What is the most popular Medicare supplement plan?

What's the most popular Medicare Supplement plan? Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

How many people have Medicare supplement insurance?

Out of the 64 million people in the United States who have traditional Medicare benefits, 81 percent of them have one sort of Medicare supplement insurance. These supplemental plans may include those that are provided by an employer, Medigap plans, or supplemental health care coverage through Medicaid.

What are supplemental insurance plans for Medicare?

Supplement insurance plans are sold by some private insurance providers in the United States. Not all companies have them, or sell all available plans, so you may have to look for one in your area. These plans help Original Medicare beneficiaries pay for some of the out-of-pocket health care costs left unpaid by Medicare.

Where can I find Medicare supplement insurance quotes?

United Medicare Advisors is an online marketplace that lets you search for Medicare Supplement Insurance quotes from multiple companies. By entering your address, zip code, and phone number, you can view policy rates from companies like Cigna, Aetna, and Mutual of Omaha, among others.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

Which is the best known supplemental plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

What is the number one Medicare plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Which plan is most often found in apartments?

which plan is most often found in apartments? A kitchen floor plan in which all the appliances and cabinets are located along a single wall. a mixing tool made of loops of wire attached to a handle used to incorporate air into foods and to keep sauces from lumping.

Which is an example of a health care setting that would use the UB 04 claim to Bill institutional services?

The UB-04 claim form is used to submit claims for outpatient services by institutional facilities (for example, outpatient departments, Rural Health Clinics and chronic dialysis centers).

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the current Medicare Part B premium?

$170.10The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What company has the best Medicare coverage?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

How do I choose a Medicare supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

What Are the Best Rated Medicare Supplement Companies in 2022?

Now that you’re familiar with the top 10 well-known Medicare Supplement companies, we’ll let you know which five are the highest rated. There are several official types of ratings for insurance companies but in this article, we’ll focus on the AM Best and S&P ratings. A high rating with both of these agencies indicates a company’s financial stability and offering of high-quality insurance products.

Why do Medicare premiums vary?

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age, location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

Is Mutual of Omaha the same as Medigap?

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

What is the best Medicare Supplement?

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

What is the best Medigap plan?

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much is Medicare Part A deductible for 2022?

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

How much does Medigap Plan G cost?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you'd have with Original Medicare (Part A and Part B).

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

What is the largest Medicare supplement insurance company?

1. Mutual of Omaha Medicare Supplement Insurance Company . Mutual of Omaha – Opening its doors in the beautiful state of Nebraska in 1909, Mutual of Omaha has grown into one of the nation’s largest Medicare Supplemental insurance providers.

What states does United Healthcare offer Medigap?

Customers will find that the most competitive states for the company’s Supplemental insurance plans include Michigan, Pennsylvania, New Jersey, Ohio, Arizona, Texas, California, and New York. If you live in one of these states, you should definitely consider looking at United Healthcare when looking for a Medigap policy.

Where is Humana Medicare based?

Humana Medicare Supplement Insurance Company. Humana – Based in Louisville, Kentucky, Humana is known for providing dependable coverage for all types of consumers, including families, military members, and seniors.

When did Medigap start?

Dating back to the 1960s when the company introduced its first Medigap plans, the company has been recognized as an innovative provider in the Medigap plan market for over five decades. Today, the company’s Supplemental plans have received an A+ (Superior) rating from A.M. Best and garnered over $2 billion in revenue.

Is Aetna a good Medicare Supplement?

Currently, Aetna’s A (Excellent) A.M. Best financial score and commitment to improving health and wellness in the communities that they serve are why many Medicare recipients consider the company to be among the 10 best Medicare Supplemental insurance companies for the health plans that are available in the marketplace.

Is Medigap standardized?

When comparing Medicare Supplemental insurance providers, it is important to note that all plans offered by Medigap insurance companies are standardized by Medicare for those who have Medicare Part A and Part B.

Does Gerber Life Insurance cover Medicare?

Gerber Life Insurance Company – While many people know Gerber for its iconic baby food producer and operate financially independent from the main Gerber company. Over the last eight years, the Gerber Life Insurance Company has expanded upon its children’s life insurance services to include Medicare Supplement plans. Holding an A A.M. Best Rating and a BBB S & P Rating, the company insures over 30,000 lives nationwide and offers health insurance plan options for seniors who have Medicare coverage, too.

Which insurance company has the largest number of Medicare Supplement customers?

AARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. 3 AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Who Are the Established Top Medicare Supplement Insurance Carriers?

In some metropolitan areas, more than 20 insurance companies sell Medicare Supplement insurance. 1 Consider the following companies for coverage, based on market share:

Why Choose a Medicare Supplement Plan?

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isn’t an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

What is United Healthcare?

UnitedHealthcare is the largest Medicare Supplement company by premiums earned, and they cover more than 308,000 people. 11 United Healthcare is known for its easy-to-use online portal, as well as its partnership with AARP. In fact, when you go to AARP to look for Medigap plans, they send you to United Healthcare.

What is Medicare Supplement Insurance?

Medicare Supplement insurance, also known as Medigap, augments your basic Medicare coverage by typically paying the 20% cost that Medicare does not cover.

What to consider when choosing Medicare supplement insurance?

When choosing Medicare supplement insurance, it’s important to consider your personal needs and preferences. While your premium is a big factor, it’s also important to look at other items, including whether you have to worry about copays and coinsurance, and what out-of-pocket costs you’ll have.

How many states does CVS offer Medicare?

CVS/Aetna combined forces in 2018. 10 It offers plans in 49 states, plus Washington, D.C. In all, 52 million people participate in some type of CVS/Aetna Medicare plan.

What Does a Medicare Supplement Plan Typically Cost?

Without providing detailed personal information, most providers are unable to release estimated costs. However, most plans begin in the range of $100 per month, and many providers offer discounts for a variety of qualifiers (such as being female or a non-smoker, or if you have more than one policy from that provider).

When Can I Buy a Medicare Supplement Plan?

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled. You may be subject to a medical underwriting examination, which is a detailed review of your medical history.

Is a Medicare Supplement Plan Worth It?

Yes. A Medicare Supplement plan can help cover what Medicare can’t—from prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits. Even getting one ER visit covered can be a huge benefit financially.

Why is AARP the best Medicare supplement?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your employer's insurance and may require coverage after the age of 65.

How is Medicare Supplement Plan cost determined?

The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it. When researching different companies, be sure to ask how they price their policies. 10 Learning which factors they base their pricing on will help you determine both the costs for you today and what to expect in the future if your health situation changes.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

When is the best time to buy a Medicare Supplement?

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can't be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts. 12

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is Medicare?

In the simplest terms, Medicare is a health insurance plan subsidized by the federal government. It was originally created to help Social Security beneficiaries receive healthcare services, but it’s now been expanded to cover everyone who is:

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What is Medicare subsidized by?

In the simplest terms, Medicare is a health insurance plan subsidized by the federal government. It was originally created to help Social Security beneficiaries receive healthcare services, but it’s now been expanded to cover everyone who is:

How many standardized benefits are there for Medicare Supplement?

The 9 standardized benefits that may be offered by a Medicare Supplement Insurance plan include the following:

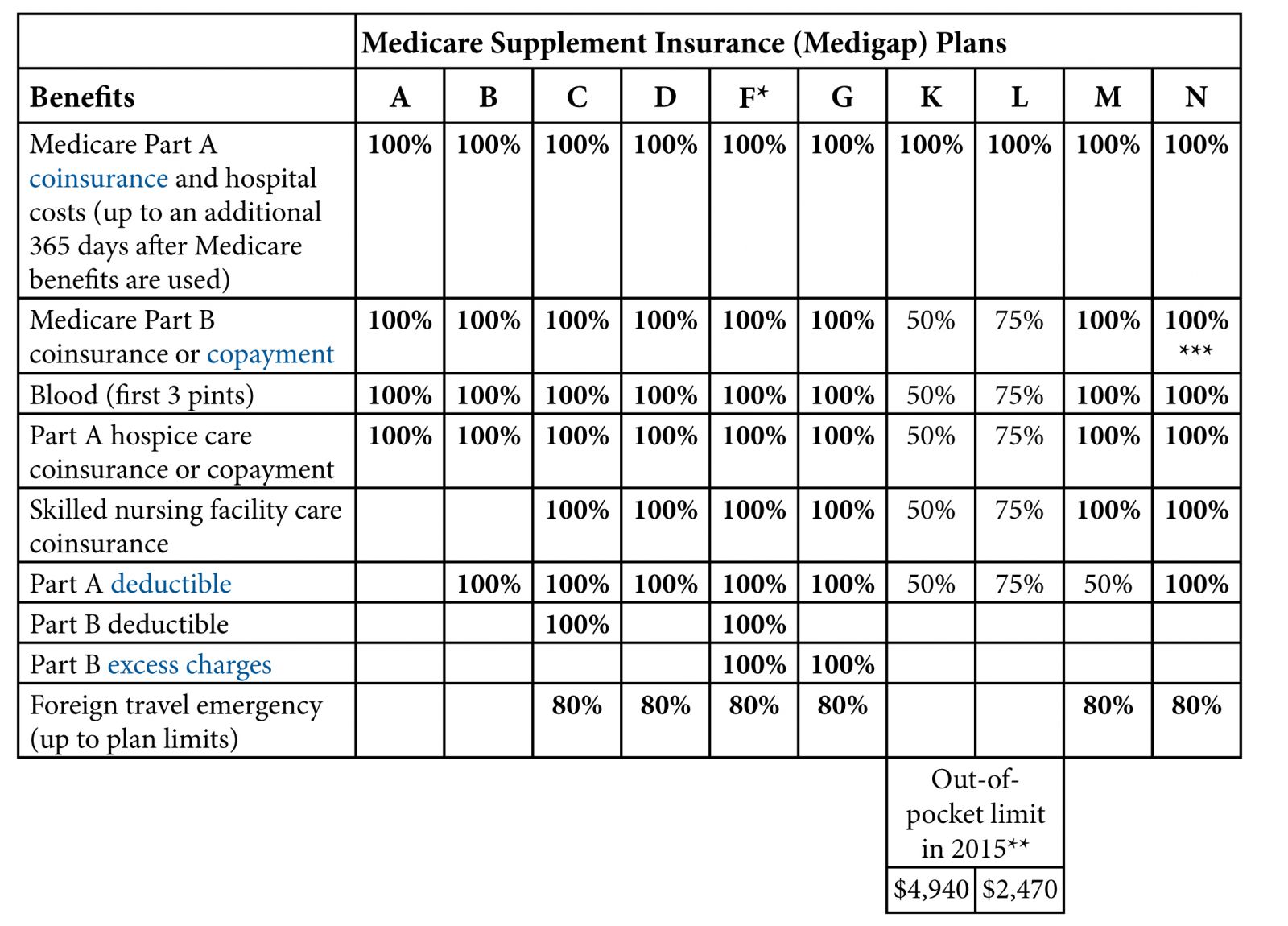

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What Is the Best Medicare Supplement Insurance Plan in 2021-2022?

There isn't one “best” Medigap plan. A specific Medigap plan might work for you if it offers coverage that works for your needs and comes with premiums that fit your budget.

What Is Medigap Insurance?

Medicare Supplement plans (commonly referred to as Medigap) are insurance plans that work alongside your Medicare Part A and Part B benefits and help cover some of your Medicare deductibles, coinsurance, copays and other costs.

What Are High Deductible Plans F and G?

Plan F and Plan G both offer high deductible options, which carry a deductible of $2,490 in 2022.

Why MedicareSupplement.com?

A licensed insurance agent can help you compare Medicare Supplement Insurance plans that are available in your area. After you use the comparison chart above, you can ask a licensed agent about the types of Medigap plans that may be offered where you live.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.