service within 55 of the state’s 87 counties. The plan also earned five stars for resolving health plan issues and four stars for chronic disease management performance.

How many stars does Optimum have?

The Optimum MA health plan stood out by earning five stars in beneficiary drug safety and drug plan customer service. The plan also earned a five-star rating for resolving consumer complaints with prescription drug benefits. Optimum provides its MA offerings to beneficiaries in 25 counties across Central and Southern Florida.

How many stars does Gundersen's MA plan have?

Gundersen’s MA plan earned its five-star overall rating by earning five stars in medical and drug health plan customer service. The health plan earned four stars for chronic disease management performance within its three-state market of Iowa, Wisconsin, and Minnesota.

What is the most comprehensive Medigap plan?

Plan F is the most comprehensive Medigap plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medigap Plan F pays the rest. This leaves beneficiaries with $0 out-of-pocket expenses. Enrollees pay a monthly premium, but they don’t need to pay deductibles or copays.

How to reduce hospital costs?

A wise option for those who: 1 Prefer predictable out-of-pocket hospital costs and rate increases 2 Reside in a state that allows excess charges 3 Enjoy traveling outside of the United States

Who is Lindsay Malzone?

Lindsay Malzone. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Do you have to pay copays for urgent care?

For example, $20 for a doctor visit and $50 for an emergency visit. There are no copays required if you visit a local urgent care facility. However, excess charges are not covered by this plan.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, provides health coverage that is more extensive than what is offered through Medicare Part A and B, including dental coverage, vision coverage and other extras depending on the company . Available through private-sector health insurers, you are eligible to purchase a Medicare Advantage plan only ...

What is a provider network?

This means the company usually sets and negotiates the relationships with the doctors. For this reason, it is important to carefully review the network — either HMO, PPO, EPO or POS — for each company you are considering.

What is an A++ rating?

A++ or "Superior" is the top grade available, and usually any company above A- is in an above-average financial situation. Better Business Bureau (BBB): The BBB rating system is a grade given to a company between A+ and F, which is determined by the complaint history and how responsive the company is to complaints.

Do health insurance plans have copays?

Additionally, plans usually have copays for certain health events, such as visits to a primary care physician or inpatient care.

Does Aetna have Medicare?

Like other Medicare Advantage plans, an Aetna policy would provide you the standard Medicare A and B along with added benefits. However, added benefits such as primary care physician copays will be more expensive when compared to a policy like Kaiser Permanente's Senior Advantage Basic.